- What Is the AI for Finance Certificate Program?

- AI for Finance Program Overview

- Do You Need to Know Python or Be Technical?

- Curriculum Overview: What You’ll Learn in the Columbia AI Certificate Program

- What AI Tools Will You Learn to Use?

- Is There Real-World Application and Case Work?

- Who Teaches the Program?

- Columbia AI Certificate Program: What’s the Learning Experience Like?

- What Networking Opportunities Are Included with the Columbia AI Certificate Program?

- How Much Does the Columbia AI Certificate Program Cost?

- How Does It Compare to Other AI Certificate Programs?

- Career Benefits of the Columbia AI Certificate Program

- Is the Columbia AI Certificate Program Worth It?

- Final Verdict: Should You Enroll in the Columbia AI Certificate Program?

What Is the AI for Finance Certificate Program?

The Columbia AI Certificate Program made in collaboration with Wall Street Prep promises to equip professionals with practical AI skills without requiring a technical background.

But is it worth the investment?

In this review, we’ll cover the curriculum, learning experience, AI tools taught, and how the program is recognized across the industry.

- No Technical Background Required: The program is designed for professionals without coding experience. Python and AI tools are taught step-by-step using real finance use cases.

- Finance-Focused Curriculum: Learn to apply AI in forecasting, risk management, trading strategy, customer analysis, and more—tailored specifically for finance professionals.

- Ivy League Recognition: Earn a certificate from Columbia Business School Executive Education and add Ivy League credibility to your résumé and LinkedIn.

- Hands-On Learning with Real Tools: Build job-ready skills using Python, OpenAI APIs, predictive models, and tools like Microsoft Copilot through practical, case-based projects.

- Access to Industry Leaders: Learn directly from Columbia faculty and AI leaders from firms like Citibank, OpenAI, PwC, and Morgan Stanley—with built-in networking opportunities.

AI for Finance Program Overview

The Columbia AI Certificate Program is an 8-week, fully online course developed in collaboration with Wall Street Prep. Together, they bring academic credibility and real-world financial training into one program.

Key highlights:

-

100% online, self-paced format (8–10 hours/week)

-

Jointly developed by Columbia Business School & Wall Street Prep

-

65 CPE credits included

-

Hands-on training with Python, OpenAI APIs, and tools like Microsoft Copilot

-

Real-world case studies from finance, banking, consulting, and corporate strategy

-

Certificate issued by Columbia Business School Executive Education

Is Columbia’s AI for Finance Program Right for You?

Whether you’re early in your career, pivoting into a new role, or already managing a team, this program equips you with the practical AI skills needed to stay relevant and create meaningful impact in your organization.

| Audience | What They’ll Gain |

|---|---|

| Finance professionals | Learn to automate workflows, enhance forecasting, and gain an edge with predictive analytics and AI tools. |

| Analysts, Quants, BI Professionals | Get hands-on experience with Python, machine learning, and LLMs to generate data-driven insights. |

| FP&A, Accounting, Treasury, Operations | Improve efficiency and scenario modeling using AI, APIs, and automation tools. |

| Managers and Team Leads | Build AI literacy to lead initiatives and create strategic integration plans. |

| Finance Tech Professionals | Understand business use cases for AI and build more impactful tools aligned with organizational needs. |

| Risk, Compliance, and Fraud Specialists | Strengthen real-time monitoring, fraud detection, and risk assessment through AI applications. |

| Consultants and Advisors | Deepen understanding of AI frameworks to better guide clients in financial services. |

| Career Switchers | Gain a practical, credible credential to pivot into AI-related roles in finance or business. |

Participants come from diverse sectors—finance, fintech, healthcare, retail, and tech—but share a common goal: to apply AI in ways that drive measurable business results.

When This Program Might Not Be the Right Fit

This program is not designed for those who want to become full-time data scientists or machine learning engineers.

While the curriculum covers foundational Python and predictive modeling, it prioritizes strategic implementation over deep algorithmic or mathematical theory. If you’re looking to train neural networks from scratch or pursue an academic track in AI, you may find this program too high-level.

Do You Need to Know Python or Be Technical?

No technical experience is required. The course starts with beginner-friendly Python training and builds toward hands-on projects that focus on business outcomes, not algorithms.

