Venture Capital Masterclass

Your Complete Guide to Navigating Venture Capital in the Real World

This job-focused training program teaches what firms look for, how to network effectively, how to interact with founders, and how to position your experience to stand out in a competitive recruiting environment.

Learn Directly From VC Practitioners

This course is designed for those pursuing a career in venture capital as well as founders and operators who want to understand how VC investors evaluate opportunities. You will learn how venture capitalists develop investment theses, assess markets, meet founders, and evaluate companies with the same investment frameworks used at top-tier firms.

Hands-On Training Across the Full VC Deal Process

You will learn through practical exercises in sourcing, due diligence, financial modeling, cap table analysis, and term sheet evaluation. Work through case studies including Uber’s fundraising history to understand how great companies are financed and how top firms like Sequoia, Benchmark, a16z, and Tiger Global make investment decisions.

Master VC Fund Strategy and Exit Outcomes

Understand the venture capital business model, how funds are structured, and how returns are measured using metrics like IRR, MOIC, TVPI, DPI, and RVPI. Learn how investors support companies after the deal through board involvement and governance, and how exits are structured across M&A and IPO scenarios.

Who Should Take This Course?

- Aspiring & Incoming VC Analysts

- VC Associates & Investors

- Entrepreneurs

- Start-up Employees & Execs

- MBAs & Business Undergrads

What You Will Learn

How Venture Capitalists Build Investment Conviction

Understand how professional investors form a differentiated point of view on markets and identify opportunities capable of venture-scale returns.

- Evaluating market structure, growth vectors and secular tailwinds

- Calculating TAM, SAM, and SOM using both top-down and bottom-up approaches, including the limitations of TAM as a predictive tool in venture capital

- Identifying compounding engines of value creation and early signals of breakout potential versus false positives

Founder Evaluation and Investor Alignment

Learn how top investors assess founders and early company quality when traditional financial data is insufficient.

- Founder-market fit and behavioral indicators of exceptional operators

- Aligning incentives between founders and investors to reduce long-term agency risk

Deal Sourcing and Proprietary Access

Study how elite investors create advantaged deal flow and secure allocations ahead of the broader market.

- Developing proprietary sourcing engines through outbound outreach, founder references and utilizing your network

- Building a high value network in a market known for its “co-opetition”

Deal Structuring and Term Sheet Economics

Learn how investment teams structure investments to align incentives and limit their downside risk throughout the full financing lifecycle.

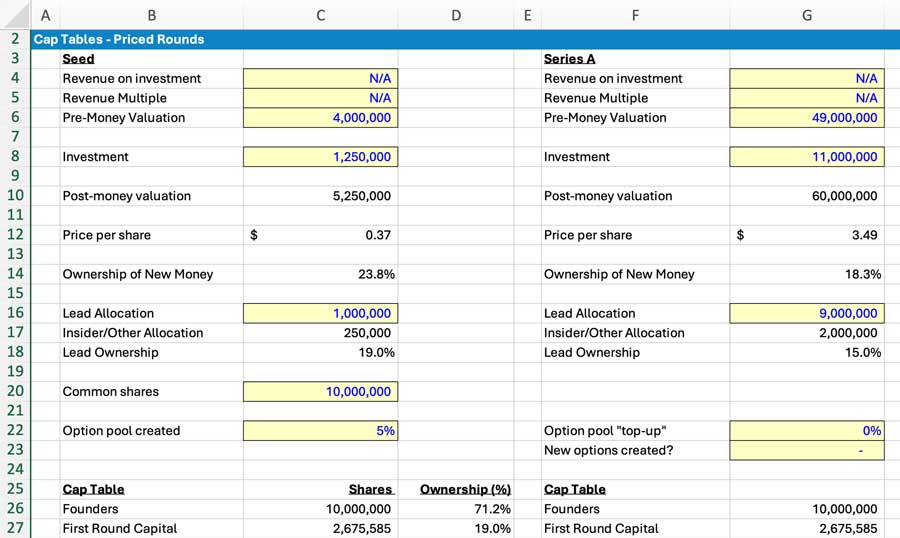

- Modeling and managing cap tables to evaluate unpriced rounds (SAFEs and Convertible Notes) and priced rounds (Seed, Series A, Series B, etc.)

- Creating and analyzing term sheets - know the impact of liquidation preferences, participation rights, anti-dilution mechanics, and control provisions on your investments

Portfolio Support, Governance, and Outcome Management

Understand the responsibilities of investors post-investment and the mechanisms that drive value creation across a portfolio.

- Board management, corporate governance, and conflict resolution between investors and founders

- Operational value creation models and post-investment support structures

Fund Strategy, Portfolio Construction, and Return Distribution

Gain a sophisticated understanding of the “business of venture capital,” including how venture fund strategy shapes investment behavior and long-term performance.

