- Top 5 AI for Business & Finance Certificate Programs

- Comparison: Which AI Program Is the Best for Finance?

- #1: AI for Business & Finance — Columbia Business School ExecEd x Wall Street Prep

- #2: No Code AI and Machine Learning — MIT x Emeritus

- #3: AI Essentials for Business — Harvard Business School Online

- #4: AI-Driven Leadership: Strategies for the Future — Stanford Online

- #5: Artificial Intelligence: Business Strategies and Applications — Berkeley ExecEd

- Alternatives to Investing in an AI Certification

- Why an AI for Finance Certificate Is Worth the Investment in 2026

Top 5 AI for Business & Finance Certificate Programs

AI is already entrenched in the workflows of modern finance.

From investment banking to private equity to corporate finance, teams are automating, forecasting, and analyzing with speed and scale once thought impossible.

- As AI reshapes finance—from forecasting to investment analysis—finance professionals are expected to develop hands-on skills with AI tools, not just a high-level understanding.

- Many top AI courses offer strategic overviews but fall short when it comes to role-specific applications for finance. Columbia Business School Executive Education x Wall Street Prep stands out for embedding AI directly into financial workflows.

- Unlike shorter or more theoretical programs, Columbia’s AI for Business & Finance Certificate provides live support, peer communities, and long-term access to updated content, making it more sustainable for ongoing career growth.

- With employers offering salary premiums for AI-fluent professionals and finance teams expanding to support AI adoption, finance-specific training offers a clear edge in career advancement.

Here are just a few recent examples:

- Morgan Stanley is deploying AI-powered chatbots to assist wealth managers.1

- Private equity firms are using AI to accelerate due diligence and target screening.2

- Visa leverages AI to detect fraud in real time across billions of transactions.3

- Goldman Sachs uses machine learning to optimize IPO pricing and bookbuilding.4

These aren’t outliers—they’re signals of a broader shift. Thousands of finance professionals are already seeing their roles reshaped by AI.

As this transformation accelerates, the demand for an AI skillset is no longer just for engineers.

Employers are urgently looking for business professionals who understand how AI works, and how to use it to drive results.

If you’re looking to upskill, not every AI course will get you there. Many are too generic, theoretical, or too technical.

Here we break down the more recognized and practical AI programs tailored for finance and business professionals, so you can find the one that matches your role, goals, and learning style.

Comparison: Which AI Program Is the Best for Finance?

| Program | Duration | Price | CEUs | Live Networking | Best For | Overall Value for Career |

|---|---|---|---|---|---|---|

| AI for Business & Finance Columbia Business School Executive Education + Wall Street Prep |

8 Weeks | $5,000 | 65 | ✅ Lifetime access to community and recruiting events |

|

|

| No-Code AI and Machine Learning MIT Professional Education |

12 Weeks | $2,850 | 8 | ❌ |

|

|

| AI Essentials for Business Harvard Business School Online |

4 Weeks | $1,850 | NA | 🟡 Limited |

|

|

| AI-Driven Leadership Stanford Center for Professional Development |

6 Weeks | $2,900 | 4.2 | ❌ |

|

|

| Artificial Intelligence: Business Strategies and Applications UC Berkeley Executive Education |

8 Weeks | $2,950 | 0 | 🟡 Limited |

|

#1: AI for Business & Finance — Columbia Business School ExecEd x Wall Street Prep

Overview: Co-created with Wall Street Prep, the #1 financial training services provider, this program is purpose-built for applying AI in finance. Unlike generic AI business courses, it integrates real financial workflows, teaching professionals how to apply AI tools like Python and SQL in areas such as forecasting, investment analysis, and automation.

Who it’s for: FP&A leaders, private equity professionals, portfolio managers, financial analysts, equity researchers, risk management professionals, corporate finance teams, and business analysts

What it solves: Equips finance professionals to use AI for forecasting, investment analysis, risk modeling, and operational automation. The course bridges technical tools with finance workflows, enabling more informed, data-driven decisions.

