- What Is College Financial Planning?

- How to Create a College Budget That Actually Works

- Understanding Credit Cards and Student Loans

- Saving and Investing Basics for College Students

- Tax Basics: What Students Need to Know

- How to Choose the Right Student Bank Account

- Developing Smart Spending Habits in College

- Common Financial Mistakes College Students Make

- For Students Interested in a Career in Finance

- Top Financial Tools and Resources for Students

What Is College Financial Planning?

College financial planning is the process of learning how to budget, manage credit, save, and make responsible money decisions while you’re still in school. It helps students balance everyday expenses, avoid unnecessary debt, and build habits that support long-term financial stability. By understanding how to track spending, use credit wisely, start saving early, and choose the right financial tools, students gain more control over their money today and set themselves up for a stronger financial future after graduation.

Managing money in college can feel like walking a tightrope, with tuition, textbooks, and everyday expenses all competing for your limited funds. But building good financial habits now can make life after graduation far less stressful. Learning how to budget, handle credit, save, and spend wisely while you’re still in school gives you more control, reduces stress, and sets you up for long-term financial success.

How to Create a College Budget That Actually Works

Budgeting doesn’t have to be complicated or painful. Start by tracking your income and expenses for a month; you’ll be surprised at how much coffee and pizza can add up. Use apps like YNAB or even a simple spreadsheet to see where your money goes. Divide your spending into categories like rent, groceries, transportation, entertainment, and miscellaneous expenses.

Make sure to cover the necessities first, but try to carve out a little bit of “fun money” each week so you can still enjoy nights out without guilt. It’s easier and more satisfying to control your spending than to restrict it completely.

Understanding Credit Cards and Student Loans

Credit can feel like a mysterious adult tool, but it’s easier to manage than it seems if you start smart. Student loans and credit cards can help pay for college and build your credit history, but misuse can snowball into a serious debt problem.

Pay off your credit card balance every month, and never treat your card as a source of extra cash. If you have a student loan, make sure you understand the interest rates and repayment options. Building good credit now means lower interest rates on future car loans or even a house someday.

Saving and Investing Basics for College Students

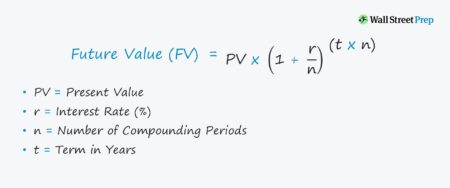

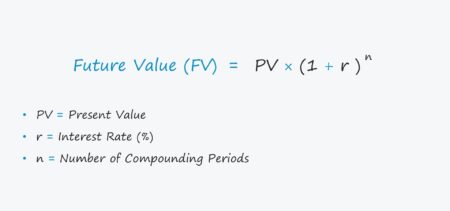

Saving money in college might feel impossible, but even small amounts add up. Start with an emergency fund of at least $500 to $1,000, enough to cover expenses such as a broken laptop or an urgent trip home. Then, think about long-term savings. Apps like Acorns or Robinhood make it easy to start investing with just a few dollars. Even contributing $20 a month to a retirement account now can grow into thousands by the time you graduate, thanks to compound interest. Think of saving as paying your future self first.

Tax Basics: What Students Need to Know

Taxes can be confusing, but understanding the basics helps keep your wallet safe. If you work a part-time job or freelance gigs, you may need to file a tax return. Keep track of W-2s, 1099s, and receipts for any deductions, like textbooks or school supplies. Learn about tax credits for students, such as the American Opportunity Credit, and take advantage where you can. Filing your taxes on time avoids penalties, and sometimes you even get a refund, free money to add to your savings or pay down debt.

How to Choose the Right Student Bank Account

Choosing the right bank account makes everyday life easier. Look for accounts with no monthly fees, easy online access, and a vast network of ATMs. Consider a student account with perks like fee waivers or cash back. Online banks often offer higher interest on savings, but local banks can provide in-person support; the choice is up to you. Either way, it’s a smart idea to automate transfers into your savings account when you receive your paycheck. Even $25 a week adds up over the course of a semester.

Developing Smart Spending Habits in College

College is full of temptations, from late-night delivery to concert tickets. Smart spending involves making intentional choices about where your money is allocated. Take advantage of student discounts at restaurants and clothing stores. Compare prices before buying textbooks: Used versions or digital copies often cost half the price of new ones.

Wait 24 hours before making nonessential purchases to avoid impulse buys. And use cash for discretionary spending, which can help you stick to your budget and make you more aware of your habits.

Common Financial Mistakes College Students Make

College students often struggle financially in similar ways. Avoid taking on high-interest credit card debt, neglecting your budget, or underestimating small fees like overdrafts. Don’t borrow more in student loans than necessary, and think twice before using “buy now, pay later” services. Missing due dates can negatively impact your credit score and result in costly late fees, so always make your payments on time. Learn from these mistakes now, and you’ll enter adulthood with more control and confidence over your finances.

For Students Interested in a Career in Finance

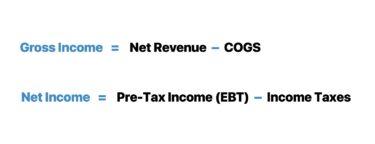

If you’re considering a future in finance—whether in banking, investing, fintech, or financial analysis—college is the perfect time to start building the skills that employers look for. Coursework in accounting, economics, and data analysis provides a strong foundation, while extracurriculars like investment clubs or case competitions help you apply what you learn.

You can also explore structured learning resources commonly used in the industry, such as financial and valuation modeling programs from reputable training providers, to get a feel for real-world tools and workflows. Gaining early exposure to topics like Excel modeling, valuation methods, and corporate finance concepts not only boosts your confidence but also gives you a practical edge when pursuing internships or entry-level roles.

Top Financial Tools and Resources for Students

- Compound Interest Savings Calculator

- Five Best Free Budgeting Tools

- Organize Your Finances With YNAB

- Household Budget Calculator

- Personal Budgeting Worksheet

- How to Master Excel Spreadsheets

- Basic Budget Calculator

- Understanding Private Equity

- Acorns: Save and Invest for the Future

- Investing in Sustainable Projects

- Robinhood Guide to Investment Basics

- Real Estate Financial Modeling

- Applied Value Investing