- The VC fund legal structure, capital calls, co-investment strategy, and LP expectations

- Measuring fund performance through IRR, MOIC, TVPI, DPI, RVPI, and the power law distribution that drives portfolio construction decisions

Breaking Into Venture Capital

Develop a practical strategy for entering and succeeding within a competitive industry environment.

- Building credibility, developing a differentiated voice, and demonstrating proprietary insight

- Networking strategies that create real access to firms, founders, and LPs

- Preparing for interviews through thesis presentation, market analysis, and investment case articulation

This is the same training program Wall Street Prep delivers in-house to investment professionals at growth equity, private equity, and technology-focused investment firms evaluating venture-backed companies

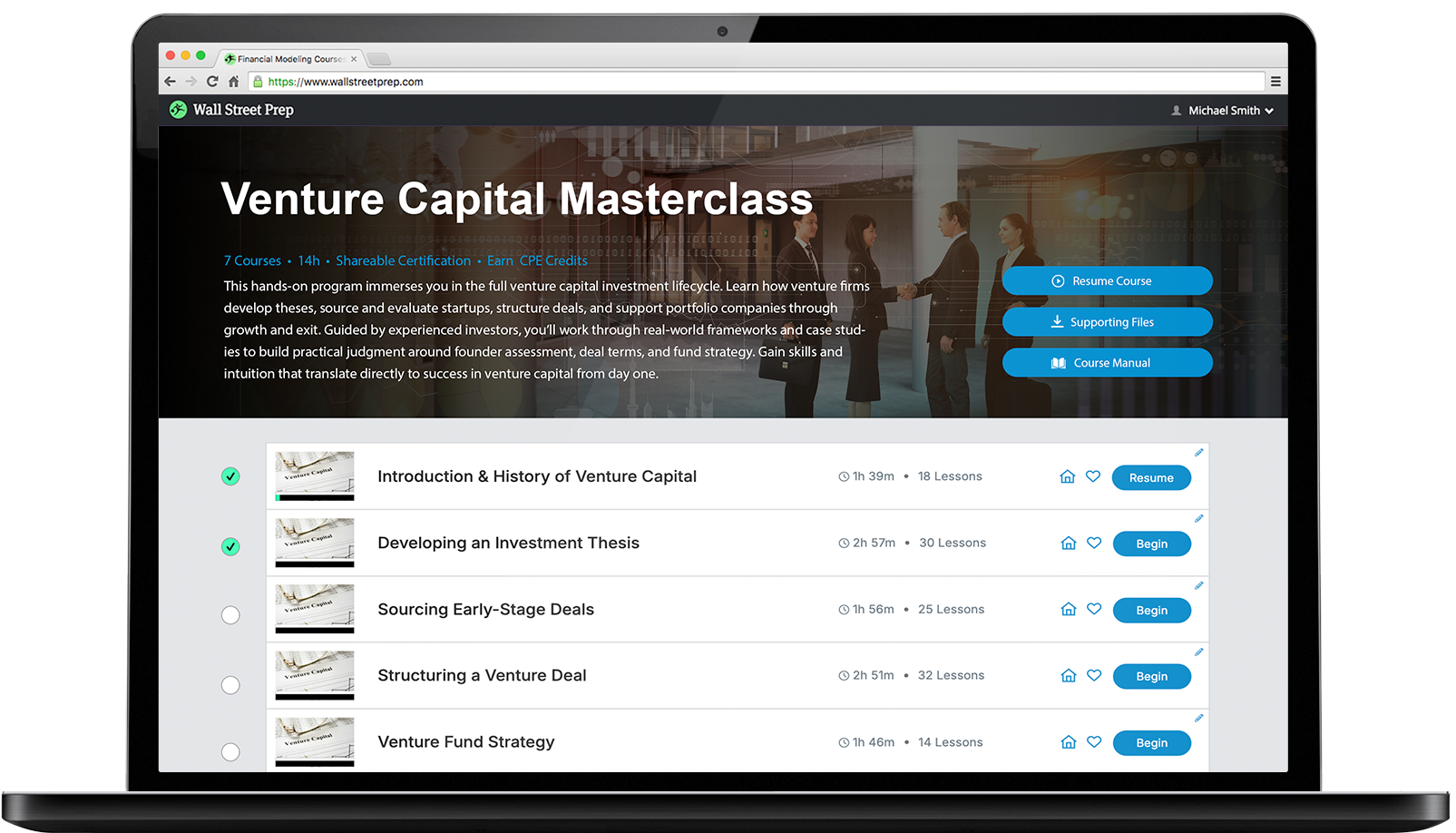

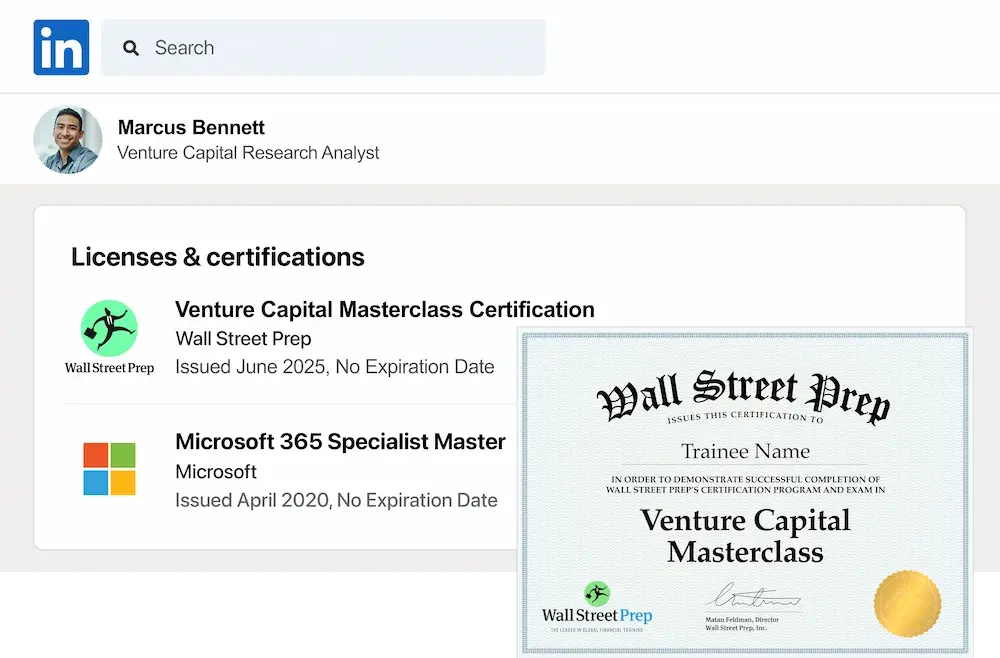

Get the Venture Capital Masterclass Certification

VC Masterclass learners are eligible to earn Wall Street Prep's globally recognized Venture Capital Masterclass Certification. The certification is earned by successfully completing the final exam from each of the program's 7 courses. These online assessments can be taken any time after enrollment in the program.

What's Included

VC 1: Introduction & History of Venture Capital

This module lays the foundation for understanding how venture capital works, from the lifecycle of a ...

VC 2: Developing an Investment Thesis

This module teaches you how to think like a venture capitalist by building and refining an investmen ...

VC 3: Sourcing Early-Stage Deals

This module explores how venture capitalists source, evaluate, and win the best deals in a competiti ...

VC 4: Structuring a Venture Deal

This module breaks down how venture capital deals are structured and negotiated. You will learn how ...

VC 5: Venture Fund Strategy

This module explains the “business of venture capital.” You will learn how VC funds are structured, ...

VC 6: Post-Investment Involvement & Exits

This module covers what happens after the investment is made, from board participation and founder r ...

VC 7: Getting a Job in Venture Capital

This module helps you understand what it takes to break into and succeed in the venture capital indu ...

Course Samples

Venture Capital Masterclass Highlights