You’ll learn:

-

How to analyze financial data with Python

-

How to connect to APIs (like OpenAI)

-

How to use AI to automate business tasks

-

How to lead AI projects at work

Curriculum Overview: What You’ll Learn in the Columbia AI Certificate Program

The Columbia AI for Business & Finance curriculum is both rigorous and highly practical. It progresses from foundational AI concepts to advanced use cases in finance and business, using Python, APIs, and real-world data sets.

| Module | What You’ll Learn |

|---|---|

| Intro to AI & Machine Learning | Get a clear understanding of how AI is already being used across key functions in finance—like trading, risk management, compliance, and operations. You’ll explore real-world case studies that show how machine learning is helping firms make faster, smarter decisions. |

| Python for Business | Designed for beginners, this module helps you get comfortable with Python by using it to solve actual business problems. You’ll learn to clean, analyze, and visualize financial data—no coding background required. |

| Predictive Analytics | Go beyond the buzzwords and learn how to build models that forecast outcomes. Using techniques like regression and decision trees, you’ll see how data can be used to predict credit defaults, estimate customer churn, or optimize portfolio returns. |

| Generative AI | This module shows you how to fine-tune pre-trained models and even build a basic AI assistant or chatbot tailored to your business use case. |

| Simulation & Optimization | Learn how to make better decisions under uncertainty. Through hands-on exercises, you’ll use simulation to model risk and optimization tools to allocate resources or structure deals more effectively. |

| Real-World Tools | You’ll put your skills to work using powerful, enterprise-grade AI platforms—including tools like Microsoft Copilot and OpenAI APIs. |

Each module is hands-on, with coding assignments, AI prompt engineering templates, and finance-specific case studies (think: loan default prediction, stock return modeling, mortgage portfolio analysis).

Download the brochure for the AI for Business & Finance Certificate Program from Columbia Business School Executive Education and Wall Street Prep.

What AI Tools Will You Learn to Use?

Throughout the 8-week program, you’ll gain hands-on experience with a wide range of AI tools and platforms used in top financial institutions.

| AI Tool | How You’ll Use It |

|---|---|

| Python (with Pandas, Matplotlib, and more) | Learn to analyze, visualize, and automate business and financial data workflows. |

| APIs (including OpenAI’s API) | Automate repetitive tasks and connect to external data sources to enhance productivity and scalability in your day-to-day work. |

| Generative AI & Large Language Models (LLMs) | Use tools like ChatGPT to summarize financial documents and create classification systems for tasks like complaint routing or fraud detection. |

| Predictive Analytics Tools | Apply linear models, logistic regression, and ensemble methods like random forests to forecast loan defaults, optimize pricing, and inform trading strategies. |

| Simulation & Optimization Tools | Quantify uncertainty and make data-driven decisions across portfolio management, workforce planning, and capital allocation. |

| Microsoft Copilot and General Productivity AI Tools | Explore how enterprise AI tools can enhance day-to-day business operations and decision-making across teams. |

| Third-party AI Tools for Finance | Evaluate real-world platforms used for investment research, market intelligence, risk modeling, and sentiment analysis so you can decide which tools are right for your organization. |

“These last two weeks opened my eyes to the possibilities of Python. The level of detail, care, and comprehensiveness in everything Professor Guetta is teaching is incredible. I had high standards for the course, but two weeks in, and it is already exceeding expectations.”

– 2025 Program Participant

Is There Real-World Application and Case Work?

Yes, this program is deeply rooted in real-world use cases. Every module includes hands-on assignments, case studies, and projects that mirror the types of challenges professionals face in finance and business today. You’ll learn by doing, not just watching.

Here’s a glimpse of what you’ll work on:

| Use Case | How You’ll Use AI |

|---|---|

| Predicting Loan Defaults | Use predictive models like decision trees and random forests to assess credit risk and improve lending decisions. |

| Automating Investment Research | Extract insights from unstructured data using AI tools to streamline due diligence and asset evaluation. |

| Building Trading Strategy Models | Apply historical data to train and back-test simple automated trading strategies using linear regression. |

| Forecasting Customer Churn | Use entity resolution and retrieval-augmented generation (RAG) techniques to anticipate and mitigate client attrition. |

| Classifying Customer Complaints | Use LLMs to build systems that automatically categorize and respond to support tickets or regulatory reports. |

| Optimizing Portfolios and Business Decisions | Learn simulation and optimization methods to make smarter decisions under uncertainty, from capital planning to workforce strategy. |

| AI-Enhanced Pricing and Satisfaction Analysis | Develop models that dynamically set prices or uncover key drivers of employee satisfaction using AI-powered analytics. |

Your projects will reflect how AI is being applied inside investment banks, hedge funds, and Fortune 500 companies. You’ll finish the program with a portfolio of work and the skills to confidently bring AI solutions to your team or organization.

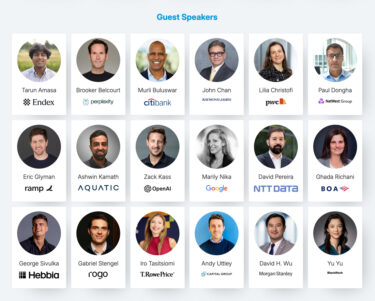

Who Teaches the Program?

