Project Finance Model Structure

Project finance modeling is an excel based analytical tool used to assess the risk-reward of lending to or investing in a long-term infrastructure project based upon a complex financial structure. All financial evaluations of a project depend upon projections or expected future cash flows generated by activities of a completed project and a financial model is built to analyze this.

A project finance model is built to be:

- Easily used

- Flexible but not overly complex

- Suitable for assisting the client in making better and more informed decisions

Evolution of a Project Finance Model

A project finance model is used throughout the project term and will need to get updated depending on the phase of the project. Below is an illustrative example of the evolution of a project finance model:

Key Components of a Project Finance Model

Project finance models are built in excel and need to follow standard industry best practices which have the following minimum contents:

Inputs

- Derived from technical studies, financial market expectations, and understanding of the project to date

- Model should be set up to run multiple scenarios using different inputs and assumptions

Calculations

- Revenue

- Construction, operating and maintenance costs

- Accounting and Tax

- Debt financing

- Distributions to equity

- Project IRR

Outputs

- Contain a summary of project metrics important to management for informed decision making

- Included financial statements (Income statement, balance sheet, cashflow statement)

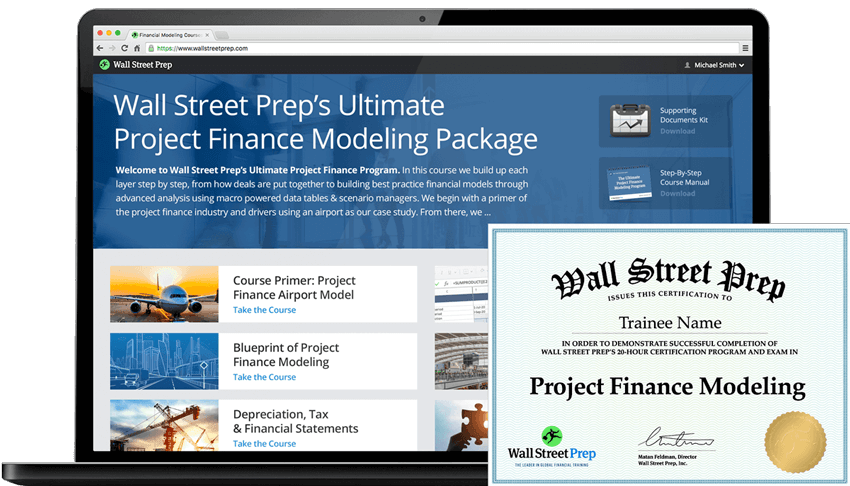

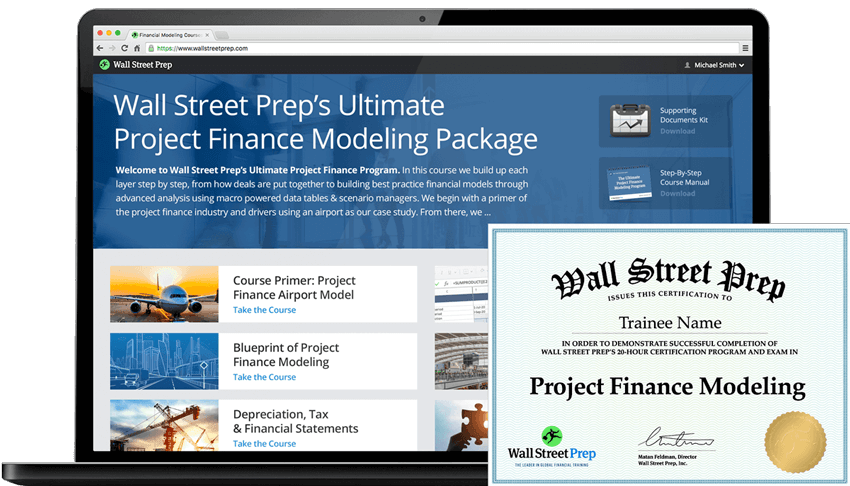

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

Enroll TodayProject Finance Model Scenario Analysis

After an initial financial model is built, scenario analysis is conducted based on variations to model inputs and assumptions.

- Scenarios might include a ‘base case’, ‘upside case’, and ‘downside case’

- Variations might be a fixed amount or % change to inputs

- Scenarios should be compared side by side

Based on changes in inputs and assumptions, the impact of key outputs are compared side by side. Relevant model outputs will depend on who the model users are:

| Model Users | Likely information analyzed |

|---|---|

| Company Management |

|

| Debt Financiers |

|

| Project Sponsors |

|

| Equity Financiers |

|

Most Important Financial Model Outputs

The debt service coverage ratio (DSCR)

DSCR is the single most important metric for debt lenders to understand the likelihood that their loan can be repaid.

Internal Rate of Return (IRR)

The Project IRR is the single most import metric for equity investors to understand the level of returns it will expect from its investment.

IRR = The average annual return earned through the life of an investment

Net Present Value (NPV)

The net present value is an output calculation which takes into account the timing and quantum of cash flows based on the time value of money.

NPV = The difference between the present value of the future cashflows from an investment and the amount of investment

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

Enroll Today