AI heavily influences portfolio management and investment strategy, offering new avenues for AI-driven value creation and a competitive edge in the investment management industry. This evolution is particularly impactful as these domains inherently depend on extensive data analysis, identifying complex patterns, and predictive modeling—areas where AI excels. Investment professionals increasingly leverage AI tools to process vast amounts of financial data, identify complex patterns, and make informed investment decisions amidst increasing market volatility.

This article will cover AI’s transformative influence on portfolio management and investment strategy, covering aspects such as asset allocation, risk management, algorithmic trading, and market sentiment analysis. It will also explore the benefits and challenges of AI integration within the investment process and its ethical implications.

- AI is transforming portfolio management by enhancing asset allocation, risk management, and investment strategies through advanced machine learning, predictive analytics, and real-time data processing.

- Machine learning optimizes asset allocation by analyzing market data, adjusting portfolios based on predicted volatility, and personalizing strategies according to investor goals and risk profiles.

- AI improves risk management by offering early warning systems, stress testing, and real-time monitoring, allowing investment professionals to proactively identify and mitigate market risks.

- Algorithmic trading is revolutionized by AI, enabling high-frequency trading and rapid decision-making based on market signals, increasing market efficiency and reducing transaction costs.

- While AI presents benefits like improved data analysis, efficiency, and risk-adjusted returns, challenges such as data quality, model transparency, and ethical considerations must be addressed for successful integration.

How AI is Transforming Portfolio Management and Investment Strategy

AI is augmenting and, in some cases, superseding traditional investment processes within the investment management industry, which historically relied on human judgment and basic quantitative models.

This transformation is occurring across multiple dimensions of the investment process:

Enhancing Asset Allocation

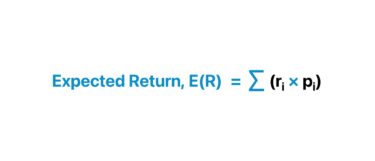

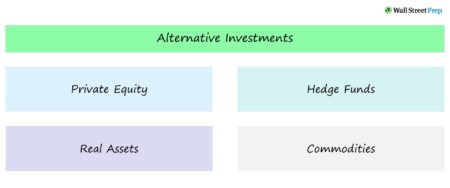

AI significantly enhances asset allocation by rapidly analyzing extensive market data and risk factors through machine learning (ML) and predictive analytics. These technologies identify subtle asset correlations among a wide range of alternative investments, enabling responsive portfolio adjustments based on predicted market volatility to optimize asset mix.

Additionally, AI optimizes portfolio allocation across multiple investor objectives—risk tolerance, return expectations, and liquidity needs—using advanced models like reinforcement learning and neural networks. This results in more personalized and efficient portfolio construction, achieving a more nuanced balance of factors than traditional methods.

BlackRock’s Aladdin platform exemplifies these capabilities, leveraging AI and machine learning to optimize asset allocation for institutional investors. By analyzing a broad spectrum of data, Aladdin assists in managing risk and optimizing returns across vast portfolios, providing investment managers with real-time, data-driven insights to align with client objectives. However, while its advanced algorithms drive efficiency, human expertise remains crucial for adapting strategies to complex market conditions.

Revolutionizing Risk Management

Advanced AI models, such as deep learning and ML models, enable a more comprehensive and dynamic assessment of various financial risks. These systems can simultaneously analyze market, credit, liquidity, and operational risks, offering a holistic and real-time view of potential threats to portfolio performance. This allows for more proactive identification and mitigation of vulnerabilities compared to traditional methods.

A significant capability lies in AI-powered early warning systems. By analyzing historical market data alongside current market conditions using pattern recognition algorithms, these systems can detect subtle signals of impending market stress before they become widely apparent. Similarly, AI-enhanced stress testing, driven by ML algorithms, can model portfolio performance across numerous potential market scenarios. This enables portfolio managers to better prepare for a wide range of adverse market conditions and strengthen overall risk management practices.

The AI in Business & Finance Certificate Program

Build a practical AI skillset and transform your career. No coding required! Enrollment is open for the Columbia Business School Executive Education and Wall Street Prep March 2026 cohort.

Enroll TodayOptimizing Portfolio Construction and Rebalancing

ML algorithms, neural networks, and optimization algorithms enhance portfolio construction by creating investment portfolios tailored to specific investment goals and risk profiles with unprecedented precision. These algorithms can integrate a wider array of constraints and preferences while optimizing for multiple objectives, leading to more efficient and personalized portfolio allocation.

