What Is Financial Planning?

Financial planning is the process of evaluating your income, expenses, debts and savings to create a clear strategy for managing your money and achieving your financial goals. It involves understanding where your money goes, setting short- and long-term objectives, building a workable budget, preparing for emergencies, and investing for the future. Effective financial planning provides structure, reduces financial stress, and helps you make informed decisions that support long-term stability and growth.

Managing your money begins with understanding your income, your expenses, and your financial habits. Having a clear plan helps you build stability today while preparing for long-term goals such as buying a home, funding an education, or retiring comfortably.

Financial planning does not need to be complicated, but it does require attention, consistency, and informed decision-making. Whether you’re starting from scratch or seeking better control over your finances, a few simple steps can help you to position yourself on a firmer footing.

Step 1: Understand Your Current Finances

The first step in financial planning is to take a clear inventory of your finances. List your income sources, monthly expenses, debts, and savings. Tracking this information gives you a realistic view of how money flows in and out of your accounts.

Break your spending into categories: essentials like rent or mortgage, transportation, groceries, and utilities; debt payments such as credit cards or student loans; and discretionary spending like dining out, subscriptions, or entertainment. Tracking these expenses over a few months can help you identify patterns and areas where adjustments can improve your financial health.

Consider reviewing your credit report and credit score as well. This can reveal hidden debts or errors and give you insight into your borrowing power. Many free online services provide annual credit reports.

Step 2: Define Your Financial Goals

Financial goals give your money direction. Short-term goals, like saving up to take a vacation or paying off the balance on a credit card, can be achieved within a few months to a couple of years. Medium- and long-term goals might include purchasing a home, starting a business, or preparing for retirement.

Write your goals in clear, measurable terms. For instance, “I want to save $3,000 for a down payment on a car in 12 months” provides a concrete target, compared with vague intentions like “I want to save money.” Establishing timelines helps you track your progress and hold yourself accountable.

Prioritize your goals based on urgency and importance. Some goals may require immediate attention, like paying off high-interest debt, while others can be pursued gradually, like building a retirement fund.

Step 3: Make a Realistic Budget That Works

A budget is a structured plan for managing your income. Start by allocating funds for essential expenses such as housing, food, utilities, and transportation. Next, plan for debt repayment and savings contributions. Finally, assign money for discretionary spending.

Creating a realistic budget requires honesty. Overly strict budgets are difficult to maintain, while overly lenient budgets may fail to produce meaningful progress.

There are several budgeting methods that you can follow, and you may need to experiment a bit to find one that works for you. The 50/30/20 rule, for example, divides your income into 50% for essentials, 30% for discretionary spending, and 20% for savings and debt repayment. Alternatively, zero-based budgeting assigns every dollar a purpose, giving you total control over how money is used.

Step 4: Create an Emergency Fund

Unexpected expenses can disrupt financial progress. An emergency fund provides a safety net for events such as medical bills, car repairs, or temporary unemployment.

Aim to save three to six months of living expenses in an accessible account. If this target seems daunting, start with a smaller goal, such as $500 or $1,000, and build gradually from there. Contributions can come from bonuses, side income, or small reductions in discretionary spending.

Place your emergency fund in a separate account to avoid the temptation to spend it on non-emergencies. High-yield savings accounts can offer interest while keeping the money liquid. If you do have a true emergency and need to dip into your fund, replenish it as soon as you can. Having an emergency fund in place reduces stress and prevents the need for high-interest borrowing in times of financial difficulty.

Step 5: Save and Invest for the Future

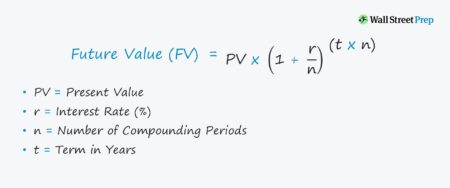

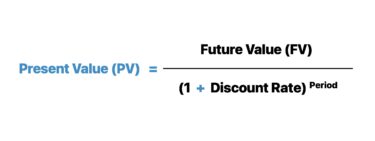

After establishing an emergency fund, focus on long-term savings and investments. Retirement accounts, such as 401(k)s or IRAs, are valuable tools because they offer tax advantages and allow for compound growth over time. Take full advantage of employer matching contributions whenever they’re available.

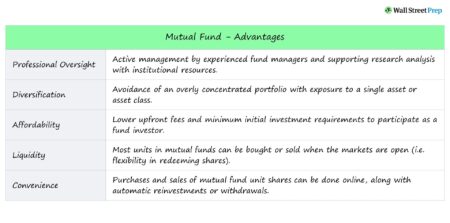

Beyond retirement, college funds, real estate investments, and entrepreneurial ventures can also benefit from dedicated investment accounts. Consider investing in a diverse array of stocks, bonds, mutual funds, and index funds that align with your risk tolerance and financial timeline. Diversification reduces the impact of market fluctuations and provides potential growth over decades.

Step 6: Review and Improve Your Plan

Life circumstances, income levels, and goals can evolve over time, and regularly reviewing your plan can help ensure that it continues to reflect your current situation. Schedule a review of your finances once a year. Evaluate your spending, debt, savings, and investments, and adjust your budget or goals as necessary.

Utilizing tools like financial apps or spreadsheets can simplify this process. Over time, minor adjustments and consistent monitoring can yield substantial improvements in your financial stability and confidence.

More Financial Planning Tools & Resources

- Budgeting 101

- Fundamentals of Budgeting

- How to Build a Better Personal Budget

- Financial Planning Fundamentals

- Financial and Valuation Modeling

- How Budgeting Makes Your Future a Reality

- Creating a Personal Budget

- Basics of Saving Money

- Six Tips for Saving Money

- Introduction to Investing

- Understanding Investment Strategies

- Wharton Applied Value Investing Certificate