- What Is the Wharton Online Real Estate Investing Certificate Program?

- Wharton Real Estate Investing Certificate Program at a Glance

- Curriculum Overview: What You’ll Learn in the Wharton Online Real Estate Certificate Program

- Who Teaches the Wharton Online Real Estate Program?

- Which Real Estate Certificate Program Is Best for Your Career?

- Career Outcomes: Is the Wharton Online Real Estate Investing Certificate Program Worth It?

Is the Wharton Online Real Estate Investing Certificate Program worth $5,000? See curriculum details, reviews, and how it compares to other programs.

- This review evaluates whether the Wharton Online Real Estate Investing Certificate Program delivers practical skills or primarily credential value.

- It breaks down the curriculum, including real estate financial modeling, underwriting, valuation, and deal structuring.

- The article compares Wharton’s program to other real estate investing certificate programs to highlight differences in depth, format, and cost.

- It explains who the program is best suited for based on career goals in commercial real estate, investing, and development.

- The review addresses common questions about career outcomes, networking access, and return on investment.

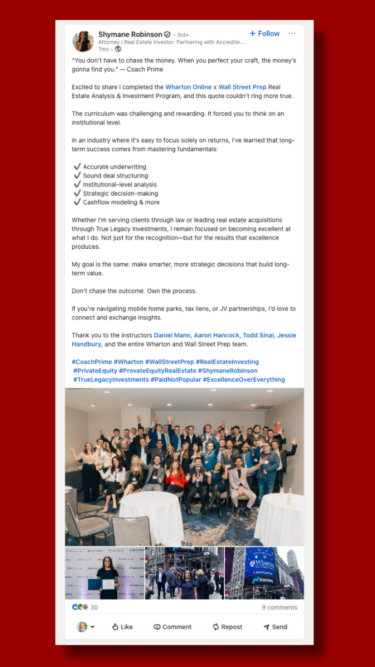

The Wharton Online Real Estate Certificate Program is gaining traction among both institutional-track professionals and entrepreneurial investors who want real-world deal skills, not just a brand-name credential.

In a crowded market of real estate certificates, this program stands out for its practical underwriting training, cohort-based learning, and dual perspective from instructors who’ve built careers in both real estate private equity and as an entrepreneur doing their own deals.

This review breaks down what the curriculum actually teaches, how it performs in practice, and who will get the most value from enrolling.

What Is the Wharton Online Real Estate Investing Certificate Program?

The Wharton Online Real Estate Investing & Analysis Certificate Program is an 8-week, fully online program designed for early- to mid-career professionals who want to build the analytical foundation used across both institutional real estate and entrepreneurial investing.

Whether participants aim to advance within institutional roles such as real estate private equity or large scale development roles, or evaluate deals as an operator, syndicator, or private investor, the program teaches a shared toolkit used throughout the industry.

Delivered in collaboration with Wall Street Prep—whose training is used by top investment firms as well as entrepreneurial real estate teams—the program blends Wharton faculty instruction with practical financial training to teach valuation, underwriting, deal structuring, and risk analysis through a clear, investment-focused framework.

Learners move beyond surface-level concepts and gain a deeper understanding of how real estate investments are evaluated, financed, structured, and executed in professional environments of all sizes, from large institutional portfolios to smaller entrepreneurial acquisitions.

Student feedback consistently points to both clarity and value. Program graduate Colton Hock shared:

“I gave this program the highest rating because of the incredible value for its cost… The professors explained the material clearly, and the class structure was very well designed.”

Wharton Real Estate Investing Certificate Program at a Glance

How Much Does the Wharton Private Equity Certificate Cost?

The program tuition is $5,000, with early enrollment discounts, monthly payment options, and tuition assistance available.

Many participants use employer professional-development reimbursement programs to offset the cost.

For entrepreneurial learners—such as syndicators, independent sponsors, and small-firm operators—the investment often pays off through stronger underwriting, more credible deal presentations, and an improved ability to evaluate opportunities the way institutional partners would.

How many hours per week does the Wharton Online Real Estate program require?

The recommended time commitment is 8–10 hours per week, which includes recorded lessons, assignments, case studies, and engagement during live office hours or networking events.

The structure is designed to fit alongside a full-time job or an active investment practice. Many entrepreneurial participants manage the workload while sourcing deals, raising capital, or operating properties.