Industry relevance and recognition: Wall Street Prep is the financial training provider of choice for the world’s top investment banks, private equity firms, and Fortune 1000 companies.

Co-developed with Columbia Business School Executive Education, this certificate brings real-world credibility and industry alignment to professionals looking to apply AI in finance. Graduates earn recognition from two trusted institutions—backed by decades of expertise in finance and executive education.

Learning experience:

- Step-by-step video lessons designed to fit a full-time schedule

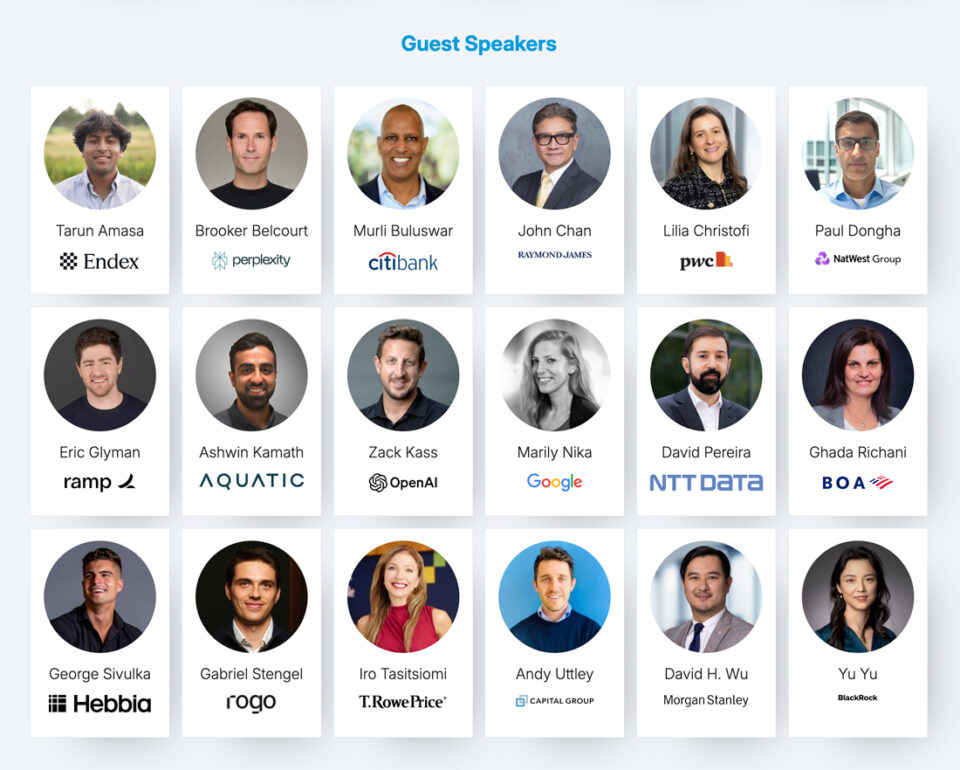

- Insights from top finance leaders at BlackRock, Morgan Stanley, Capital Group, and more on how AI is being implemented across investment strategy, risk modeling, and banking operations

- Personalized support through live 1:1 coaching and office hours

- Ongoing in-person networking events hosted in major cities after the program ends

- Access to invitation-only LinkedIn group and Slack channels

- Invitation to a closing ceremony at Columbia’s NYC campus

- Continued access to updated materials and new content for 2 years after completion