One of the most compelling aspects of the Columbia AI for Business & Finance Certificate Program is the caliber of its teaching team.

You’ll be learning from Columbia Business School faculty, top AI strategists, and finance executives who are actively shaping how artificial intelligence is being implemented in the real world.

At the center of the program is Daniel Guetta, Program Director and Professor of Professional Practice at Columbia Business School.

A former data scientist at Palantir, Guetta brings deep expertise in business analytics, pricing, data science, and cloud computing. His work bridges academic rigor with practical application, which is exactly the combination that makes this AI executive education program so effective.

Guetta also co-authored Python for MBAs and has worked with global firms to solve some of their most complex challenges using data and AI.

Throughout the program, you’ll also hear directly from industry leaders who are at the forefront of AI in finance, including:

- Zack Kass – Former Head of Go-To-Market at OpenAI, where he helped scale AI adoption across industries

- Brooker Belcourt – GM of Finance at Perplexity AI, with past experience at Citadel and Goldman Sachs

- Lilia Christofi – EMEA Data & AI Financial Services Partner at PwC, known for driving AI adoption across global markets

- Paul Dongha – Head of Responsible AI & AI Strategy at NatWest Group, focused on building ethical and trustworthy AI frameworks

- Murli Buluswar – Head of U.S. Personal Banking Analytics at Citibank, leading a 700+ person team applying AI for data-driven decision-making

- Yu Yu – Director of Data Science at BlackRock, where she develops generative AI tools to enhance client services and business outcomes

- David Wu – Head of Firmwide AI Product Strategy at Morgan Stanley, responsible for deploying GenAI platforms across the wealth management division

This level of access to C-suite leaders, AI product strategists, and data science directors at some of the world’s top financial institutions is rare in any AI certificate program.

Whether it’s understanding how Morgan Stanley is rolling out GenAI platforms or how Citibank is embedding analytics into everyday decision-making, you’ll get insider perspectives you won’t find anywhere else.

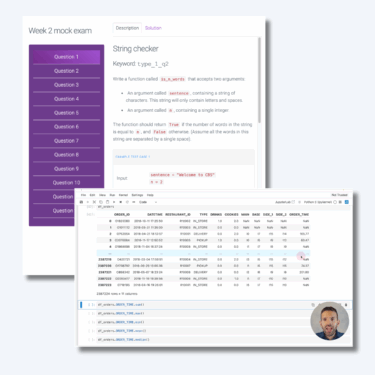

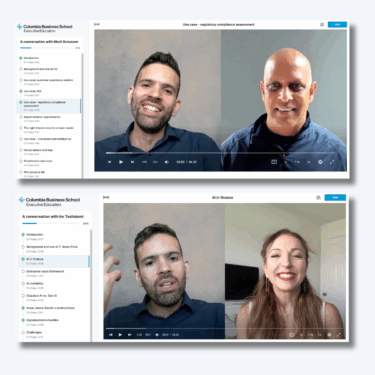

Columbia AI Certificate Program: What’s the Learning Experience Like?

As part of a guest speaker series, Program Director Daniel Guetta interviews Murli Buluswar (Citibank) and Iro Tasitsiomi (T. Rowe Price), who share how their organizations are implementing AI in practical and impactful ways.

This 8-week AI certificate program is designed with working professionals in mind.

Whether you’re balancing a full-time job, managing a team, or looking to upskill on your own time, the format is built to be both rigorous and flexible. The course is fully online and self-paced, with a recommended commitment of 8–10 hours per week.

You’ll progress through structured weekly modules, each focused on helping you apply AI in finance and business settings.

Here’s what’s included:

- Short, engaging video lessons led by Columbia Business School faculty and Wall Street Prep instructors, with additional insights from guest speakers like former OpenAI executive Zack Kass, Citibank’s Head of U.S. Personal Banking Analytics Murli Buluswar, and leaders from PwC, BlackRock, and Morgan Stanley

- Weekly Python exercises, built for beginners, to help you automate tasks and analyze financial data

- Step-by-step guides for using AI tools, including prompt engineering and working with APIs

- Real-world case studies that show how AI is being used for investment analysis, pricing strategy, workforce planning, and more

- Downloadable templates and AI tools to use in your own role

- Live virtual office hours with faculty and industry mentors for personalized guidance

- A final capstone project using real financial datasets, where you’ll apply everything you’ve learned to a real-world business challenge

The learning experience is intentionally hands-on. You’ll explore predictive analytics, generative AI, and machine learning through projects that mimic the types of tasks professionals face in roles like investment banking, FP&A, or data analysis. Even if you don’t have a technical background, the course is structured to help you build confidence using AI.

What Networking Opportunities Are Included with the Columbia AI Certificate Program?