What is the format?

The program runs for 8 weeks, delivered 100% online with a mix of asynchronous and live components.

Each week includes video lessons, readings, case studies, and hands-on technical exercises that translate directly into real-world deal work, whether evaluating a small multifamily acquisition or underwriting a larger institutional transaction.

A major differentiator of Wharton Online + Wall Street Prep is the emphasis on live learning and direct interaction.

Participants gain access to:

- Weekly live office hours

- One-on-one coaching sessions

- Networking events with faculty and industry professionals

These sessions allow both institutional and entrepreneurial learners to ask deal-specific questions, get feedback on underwriting assumptions, and build relationships with peers pursuing a wide range of career paths.

“I really got to know my instructors, especially during the 1:1 training sessions with them,” says program graduate Sai Kalidindi.

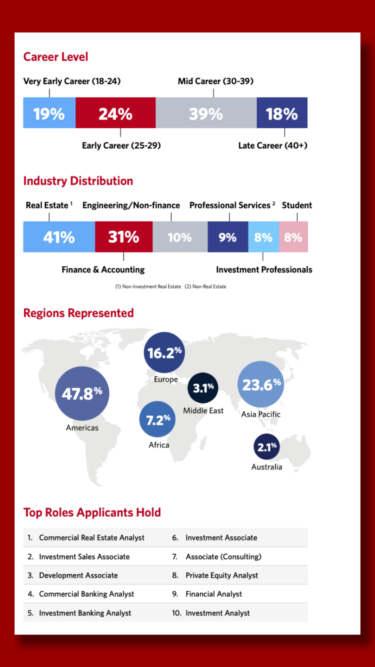

Who is this program best for?

Whether your goal is to grow within a large investment organization or to build your own pipeline of deals, the program provides the institutional-grade skills needed to evaluate opportunities with confidence.

Participants come from a wide range of backgrounds, including:

- Real estate investment professionals and operators

- Syndicators, GPs, and independent sponsors seeking stronger underwriting and deal evaluation skills

- Private investors and family offices looking to assess opportunities with greater rigor

- Investment bankers and corporate finance professionals expanding into real estate

- Brokers, consultants, lawyers, finance and accounting professionals, and real estate analysts who want deeper insight into how investors underwrite deals

- Private lenders and credit professionals who benefit from understanding equity-side analysis

- Career switchers entering commercial real estate or building their first investment track record

One of the program’s strengths is its applicability across career paths: institutional, entrepreneurial, advisory, and operator-focused learners all use the same analytical toolkit in different ways.

How difficult is the Wharton Online Real Estate program?

The program is academically challenging in a productive and supportive way. Learners build skills that mirror how professional investors evaluate deals.

The curriculum covers industry-standard topics such as:

- Financial modeling and underwriting

- Capital structures, waterfalls, and joint ventures

- Cash flow modeling and promote structures

- Valuation (DCF, cap rates, comparables, replacement cost)

- Market and risk analysis frameworks

While the material moves quickly, it is designed to be accessible. Learners with some analytical or finance exposure may progress faster, but motivated beginners regularly succeed with the support of live instruction, coaching, and cohort interaction.

Does the Wharton Online Real Estate program help with getting a job?

While no certificate can guarantee a role, the Wharton Online Real Estate program provides the analytical rigor, underwriting sophistication, and networking access that support institutional careers as well as entrepreneurial tracks like GP syndications and independent sponsor deals.

Hundreds of graduates share their experience of meeting their Wharton Online peers.

Participants gain access to:

- The Wharton Online graduate network of 5,000+ professionals across 110+ countries—an ecosystem that includes acquisitions analysts, syndicators, fund managers, developers, and private lenders.

- Invitation-only LinkedIn and Slack groups where graduates exchange models, deal decks, off-market leads, capital sources, co-GP opportunities, and hiring updates for acquisitions, development, and asset management roles.

- Virtual and in-person networking events that connect operators, analysts, and capital allocators.

- Speaker sessions with managing partners, institutional LPs, and platform operators who share insights about sourcing, underwriting, JV structuring, and raising capital.

Program graduate Andrew Line says, “Having completed this certificate with Wharton and WSP, I’m ready to be a GP for my syndicates. I have the technical skills, valuation frameworks, and templates. Plus, I have some new friends and a network in the industry.”