- Certificate from Columbia Business School Executive Education

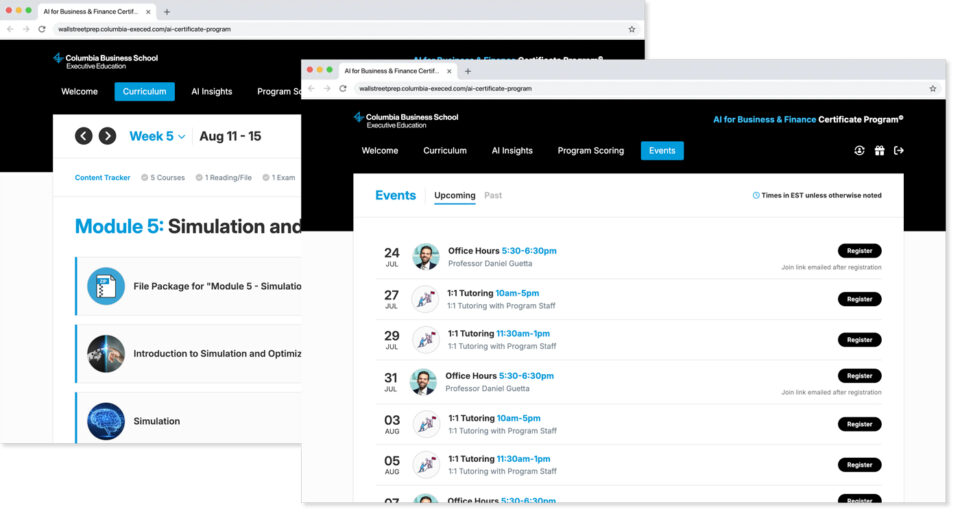

Columbia Business School Exec Ed + Wall Street Prep’s AI for Business & Finance Certificate Program offers ample opportunity for participants to connect with staff and each other in live sessions.

Curriculum:

- 10/10 for finance alignment: The curriculum is built around real-world applications of AI across FP&A, investment analysis, risk modeling, and more.

- Continuously updated content: As AI evolves, so does the program. You’ll get access to updated course materials for two years after your cohort ends.

- Built for what’s happening now: Case studies and exercises are regularly refreshed to reflect the latest tools, use cases, and trends in AI for finance.

- Hands-on and job-ready: Lessons are grounded in practical skills like Python, predictive analytics, and OpenAI tools, not just theory.

- Taught by experts shaping the field: Learn from Columbia Business School faculty and Wall Street Prep instructors who train top finance teams globally.

Technical level: Low-code — just enough coding (Python, SQL) to be dangerous without overwhelming non-technical learners

“We kept hearing the same thing from business schools and finance teams: ‘We need to help our people get up to speed on AI—fast,” says Wall Street Prep CEO Matan Feldman. “That’s really what sparked this program. It’s built to meet that need with skills that actually translate into the work finance professionals do every day.”

Download the AI for Business & Finance Certificate program brochure.

#2: No Code AI and Machine Learning — MIT x Emeritus

Overview: Good for professionals who need to understand how AI works without writing code. Strong fit for mid-career managers and senior leaders overseeing AI integration.

Who it’s for: Product managers, Project managers, Consultants, Entrepreneurs

What it solves: Provides a foundational understanding of AI and ML concepts, with a focus on how to evaluate, deploy, and manage AI initiatives in a business setting

Industry relevance and recognition: The No-Code AI and Machine Learning program is backed by MIT Professional Education, a globally recognized institution in engineering and innovation.

While the program is not tailored to finance, it offers broad industry relevance for professionals seeking to understand AI strategy and implementation across sectors like healthcare, manufacturing, and operations.

For finance professionals, it may serve as a helpful primer on AI concepts—but lacks the domain-specific depth found in finance-focused programs.

Learning Experience:

- Weekly asynchronous video lectures delivered by MIT faculty, focusing on AI strategy, applications, and concepts

- Case studies from industries like healthcare, manufacturing, and retail—but limited focus on finance-specific use cases

- Emphasis on strategic understanding over hands-on coding or technical buildout

- Includes video lectures, interactive exercises, and discussion forums

Curriculum:

- Introductory AI concepts covered: Learners explore machine learning fundamentals including classification, regression, and language models.

- Understand broad business applications: Learn how to assess AI use cases and consider their strategic implications across different functions.