Intuitive, Practical, and Built for the Real VC Workflow

Intuitive, Practical, and Built for the Real VC Workflow

Wall Street Prep’s Venture Capital Masterclass is designed to be intuitive, self-paced, and deeply practical. The program walks learners through the full venture capital investment lifecycle, from sourcing and thesis development to diligence, deal execution, and portfolio support. Using real-world case studies including Uber’s fundraising history, learners engage with authentic VC workflows such as market sizing, founder evaluation, cap table modeling, and term sheet analysis. The course emphasizes how venture capital decisions are actually made inside top firms and what it takes to think and operate like a professional VC investor.

Expert-Led Support Center

Expert-Led Support Center

Upon enrollment, students receive free and unlimited access to Wall Street Prep’s Online Support Center. Learners can ask questions, download updated resources, and receive guidance from a dedicated support team made up of experienced finance and investing professionals. This ensures clarity on complex venture topics such as fund economics, term sheet mechanics, valuation tradeoffs, and portfolio construction, helping learners confidently apply concepts to real investment scenarios.

Private Online Tutoring (Additional Fee Applies)

Private Online Tutoring (Additional Fee Applies)

For those seeking personalized guidance, live one-on-one online tutoring is available for an additional fee. Sessions are conducted via video chat and allow students to work directly with experienced professionals on venture-specific topics such as investment thesis development, cap table modeling, or interview preparation. Tutors and students can collaborate in real time using shared models, a virtual whiteboard, and integrated file sharing to deepen understanding and accelerate learning outcomes.

Prerequisites

The program assumes a basic introductory knowledge of accounting (e.g. interaction of balance sheet, cash flow, and income statement) and proficiency in Excel. Students with no prior background in Accounting should enroll in the Accounting Crash Course. Students with limited experience using Excel should enroll in the Excel Crash Course.

Earn CPE Credits with WSP Online Courses

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.