What Is an Economics Glossary?

An economics glossary is a reference tool that defines key terms, concepts, and frameworks used in economic analysis, finance, markets, and policy. It provides clear, concise explanations that help readers understand complex ideas—from supply and demand to financial instruments and macroeconomic indicators. A well-structured glossary supports students, investors, and professionals by making foundational concepts easier to learn, compare, and apply in real-world contexts.

A

Accountability

The obligation of leaders or institutions to answer for their decisions and actions

Acquisition

When one company purchases another by buying either its shares or assets

Administratively Feasible

A policy or program that a government has the capacity, knowledge, and resources to carry out effectively

Adverse Selection

A situation in which private information leads markets to attract participants with hidden risks, often undermining the outcome (such as only unhealthy people buying health insurance)

Aggregate Demand

The total demand for goods and services in an economy at a given overall price level

Aggregate Supply

The total quantity of goods and services that producers in an economy are willing to supply at a given overall price level

Alpha

A measure of an investment’s performance relative to a benchmark, indicating excess return

Allocation

How resources, responsibilities, and benefits are distributed in an economy

Altruism

Taking on a cost to yourself in order to help another person

Antitrust Policy

Laws that prevent monopolies and collusion to keep markets competitive

Arbitrage

The act of buying a good in one market at a low price and selling it in another at a higher price to profit from the difference

Artificially Scarce Good

A good that people can be excluded from using but that one person’s use does not reduce another’s ability to use (such as paywalled digital content)

Asset

Anything of financial value owned, such as property, stocks, or equipment

Asset-Backed Security (ABS)

A financial instrument backed by a pool of loans, such as mortgages or credit card debt

Asset Price Bubble

A rapid increase in the price of an asset driven by speculation and optimism, disconnected from its fundamental value

Asymmetric Information

When one party in a transaction has more or better information than the other

Average Product

Output produced per unit of a particular input, often measured as output per worker

B

Balance Sheet

A financial statement showing assets, liabilities, and net worth

Bank

A financial institution that accepts deposits and issues loans

Bank Money

Deposits created when banks extend loans

Bank Run

A rush of withdrawals by depositors who fear that a bank will collapse

Bargaining Power

The ability to negotiate better terms in a deal or contract

Base Money

Currency in circulation and reserves held by banks at the central bank

Behavioral Experiment

A controlled study designed to observe and measure human decision-making

Best Response

In game theory, the choice that provides the best outcome given the choices of others

Bid-Ask Spread

The difference between the highest price a buyer will pay and the lowest price a seller will accept

Bond Yield

The return an investor earns from holding a bond, usually expressed as a percentage

Budget Constraint

A representation of all possible combinations of goods someone can afford given income and prices

C

Capital Goods

Long-lasting tools and equipment used to produce other goods and services

Capital Structure

The mix of debt and equity a company uses to finance its operations

Capitalism

An economic system in which private owners control firms, hire workers, and sell goods for profit in markets

Capitalist Revolution

The rapid economic growth that began with industrial capitalism, fueled by new technology and market expansion

Cartel

A group of firms colluding to act like a monopoly by fixing prices or limiting output

Causality

A genuine cause-and-effect relationship between two variables

Central Bank

The government institution that issues base money, manages monetary policy, and regulates banks

Ceteris Paribus

Latin for “other things equal,” used to isolate the effect of one factor by holding others constant

Co-Insurance

Sharing resources so that when one household suffers a shock, others provide support

Collateral

An asset pledged to secure a loan, which the lender can seize if the borrower defaults

Commodity

A standardized product, often raw material or agricultural, traded on markets

Common-Pool Resource

A resource that is rival (one person’s use reduces another’s) but hard to exclude people from using (such as fisheries or groundwater)

Competitive Equilibrium

The market outcome where supply equals demand and no participant can unilaterally improve their outcome

Complements

Goods consumed together, where an increase in the price of one reduces demand for the other

Conflict of Interest

A situation where a person’s private interests interfere with professional duties

Conspicuous Consumption

Buying goods or services to display wealth and status

Constant Prices

Prices adjusted for inflation to reflect actual purchasing power

Constant Returns to Scale

When doubling all inputs exactly doubles output

Constrained Choice Problem

A decision-making process where the best option must be chosen within limits like budgets or technology

Consumer Durables

Long-lasting household goods, such as cars or refrigerators

Consumer Price Index (CPI)

An index tracking changes in the average price of consumer goods and services over time

Consumer Surplus

The extra value consumers receive because they are willing to pay more than the actual price

Consumption

Spending on goods and services for personal use

Consumption Smoothing

Efforts to keep consumption stable over time, often through saving or borrowing

Contract

An agreement that defines rights and obligations of parties

Cooperation

Working together for shared benefit

Cooperative Firm

A company owned and run by its workers, who share profits

Copyright

A legal right that gives creators control over the reproduction and use of their work

Correlation

A statistical relationship between two variables, not necessarily causal

Creative Destruction

The process in which innovation replaces old industries with new ones, creating growth while displacing jobs

Credit-Constrained

Facing limits on borrowing or available only at unfavorable terms

Credit-Excluded

Completely unable to borrow

Credit Rationing

When lenders restrict loan amounts, even if borrowers are willing to pay more interest

Crowding Out

When government activity reduces private activity, such as higher spending pushing up interest rates and discouraging private investment

Cyclical Unemployment

Joblessness caused by downturns in overall demand during recessions

D

Debt

Money owed by one party to another

Debt-to-Equity Ratio

A measure that compares how much a company owes to creditors versus how much is financed by shareholders’ investments

Deadweight Loss

The loss of economic efficiency that occurs when markets fail to reach equilibrium, such as from taxes or price controls

