The Project finance industry is broad and consists of financial, legal, and technical jobs. Certain functions of each of these categories will require understanding of project finance. However, financial jobs in project finance will require deep understanding of project finance and the project finance model structure.

The Project finance industry is broad and consists of financial, legal, and technical jobs. Certain functions of each of these categories will require understanding of project finance. However, financial jobs in project finance will require deep understanding of project finance and the project finance model structure.

The Project Finance career path in a financial organization (advisory firms and investment banks) starts at the analyst level and progresses to managing director or partner level:

- Project Finance Associate

- Project Finance Senior Associate

- Project Finance Manager or Vice President

- Project Finance Director

- Project Finance Managing Director or Partner

The career path of project finance professionals in financial organizations is less standard than traditional investment banking or consulting since most project finance jobs require some knowledge of infrastructure, construction, public agency advisory or financing. Most individuals break into project finance at the Senior Associate level after they have had a little experience related to the infrastructure industry. There cases where people break into the Project Finance industry at the associate level because they are placed into a project finance group by a recruited rotational associate program out of undergrad or graduate school.

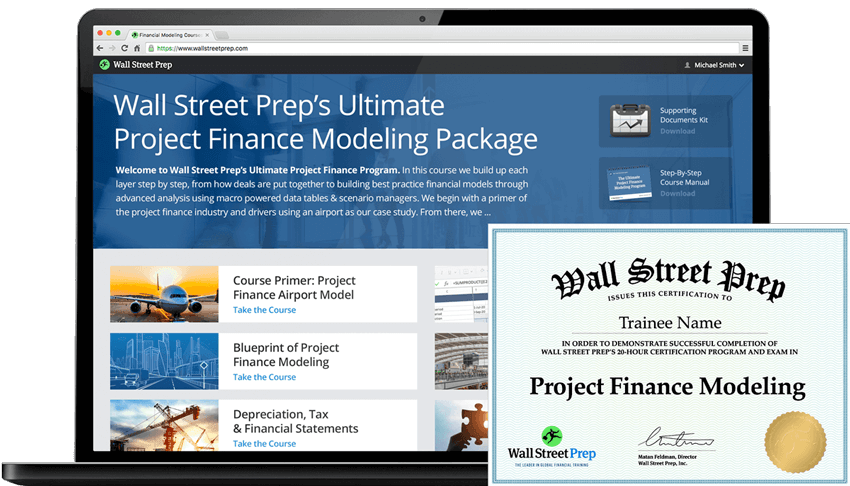

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

Enroll TodayProject finance is separated into advisory functions and lending functions. A developer is a hybrid of these roles (both advise and lend). For more information on these functions, read our article on project finance job descriptions and responsibilities. The firms that have these functions are listed below:

| Advisory | Lending | Developers |

|---|---|---|

| The Big 4 (EY, KPMG, Deloitte, PwC), boutique firms including Project Finance ltd., and SXM Strategies. | Investment banks such as Citibank, JP Morgan, Morgan Stanley | Developers: Meridiam, Skanska, Star America, Plenary |

Before we continue… Download the IB Salary Guide

Use the form below to download our free Investment Banking Salary Guide:

The “Typical” Career Path

To reiterate, this is rough career map and doesn’t apply to all project finance financial roles. For example, the requirement for getting into an Advisory Firm or Investment Bank is often a CFA or MBA and the completion of a 2-year bank rotation program.

Roles in Advisory Firm and Investment Banks

Advisory Firm or Investment Bank Associate

The analyst is the workhorse of project finance. The Associate’s primary tasks are data gathering, model building and maintenance as well as coordination across the various stakeholders.

- Associate Salary: $60,000 to $80,000 plus bonuses.

- Experience: The typical candidate will have 1-3 years of experience with a finance or accounting background. Hiring directly out of undergrad is rare, but it does happen at larger organizations.

Advisory Firm or Investment Bank Senior Associate

A Senior Associate often directs junior associates and runs projects but is still in the weeds and is very much involved in the financial modeling process.

- Senior Associate Salary: $85,000 to $120,000 plus bonuses.

- Experience: While undergrads are hired as associates, MBAs are hired as senior associates. Similar to the project finance associates, finance and accounting backgrounds are preferred. 3-5 years of experience is typical.

Advisory Firm or Investment Bank Manager or Vice President

By this point the project finance professional has proven his/her worth, has performed numerous analyses and has been a key individual contributor in many deals.

- Manager or Vice President Salary: $120,000 to $170,000 plus bonuses.

- Experience: 5-10 years of experience is typical. Managers/ Vice Presidents are either internally promoted, laterally hired, or brought in from other financial firms.

Advisory Firm or Investment Bank Director

By this point the project finance professional has performed numerous analyses and has been a key individual contributor in many deals and can provide strategic guidance based on experience.

- Director Salary: $170,000 to $250,000 plus bonuses.

- Experience/Typical Candidate: 10+ years of experience running many deals and able to provide strategic insight into transactions.

What happens after the Director Level?

After the Director level, the majority of project finance professionals tend to stay within project, either in their current organization or at other companies. At large financial advisory firms and investments banks, directors can progress internally by taking the lead on larger deals. They may also progress to the Managing Director/Partner level who is responsible for business development and originating projects for the firm. The Managing Director/Partners in firms are industry leaders and the “face” of an organization and oversee a division within their firm.

Roles at a Developer and Private Equity Fund

A developer is a very small and lean firm. It is rare that a developer will hire someone straight out of undergraduate or graduate school

A Developer has many roles and responsibilities and works with a team to bring an idea from concept to completed construction. Some developers have their own internal private equity fund. They are responsible for coordinating all parties involved in the development of the project including, finance, legal, and technical elements. Depending on the size, scope, and complexity of the transaction, they can both advise as well as lend to a project.

A developer is a very small and lean firm or a subsidiary of a construction company who is developing a project. It is rare that a developer will hire someone straight out of undergraduate or graduate school since they only want candidates who can hit the ground running. These professionals are often at the Manager/Vice president or above levels within an advisory firm or investment bank. There is a non-linear career path at a developer and there are often no titles since they only are concerned with “getting a deal done”.

Work Life Balance

Generally, project finance professionals have a similar or better work-life balance than investment banking or traditional consulting but can be substantially better depending on the firm. Hours range from 50-60 hours a week but can spike to 70-80 hours per week based on urgent demands of a live transaction.