Participants from the Columbia AI for Finance Certificate Program connect in person at a New York City meet-up.

While the curriculum is strong on its own, what makes this program exceptional is its vibrant, built-in professional network.

As AI and finance continue to evolve at a rapid pace, who you learn with can be just as valuable as what you learn.

“This program can be best described as online learning meets MBA style networking,” says Program Director Daniel Guetta. “On the one hand you’re working efficiently on your own time attending virtual office hours and one-on-one tutoring sessions, but you also have great networking opportunities as you would on campus.”

Research from LinkedIn shows that 80% of professionals1 consider networking essential to career success, and nearly 70% of job placements come through referrals or connections.2

This program makes it easy to build meaningful relationships that last well beyond the 8 weeks:

- Weekly Office Hours & Live Q&As

Engage directly with Columbia Business School faculty, Wall Street Prep instructors, and industry experts. These live sessions allow participants to clarify complex topics and get real-time feedback on how to apply AI in their current role. - Slack Channels by Region

Stay connected with peers in your area, whether you’re in New York, London, or Singapore. These regional Slack groups create a sense of local community within a global cohort. - LinkedIn Alumni Group

Graduates are invited to a private alumni group where they can exchange insights, share job opportunities, and access exclusive events and content. This ongoing connection turns a short course into a long-term professional asset. - In-Person Networking Events

Optional meetups and roundtables in New York City offer opportunities to build face-to-face relationships with classmates, program faculty, recruiters, and guest speakers from leading firms.

How Much Does the Columbia AI Certificate Program Cost?

Compared to other executive AI programs (some of which cost $8K–$12K and are less tailored to finance), the Columbia certificate offers competitive value for the depth of curriculum and level of instructor access.

- Tuition: $4,800 before early enrollment deadline; $5,000 afterward

- Payment Options: Pay in full, or over time with monthly installments.

- $500 Tuition Assistance: Available on a first-come, first-served basis via application

How Does It Compare to Other AI Certificate Programs?

| Program | Duration | Price | CEUs | Live Networking | Best For | Overall Value for Career |

|---|---|---|---|---|---|---|

| AI for Business & Finance Columbia Business School Executive Education + Wall Street Prep |

8 Weeks | $5,000 | 65 | ✅ Lifetime access to community and recruiting events |

|

|

| No-Code AI and Machine Learning MIT Professional Education |

12 Weeks | $2,850 | 8 | ❌ |

|

|

| AI Essentials for Business Harvard Business School Online |

4 Weeks | $1,850 | NA | 🟡 Limited |

|

|

| AI-Driven Leadership Stanford Center for Professional Development |

6 Weeks | $2,900 | 4.2 | ❌ |

|

|

| Artificial Intelligence: Business Strategies and Applications UC Berkeley Executive Education |

8 Weeks | $2,950 | 0 | 🟡 Limited |

|

Career Benefits of the Columbia AI Certificate Program

| Benefit | What It Means for You |

|---|---|

| Columbia-Backed Credential | Add Ivy League recognition to your resume and LinkedIn profile |

| 65 CPE Credits | Maintain professional certifications while building future-proof skills |

| Faculty & Industry Network | Build relationships with practitioners from firms like OpenAI, Citibank, PwC, and Morgan Stanley |

| Confidence with Tools | From Python to OpenAI APIs, gain hands-on experience to lead AI discussions at work |

Is the Columbia AI Certificate Program Worth It?

If you’re looking to build AI fluency without pivoting your career into tech—and you want to stay competitive in finance or business—the Columbia AI for Business & Finance Certificate Program is a good investment.

What makes it worth it:

- Real-world curriculum tailored for finance

- Access to top AI minds and industry leaders

- Practical tools and frameworks you can use immediately

- A strong professional network that keeps growing after the course

- The credibility of Columbia Business School

In a time when “AI-washing” is everywhere, this program delivers substance. You’ll learn how to lead and make impactful business decisions with AI.

Final Verdict: Should You Enroll in the Columbia AI Certificate Program?

It’s no longer a question of if you’ll work with AI, but how soon.

A McKinsey survey shows that 78% of financial organizations have embedded AI into at least one business function—up from 55% just a year earlier —and over 70% of financial institutions now rely on AI for fraud detection and risk management. 3

In short: If you’re not learning how to work with AI, someone else is, and they’ll be first in line for the next promotion or role.

Learn more about the upcoming cohort for the AI for Business & Finance Certificate Program.

- 1 https://news.linkedin.com/2017/6/eighty-percent-of-professionals-consider-networking-important-to-career-success

- 2 https://questromfeld.bu.edu/blog/2025/05/22/the-power-of-networking-why-70-of-job-seekers-find-success-through-connections/

- 3 https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai?utm_source=chatgpt.com