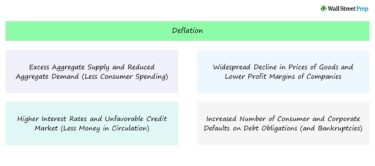

Deflation

A sustained decrease in the overall price level

Demand Curve

A graph showing the quantity of a good consumers are willing to buy at different prices

Derivative

A financial contract with a value that depends on an underlying asset, such as options, futures, or swaps

Diminishing Returns

The principle that adding more of one input while holding others constant eventually produces smaller increases in output

Discounted Cash Flow (DCF)

A valuation method that estimates a company’s value by projecting future cash flows and discounting them to present value

Discount Rate

The interest rate used to determine the present value of future payments

Disposable Income

Income available to spend or save after taxes and transfers

E

Equity Financing

Raising capital by selling shares of stock

Equilibrium

A state where opposing forces are balanced, such as supply equaling demand

Equity

Ownership in a company, or fairness in resource distribution

Externality

A cost or benefit of an action that affects others who did not choose it

F

Fiscal Policy

Government decisions on spending and taxation to influence the economy

Free Rider

Someone who benefits from a resource or service without paying for it

Frictional Unemployment

Short-term unemployment occurring as people change jobs

G

Game Theory

The study of strategic decision-making among interdependent participants

GDP (Gross Domestic Product)

The total value of goods and services produced within a country over a period

H

Hedging

Using financial instruments to reduce the risk of adverse price movements

Human Capital

The skills, knowledge, and experience possessed by individuals

Hyperinflation

Extremely high and accelerating inflation that erodes currency value

I

Imperfect Competition

Market conditions where individual firms have some control over prices

Inflation

A general increase in prices over time

Initial Public Offering (IPO)

The first sale of a company’s shares to the public

Interest Rate

The cost of borrowing money or return for lending

Investment

Spending on assets that will generate future returns

L

Labor Force

The total number of people employed or actively seeking employment

Leveraged Buyout (LBO)

Acquisition of a company using a high proportion of borrowed funds

Liquidity

The ease of converting an asset into cash without significant loss of value

Liquidity Risk

The risk of being unable to sell an asset quickly without losing value

M

Marginal Cost

The extra cost of producing one additional unit of output

Marginal Product

Additional output produced by one more unit of input

Market Capitalization

The total value of a company’s shares (price per share times number of shares)

Market Failure

When markets fail to allocate resources efficiently

Market Power

The ability of a firm to set prices above competitive levels

Merger

The combination of two companies into one

Monetary Policy

Actions by a central bank to control money supply and interest rates

Monopoly

A market with only one seller

Moral Hazard

When one party takes greater risks because they do not bear the full consequences

N

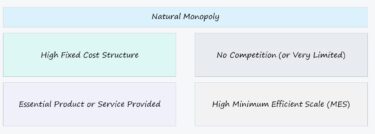

Natural Monopoly

A market where a single firm can supply the entire market at lower cost than multiple firms

Nominal Value

The stated value of money or prices, unadjusted for inflation

O

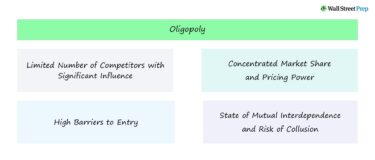

Oligopoly

A market dominated by a few firms

Opportunity Cost

The value of the next best alternative forgone

Option

A contract giving the right, but not the obligation, to buy or sell an asset at a set price before a specific date

P

Principal-Agent Problem

A situation where an agent’s interests differ from the principal’s, creating potential conflicts

Private Equity

Investments in privately held companies, often with active management and eventual exit

Productivity

Output per unit of input

Property Rights

Legal rights over the use and transfer of resources

Public Good

A non-rival, non-excludable good, such as national defense

Q

Quota

A limit on the production or import of a good

R

Real Wage

Wages adjusted for inflation

Recession

A period of declining economic activity

Rent-seeking

Seeking wealth without creating value, often through manipulation or lobbying

Return on Equity (ROE)

Profitability relative to shareholders’ equity

S

Scarcity

The fundamental economic problem of limited resources and unlimited wants

Securities

Tradable financial assets like stocks, bonds, or derivatives

Shareholder

An owner of shares in a company

Spread

The difference between yields, interest rates, or bid and ask prices

Structural Unemployment

Long-term unemployment caused by shifts in the economy

Substitute Goods

Goods that can replace each other in consumption

Supply Curve

A graph showing the quantity supplied at different prices

T

Tangible Asset

A physical resource that has a finite monetary value

Tax Incidence

The distribution of the economic burden of a tax

Technological Change

Advances that improve production methods

Trade-Off

A choice requiring giving up one thing for another

U

Underwriting

The process by which investment banks evaluate and assume the risk of issuing new securities

Unemployment Rate

The percentage of the labor force actively seeking work but unable to find it

Utility

Satisfaction or happiness from consuming goods and services

V

Valuation Multiples

Ratios used to value companies, such as P/E or EV/EBITDA

Venture Capital

Investment in early-stage companies with high growth potential

Volatility

The degree of variation in an asset’s price over time

W

Wage

Payment to workers for labor

Wealth

Total value of what someone owns minus debts

Y

Yield Curve

A graph of interest rates for bonds with different maturities

Z

Zero-Sum Game

A situation in which one participant’s gain equals another’s loss

Additional Resources

- What Is Economics?

- The A to Z of Economics

- Types of Investment Products

- Investing in Green Bonds

- Recession, Hyperinflation, and Stagflation

- Understanding Private Equity Funds

- Private Equity Analyst Training

- How Financial Markets Work

- Real Estate Financial Modeling

- Guide to Value Investing

- Valuation Modeling Certification

- Fiscal Policy: Taking and Giving Away