Automated rebalancing, powered by AI-powered portfolio management systems utilizing algorithmic trading capabilities, marks another significant advancement with these technologies. These systems continuously monitor portfolios and execute rebalancing trades based on predefined rules and market changes, ensuring portfolios remain aligned with target allocations without constant human intervention. This automation increases efficiency, reduces costs, and allows investment professionals to focus on strategic decisions and client relationships. Systematic rebalancing also helps enforce investment discipline by mitigating emotional biases.

Enhancing Algorithmic Trading

AI is significantly enhancing algorithmic trading through high-frequency and low-latency execution. Sophisticated AI systems can analyze market data in microseconds, executing trades at a speed beyond human capabilities. Driven by complex rules and market signals, these algorithms continuously learn and adapt to evolving market conditions, contributing to greater trading performance and market responsiveness.

ML algorithms can also identify statistical arbitrage opportunities by detecting rapid price discrepancies in related securities or financial markets, executing trades swiftly to capture fleeting advantages, potentially impacting liquidity in the secondary market.. This increases market transaction speed and efficiency, potentially reducing trading costs for portfolio managers, hedge fund managers, and institutional investors. Moreover, AI-powered algorithmic trading optimizes large order execution by intelligently breaking them down and routing them to minimize market impact — a key benefit for institutions managing substantial asset allocation.

A prime example of this in action is Citadel Securities, a major player in algorithmic trading that extensively uses AI for high-frequency trades. By analyzing market data in microseconds, Citadel’s AI algorithms are designed to capture opportunities based on those very fleeting price discrepancies across markets. These sophisticated systems continuously learn from new data, adapting their strategies to optimize performance while rigorously managing risk. However, the immense power and speed of such AI-driven systems necessitate constant oversight to avoid unintended consequences, including potentially exacerbating market volatility or contributing to phenomena like flash crashes.

Leveraging Sentiment Analysis

AI is also used to leverage sentiment analysis to review key textual data to enhance investment decision-making. Using advanced natural language processing (NLP) algorithms, it can analyze news articles, financial reports, earnings call transcripts, and analyst research to gauge market sentiment (positive, negative, or neutral opinions) toward companies, sectors, or the broader market. By processing vast amounts of unstructured data, AI systems can detect subtle shifts in sentiment that may precede significant market trends, providing investment professionals with potential early indicators.

Sentiment analysis can also help identify emerging trends and investment opportunities. By tracking discussions across various financial sources, AI can spot growing interest in new technologies, changing consumer preferences (as discussed in relevant industry reports), or regulatory developments that may influence investment outcomes. This enables portfolio managers to make more informed investment decisions based on a comprehensive understanding of market sentiment and perceptions derived from pertinent financial information.

Enhancing Fundamental Analysis

AI models efficiently process vast amounts of financial data, including financial statements, earnings reports, and regulatory filings. For instance, ML algorithms can compare key financial metrics against historical trends and competitors to identify potential value investment opportunities or risks. This enables a more comprehensive and timely assessment of company financials than traditional manual methods.

Furthermore, AI tools improve forecasting and valuation by integrating more data points and discerning complex relationships. AI-powered forecasting models can potentially generate more accurate predictions of future earnings and cash flows, crucial for valuation. This can lead to more reliable estimates of undervalued assets and support better investment outcomes and informed investment decisions.

Personalized Investment Recommendations

AI can deliver highly personalized investment advice and portfolio construction. It achieves this level of personalization by analyzing individual investor profiles, which include risk tolerance, financial goals, time horizon, income needs, and preferences. This analysis allows AI systems to generate tailored investment recommendations that better align with each investor’s unique circumstances, going beyond basic risk assessments.

Modern AI systems can also incorporate behavioral patterns, spending habits, and values to create truly customized portfolios. For example, an AI system advisor might identify a preference for sustainable investments based on various data points. This personalization extends to tax optimization, where AI analyzes an investor’s tax situation to recommend tax-efficient strategies, aligning investment strategies with their holistic financial picture.

Benefits and Challenges of AI in Portfolio Management and Investment Strategies

While AI presents significant potential for transforming portfolio management, its implementation involves key benefits and substantial challenges that investment professionals must understand to leverage AI effectively in their investment processes.

The benefits of AI in portfolio management and investment strategy:

- Increased efficiency and automation: AI systems can handle routine tasks such as data gathering, initial screening, and basic analysis, freeing human investment professionals to focus on higher-value activities. This automation reduces operational costs while increasing the volume of potential investments that can be evaluated, ultimately impacting the return on investment.