Can beginners take it?

Yes, beginners can absolutely succeed in the program, but newcomers should expect a meaningful learning curve.

The curriculum starts with the fundamentals of real estate as an asset class, then progressively moves into the technical skills used by institutional and entrepreneurial investors: valuation, capital stack structuring, waterfall modeling, underwriting, and market analysis.

Learners without a finance or modeling background should plan to spend additional time outside of sessions reviewing concepts and practicing in Excel, especially during the underwriting and waterfall modules.

Many first-time investors, career switchers, and aspiring GPs thrive in the program thanks to the live office hours, 1:1 coaching, step-by-step modeling exercises, and the ability to ask deal-specific questions in real time.

For beginners willing to put in the work, this program often becomes the fastest path to thinking—and underwriting—like a professional investor.

How can I learn more about the curriculum?

To learn more about the Wharton Online Real Estate Certificate Program curriculum, you can download the brochure or register for a free information session.

Curriculum Overview: What You’ll Learn in the Wharton Online Real Estate Certificate Program

The Wharton Online Real Estate curriculum is structured around how real estate deals are actually evaluated. Each module builds on the last, focusing on underwriting, analysis, and decision-making that professionals use in real investment situations.

Program graduate Mario Urquia describes the coursework as “truly informative,” noting that “each week is carefully curated and well-detailed, making a significant difference in my understanding of REPE. Worth every penny.”

| Module | You Will Be Able To |

|---|---|

| Module 1: Introduction to the Real Estate Asset Class |

|

| Module 2: The Real Estate Investment Framework |

|

| Module 3: Financing and Taxation of Real Estate |

|

| Module 4: The Real Estate Deal Process |

|

| Module 5: Real Estate Investment Analysis & Financial Modeling (Part 1) |

|

| Module 6: Real Estate Investment Analysis & Financial Modeling (Part 2) |

|

| Module 7: Analyzing Market Risk Factors |

|

| Module 8: Analyzing Property-Level Risk Factors |

|

| Module 9: Capstone Project: Investment Case Study |

|

Who Teaches the Wharton Online Real Estate Program?

The Wharton Online Real Estate Investing Certificate Program is taught by a combination of Wharton faculty and senior real estate practitioners, giving learners both academic rigor and real-world execution.

A distinguishing strength of the program is the dual perspective offered by its practitioner instructors—one grounded in institutional private equity and the other in entrepreneurial dealmaking. This blend helps learners see how institutional frameworks translate into both large-scale investing and GP-led transactions.

Faculty

Aaron Hancock — Senior Vice President, Artemis Real Estate Partners

Aaron brings deep institutional investing experience across real estate private equity, capital raising and investor relations, and investment banking.

At Artemis Real Estate Partners, he evaluates and structures large-scale acquisitions, JV partnerships, and portfolio-level investments. His background includes roles at JBG Smith, where he worked on digital infrastructure investments, and at a family office focused on master-planned development.

Aaron gives learners a clear view into how institutional investors underwrite deals, assess GPs, structure capital stacks, and make investment decisions.

Daniel Mann — Founder, Rockwest Real Estate

Daniel is an entrepreneurial investor and operator with experience spanning acquisitions, development, and asset management.

As the founder of Rockwest Real Estate, he leads investment and management strategies across commercial and mixed-use assets. He also serves as CEO of First Cut Barrel Co., reflecting his broader experience building and scaling operating businesses.

Daniel teaches the practical, deal-by-deal execution side of the industry—how to source opportunities, build pro formas, raise capital, structure GP–LP partnerships, and close transactions as an entrepreneurial operator.

Todd Sinai — Professor of Real Estate & Business Economics, Wharton School

Professor Sinai is a leading authority on housing markets, pricing, and economic policy. His research-driven approach gives learners a strong analytical foundation for thinking about real estate at an institutional level.

Benjamin J. Keys — Professor of Real Estate & Finance, Wharton School

Professor Keys specializes in mortgage markets, financial systems, and household credit. His experience grounds the program in the realities of how financing and policy shape real estate investment outcomes.

Jessie Handbury — Associate Professor of Real Estate, Wharton School

Professor Handbury focuses on urban economics and data-driven market analysis. Her work helps learners understand how neighborhoods, consumer behavior, and city dynamics directly influence property performance.