- Examples from multiple industries: Course content includes real-world scenarios, though not tailored specifically to finance roles.

- Emphasis on responsible AI: Covers key ethical considerations and best practices for deploying AI in a variety of business settings.

Technical level: No-code — emphasizes strategy, decision-making, and oversight rather than hands-on development

#3: AI Essentials for Business — Harvard Business School Online

Overview: Backed by HBS, this course lends strong employer credibility. Finance is mentioned as one of several functional areas, but it’s not the focus. The curriculum is broader—suitable for roles in marketing, operations, and HR as well.

Who it’s for: Business leaders and managers, Marketing, Product management, Operations, HR

What it solves: Helps professionals identify high-impact AI use cases across functions, manage AI projects, and communicate effectively with technical teams

Industry relevance and recognition: Offered through Harvard Business School Online, this program carries strong name recognition and credibility with employers across industries. It’s designed for business leaders, managers, and decision-makers looking to understand AI at a strategic level.

However, it is not tailored to finance—the course emphasizes broad cross-functional applications in areas like marketing, operations, and product management.

Finance professionals may find the content relevant for understanding organizational AI strategy, but less actionable for technical or workflow-specific applications in finance.

Learning Experience:

- Self-paced format with weekly deadlines on the HBS Online platform

- Bite-sized videos from HBS faculty and guest business leaders

- Interactive graphs, cold-call simulations, and frequent activity changes (every 3–5 minutes) to sustain attention

- Global peer networking via the HBS Online Community’s networking group

- Case-based learning with examples from Amazon, Microsoft, Moderna, Mozilla, and Novartis

- Course access ends 60 days after your final deadline, compared to Columbia’s program, which offers ongoing updates and full material access for 2 years

Curriculum:

- Covers AI fundamentals and strategy: Introduces core topics such as generative AI, data infrastructure, and frameworks for value creation.

- Broad industry focus: Examples span a range of sectors; limited emphasis on finance-specific functions or decision-making contexts.

- Explores organizational readiness: Includes topics like digital ethics, privacy, and preparing teams for AI adoption.

- Geared toward general leadership roles: Best suited for business leaders seeking conceptual awareness rather than hands-on technical depth.

- Lacks finance-specific tools and cases: Does not include instruction in Python, or applied AI use in areas like FP&A, investment analysis, or risk modeling—unlike Columbia’s program.

Technical level: No-code — focused on business implications, organizational change, and strategic decision-making

#4: AI-Driven Leadership: Strategies for the Future — Stanford Online

Overview: Designed for senior leaders driving enterprise-level AI adoption. Less focused on finance-specific applications, but valuable for CFOs and finance executives leading digital transformation.

Who it’s for: Executives in finance, strategy, or transformation roles

What it solves: Prepares leaders to navigate the business and ethical implications of AI, lead AI-focused teams, and integrate AI strategy across departments

Industry relevance and recognition: Stanford’s course is geared toward senior leaders navigating organizational change in the age of AI. It focuses on leadership strategy, data culture, and digital implementation across industries.

While it’s not finance-specific, the program reflects growing demand for leaders who can manage AI integration, anticipate risks, and foster innovation in complex environments.

Learning Experience:

- 6-week online course with flexible learning pace

- Instructor-led content from Stanford faculty

- Peer collaboration through study groups and networking forums

- Final capstone project to design an AI implementation plan

- Access to course materials for up to 6 months post-completion

Curriculum:

- Designed for organizational leadership: Focuses on managing AI-driven change, not developing technical finance capabilities.

- Covers foundational leadership topics: Includes data readiness, workflow design, and AI governance strategies.

- Use cases are broad, not finance-specific: Highlights generative AI and predictive analytics, but lacks depth in FP&A, risk modeling, or investment workflows.

- Best for senior leaders: Aimed at executives guiding AI adoption—less suited for those seeking practical finance applications or tools like Python.

