What Is Retirement Planning?

Retirement planning is the process of preparing your finances so you can maintain your lifestyle and meet expenses after you stop working. It involves estimating future needs, saving consistently, choosing the right investment accounts, and selecting a strategy that aligns with your age, risk tolerance, and long-term goals. Effective retirement planning helps you build wealth over time, protect yourself from financial uncertainty, and secure greater freedom and stability later in life.

Preparing for retirement can seem daunting, but it’s one of the smartest financial moves anyone can make, no matter their age. Building a plan early lays the groundwork for long-term stability and freedom later in life. Whether someone is just starting their career or approaching their 50s, a clear investment roadmap and steady contributions can make a major difference. A strong retirement plan accounts for income, future expenses, risk tolerance, and the time left before retirement, and it should evolve as life changes, focusing on growing wealth strategically and sustainably over time.

Planning for Your Future

Securing your financial future begins with planning. Starting early gives you more options and flexibility as life changes. A personal retirement plan helps ensure that you can maintain your independence later in life. You might also participate in an employer-sponsored plan, like a 401(k), but even with these types of plans, it’s still important to make thoughtful decisions about how your money is invested and allocated. If you want a deeper understanding of these concepts as you build your long-term plan, financial training can help you strengthen the foundation of your retirement strategy.

Saving Money for Retirement

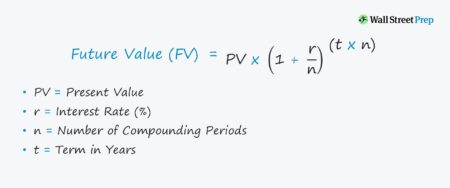

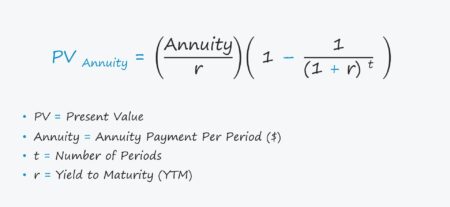

Before you can invest, make sure that you’ve covered your short-term needs. Start by building an emergency fund that covers three to six months of living expenses. Having a safety net protects you from unexpected costs, such as car repairs or a job loss, without forcing you to pull money out of your retirement accounts. Once that’s in place, you can begin contributing to retirement accounts such as a 401(k) or an individual retirement account (IRA). If your employer matches 401(k) contributions, take full advantage of that benefit: It’s essentially free money for your future. Automating contributions to your retirement can help you stay consistent and allows your savings to grow through compound interest over time.

Investing in Stocks for Retirement

Investing in the stock market remains one of the best long-term strategies for building wealth. Stocks typically offer higher returns than bonds or savings accounts, though they come with more short-term risk. Younger investors can afford to take on that risk because they have time to recover from market dips. Historically, holding stocks for a decade or more greatly reduces the impact of short-term volatility. Those nearing retirement often shift toward more stable investments to protect their savings from sudden market swings.

Investment Strategies for Retirement

There’s no single formula for retirement investing. The right approach depends on your age, financial goals, and comfort with risk. Two popular strategies are investing in target-date funds, which automatically adjust your investments as retirement approaches, and dollar-cost averaging, where you invest a fixed amount regularly. This steady approach helps minimize emotional reactions to market highs and lows and promotes consistent growth over time.

Hiring a Financial Advisor

Managing investments can be complex, and professional guidance often pays off. A qualified financial advisor can design a plan suited to your goals and risk tolerance. Look for a fiduciary advisor; they’re legally required to act in your best interest. Always ask how they’re paid, whether through commissions or flat fees, and make sure their investment philosophy aligns with yours. You can verify an advisor’s financial training and disciplinary history through state and regulatory resources before committing.

Diversification: A Key to Stability

Diversification means spreading your money across different types of investments, such as stocks, bonds, and real estate, to reduce risk. When one area of the market struggles, others may perform better, balancing your portfolio’s performance. Investing in a mix of asset classes helps smooth out volatility and maintain long-term growth. Investors should diversify both between asset types and within them, such as owning stocks from different sectors or regions. A well-diversified portfolio is one of the best defenses against market uncertainty.

The ultimate goal of retirement investing is to secure the freedom to live life on your own terms. Success comes from consistent saving, thoughtful diversification, and disciplined decision-making. Every dollar invested today brings you closer to a future where your time, choices, and peace of mind are fully in your control.