Guest Speakers & Industry Leaders

In addition to Wharton faculty, learners hear directly from senior real estate leaders across private equity, development, asset management, and finance:

- Dean Adler — Founder & CEO, Lubert-Adler

- Jeff T. Blau — CEO, Related Companies

- Chris Lee — Co-President & Partner, KKR Real Estate

- Anar Chudgar — Co-President, Artemis Real Estate Partners

- Michael Vu — Senior Managing Director, Artemis Real Estate Partners

- Hal Fetner — President & CEO, Fetner Properties

- Evan Levy — Vice Chairman, The Amherst Group

- Christopher Méndez — Managing Director, Pearlmark

- Alan Ratner — Managing Director of Equity Research, Zelman & Associates

Together, this lineup blends academic rigor with frontline market experience, giving learners exposure to how institutional investors, developers, and operators approach real estate in practice.

“The weekly interview series is truly outstanding,” says program graduate Robert Padilla. “The insights from the interviews alone are priceless.”

Which Real Estate Certificate Program Is Best for Your Career?

| Program | Duration & Format | Price | Learner Objectives | Live Networking | Best For | Overall Value for Career |

|---|---|---|---|---|---|---|

| Wharton Online x Wall Street Prep: Real Estate Investing & Analysis Certificate Program | 8 weeks online with live office hours | $5,000 |

|

✅ Lifetime access to community happy hours and recruiting events |

|

★★★★★ |

| Cornell Real Estate Certificate Program | 2 weeks; 100% online | $3,750 |

|

❌ No mention of live networking outside of the program |

|

★★★ |

| Harvard Business School Real Estate Certificate Program | Finish in 8 months to 3 years; 4 online courses | $13,760 |

|

❌ No mention of live networking opportunities on program page |

|

★★★ |

| NYU Real Estate Investing Certificate | 6 online courses | $5,067–$5,262 |

|

✅ Yes, they have meet-ups and conferences alumni can attend. |

|

★★★★ |

| CRE Analyst’s FastTrack Program | 8 week Zoom-based course but includes live office hours and learning events | $5,999 |

|

✅ Program page mentions networking opportunities after graduation |

|

★★★ |

Career Outcomes: Is the Wharton Online Real Estate Investing Certificate Program Worth It?

The short answer: yes—if you want to think, underwrite, and communicate like a professional investor.

This program delivers meaningful value for both institutional-track professionals and entrepreneurial operators.

Its greatest strength is the way it compresses years of trial-and-error into an 8-week structure that teaches you how deals are actually evaluated in the market by capital providers, ICs, and sophisticated operators.

At $5,000, it’s an investment, but one designed to save you years of learning on the job and significantly elevate how you evaluate, structure, and present deals.

Career Outcomes: What to Expect with the Wharton Online Real Estate Certificate

- This won’t place you into a job—but it will change what you can do: Graduates leave with practical skills in real estate modeling, property evaluation, and real-world financial modeling used on commercial properties.

- It gives you a credible baseline: The Wharton Online + Wall Street Prep certificate signals working knowledge of real estate capital markets and deal analysis—useful when speaking with employers, investors, or partners.

- Skills translate across roles: Graduates apply the training in investing, lending, asset management, and development projects, rather than being locked into one career path.

- You get out what you put in: Graduates who actively apply the skills and participate in ongoing meetups and events tend to see the greatest career impact.

- Networking is ongoing, not transactional: Lifetime meetups and events create repeated chances to meet active professionals. One graduate, Robin Barua (Waybar Development), met an investment banking professional at a program event and later completed a deal together.

When This Program Might Not Be the Right Fit

This is a technical, modeling-heavy, deal-focused program. It’s built for people who want to sharpen underwriting skills and make investment decisions with real rigor.

It may feel misaligned if you:

- Prefer high-level conceptual material rather than hands-on modeling

- Are looking for a lightweight introduction to real estate fundamentals

- Aren’t interested in underwriting, Excel work, or analytical frameworks

- Want a purely theory-based program without applied case work

Bottom line:

If you’re serious about improving your investment judgment—whether you’re building a career in institutional real estate or scaling an entrepreneurial platform—this program is worth it. It gives you the frameworks, technical skills, and network to operate at a higher level, regardless of where you sit in the market.

Download the brochure or register for a free info session to learn more about the Wharton Online Real Estate Investing Certificate Program.