Technical level: No-code — focused on leadership, strategy, and cross-functional alignment

#5: Artificial Intelligence: Business Strategies and Applications — Berkeley ExecEd

Overview: Well-suited for business professionals leading digital strategy or transformation efforts, but finance professionals looking for more targeted applications (like in FP&A, private equity, or investment modeling) may benefit more from a finance-specific course.

Who it’s for: Senior leaders including C-suite executives overseeing the integration of AI into their organization, Data scientists and analysts, Mid-career professionals

What it solves: Teaches how to identify AI opportunities, assess vendor tools, and build an AI adoption roadmap

Industry relevance and recognition:

Berkeley Executive Education is widely respected for its leadership in innovation and technology, and this program reflects that reputation with a strong emphasis on strategic AI adoption across sectors. The curriculum is designed for cross-functional business leaders navigating AI integration in roles such as product, operations, and general management.

While relevant to finance professionals interested in broader applications of AI, it does not offer the finance-specific tools, use cases, or role alignment found in Columbia’s AI for Business & Finance Certificate.

Learning Experience:

- Includes four live faculty sessions, recorded lectures, and peer discussions

- Hands-on capstone project applies learnings directly to a real business initiative

- Learning platform supports flexible access and interactive assignments

- Unlike Columbia’s program, Berkeley’s access to course materials and updates may be time-limited post-program (not explicitly stated), whereas Columbia participants retain access to updated materials for 2 years

Curriculum:

- Covers foundational AI topics: Introduces key concepts like machine learning, natural language processing, and predictive analytics.

- Cross-industry lens: Case studies span various sectors—finance is included but not the primary focus.

- Suited for general business audiences: Designed for leaders exploring AI strategy, not hands-on finance practitioners.

Technical level: No-code with optional technical exploration

The AI in Business & Finance Certificate Program

Build a practical AI skillset and transform your career. No coding required! Enrollment is open for the Columbia Business School Executive Education and Wall Street Prep March 2026 cohort.

Enroll TodayAlternatives to Investing in an AI Certification

If you’re not ready to commit to an AI certification in finance, you can still build foundational knowledge and stay current on trends with free or low-effort options like:

- Follow AI newsletters

Stay up to speed with curated insights from The Algorithm (MIT Tech Review), Import AI, and industry roundups like McKinsey’s AI reports. - Read finance-focused case studies

Companies like Goldman Sachs, Visa, and BlackRock regularly publish examples of how they’re applying AI in investment banking, fraud detection, and asset management. - Watch short-form AI explainers

YouTube channels like Two Minute Papers or Microsoft Research break down complex topics into digestible videos. - Explore free foundational courses

Platforms like Coursera, edX, and Google AI offer no-cost intros to AI, machine learning, and prompt engineering.

These options offer a flexible way to start—but they often lack structure, support, and practical relevance to finance.

Why an AI for Finance Certificate Is Worth the Investment in 2026

Self-study courses are a great way to explore the basics. But if you’re serious about applying AI in your work—and standing out—structured, finance-specific training can take you further, faster.

There’s real opportunity here: Generative AI is expected to deliver $200–$340 billion in annual value to the banking and finance sector, according to McKinsey. And companies are actively looking for professionals who know how to turn that potential into results.

Consider this:

- 78% of CFOs say their teams need stronger AI skills to keep up with where the industry is headed 5

- Employers are offering a 42% salary premium for finance pros who bring AI fluency to the table (PwC & AWS) 6

- More than two-thirds of finance leaders plan to expand their teams in the next year as companies need more staff to support AI implementation, analysis, model governance, and strategic application. 7

- On LinkedIn, AI-related job posts have jumped 17% year-over-year, and profiles listing AI skills have increased 142x since 2016 8

The takeaway is clear: As demand rises for AI-literate professionals in business and finance, those with the foresight to upskill now will be best positioned to lead future-ready teams.

Whether you’re working in FP&A, private equity, corporate strategy, or risk management, AI literacy is quickly becoming essential for higher-impact roles, better pay, and greater influence.