- Improved data analysis and pattern recognition: AI excels at processing vast amounts of data and identifying patterns that might not be obvious to human analysts. ML algorithms can analyze structured data from financial statements alongside unstructured data from news sources, financial sources, and other alternative data sets.

- Potentially enhanced risk-adjusted returns: By incorporating more data points and detecting subtle market signals earlier, AI-powered investment strategies have the potential to deliver better investment outcomes. AI systems can continuously monitor portfolios and market conditions, making rapid adjustments when necessary to optimize performance or mitigate risks.

- Greater speed and scalability: AI systems can analyze market data and execute trades in milliseconds, providing a significant competitive edge in fast-moving markets. These systems can also scale to analyze thousands of securities, mutual funds, or data points simultaneously without proportional increases in cost or resources.

The challenges of AI in investment banking and investment strategy:

- Data quality and bias in AI algorithms: AI systems are only as good as the data they’re trained on. Poor data quality, selection bias, or unrepresentative historical market data can lead to flawed models and potentially costly investment errors. Additionally, if historical data contains inherent biases, AI models may not perform well when conditions change dramatically.

- The “black box” nature of some AI models and interpretability: Many advanced AI models, particularly deep learning systems, operate as “black boxes” where the reasoning behind specific recommendations isn’t easily explained. This lack of transparency creates challenges for investment managers who must understand and justify their investment decisions to clients or stakeholders.

- Regulatory and ethical considerations: The use of AI in investment management raises numerous regulatory questions regarding fairness, transparency, and accountability. Investment managers must ensure their AI systems comply with existing regulations while preparing for evolving regulatory frameworks.

- The need for human oversight and expertise: Despite advances in AI technology, human judgment remains essential in investment management. AI systems may struggle with unprecedented market conditions, geopolitical events, or other situations without historical precedents. Human advisors provide crucial oversight, questioning assumptions, and making strategic decisions.

These benefits position AI as a powerful catalyst for enhanced efficiency, deeper insights, and potentially superior outcomes in portfolio management and investment strategies. However, realizing these advantages is contingent on effectively addressing the challenges associated with AI adoption.

Ethical Considerations for AI in Investment Banking

The increasing integration of AI into investment banking and portfolio management brings forth critical ethical considerations that financial institutions must proactively and continuously address.

Ensuring responsible and sustainable AI-driven value creation requires careful attention to the following:

- Algorithmic bias: Ongoing rigorous testing and monitoring are essential to identify and mitigate biases in AI algorithms that could lead to unfair outcomes or perpetuate historical disadvantages, ensuring fair treatment and access to opportunities for all clients.

- Job displacement and transformation: Financial institutions must proactively manage the impact of automation by prioritizing human capital as a core asset. This includes investing in retraining programs to equip employees with new skills as traditional roles evolve, rather than simply eliminating positions.

- Transparency and accountability: Developing explainable AI models and clear disclosure frameworks is crucial to ensure both employees and clients understand the basis of AI-driven investment decisions affecting their assets, upholding the right to transparency and fostering trust and accountability for all outcomes.

- Data privacy: Robust data governance frameworks, clear consent mechanisms, and strict purpose limitations for data usage are necessary to protect client privacy when AI systems require access to substantial personal and financial data, ensuring responsible data handling.

Addressing these ethical considerations proactively and sustainably is paramount for maintaining trust, ensuring fairness, and fostering the long-term responsible adoption of AI that truly creates value within the financial industry.

Embracing AI in Portfolio Management and Investment Strategy

AI’s influence on portfolio management and investment strategies is rapidly expanding, transforming the investment process from asset allocation and risk management to algorithmic trading and personalized advice. The potential for enhanced efficiency, deeper analytics, and improved outcomes compels investment professionals to embrace AI integration. While challenges like data quality and interpretability require careful navigation, forward-thinking firms are adapting.

Understanding AI’s capabilities and limitations is increasingly crucial for investment professionals and those entering the field. The investment industry is undergoing an AI-driven transformation that promises to reshape financial markets and investment strategies. Success in this transformation will likely hinge on effectively combining AI’s analytical power with human judgment, creativity, and ethical oversight, fostering a collaborative approach for a complex, data-rich future.

The increasing influence of AI is transforming portfolio management and investment strategies. To understand and navigate this evolving landscape, a strong foundation in analytical and strategic principles is essential. Explore Wall Street Prep’s comprehensive courses to master crucial financial modeling and data analysis techniques, skills that will empower you to excel in the modern finance industry.