What is Project Finance?

Project finance is used to refer to a non-recourse or limited recourse financing structure in which debt, equity and credit enhancement are combined for the construction and operation or the refinancing of a facility in a capital-intensive industry.

In other words…

Project finance refers to how an infrastructure project is commercially and financially structured where future project revenues pay back the initial money invested where investors are subject to limitations on losses in the event of project non-performance.

Project finance is a financial structure used across the development of a broad spectrum of infrastructure assets. These assets typically fall within the below buckets.

| Social Services |

|

| Road and Rail |

|

| Energy and Utilities |

|

| Communications |

|

| Ports and Airports |

|

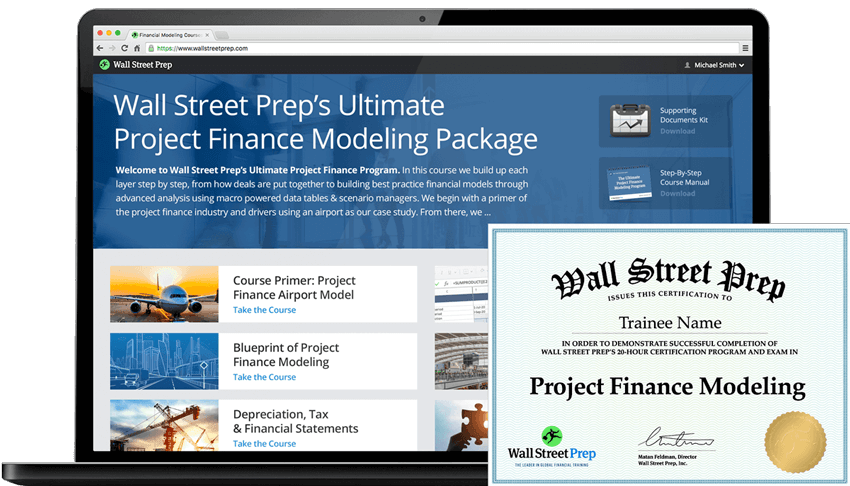

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

Enroll TodayProject Finance Jobs

Developing infrastructure is a big undertaking spanning across infrastructure asset classes as well as different roles and responsibilities for each project. A project finance deal will require the services of a whole host of advisors and specialists in unrelated disciplines whose role has one thing in common- all of their input is related to the same project that must be assembled on paper in legal agreements. There are many jobs within the infrastructure industry which will require a working knowledge of project finance and understanding the “big picture” of project finance is critical for even non-financial roles in infrastructure.

The team of advisors and specialists will start working on the project at different stages of its development. The involvement of each specific party differs considerably in terms of quantity of work performed; this can also depend on the type of the project. For example, technical jobs would be more involved in a project using innovative technology such as satellites than more “routine” projects such as roads.

Financial Jobs in Infrastructure

Financial jobs in infrastructure consists of advising, directly providing capital, or coordinating the financial arrangements for the project. There are many firms that satisfy various financial needs of a project and involve different finance roles and responsibilities in a financial organization. However, most project finance deals are large and complex in nature, therefore requiring several financial firms to be involved in a transaction.

- Example: One financial firm will be providing project debt and another financial firm would be advising the government on structuring a deal to best protect tax payer dollars.

Legal Jobs in Infrastructure

Legal jobs in infrastructure also consists of advising various parties within a project deal. There will be multiple legal advisors providing input for different parties involved in a project finance deal. The objective of each lawyer is to protect the interest of their client. Legal jobs span a range of specialized expertise in many different fields such as lending, real estate, and administrative law. In practice, no single professional can possess enough knowledge in such a wide range of fields.

- Example: One lawyer might advise the debt lenders on their financing agreements and another lawyer may advise the engineers on the legal framework for environmental approvals for the project.

Technical Jobs in Infrastructure

Technical jobs in infrastructure spans a wide range of services. There are technical firms that are only responsible for the design and engineering components of the project while other technical firms may be responsible for the actual construction and day to day maintenance of the project.

In summary, the input from financial, legal, and technical specialist of a project will have a direct cost impact to a project. The cost impacts will ultimately affect the ability to finance and the cost in which financing can be obtained

Both types of firms will have to work hand in hand to make and keep a project operational. Even larger technical firms may not have the ability to all the technical components of a project in house and require subcontracting of technical specialist for a project.

- Example: A technical advisor in a project finance deal will assist financial and legal firms in understanding the general technical solution and its impact to financing and legal arrangements. Another technical firm will be responsible for the design of the physical project.

In summary, the input from financial, legal, and technical specialist of a project will have a direct cost impact to a project. The cost impacts will ultimately affect the ability to finance and the cost in which financing can be obtained. Project finance consists of understanding the entire deal and structuring the project to share risks.

Project Finance Roles and Responsibilities in Financial Organizations

In a project finance deal, there are typically two sides to a transaction: the buy-side and sell-side. On both sides of the transaction, there are two broad buckets of services, advisory and lending. Advisory consists of providing financial advice but not providing financing for projects. Lending requires providing financing for the project through a debt or equity investment.

- Sell-side: Party wanting to finance, build, improve, or sell a new or existing asset

- Buy-side: Party who will finance build, improve or buy a new or existing asset

There are financial organizations who can provide services to both sides of project finance deals; however, one firm is never involved on both sides on the same transaction due to conflicts of interest.

| Sell-side | Buy-side |

|---|---|

| Advises the seller (typically a government entity) on the financial arrangements and structuring of a project finance deal. They will solicit and review buy-side bids for the project and negotiate on behalf of the seller the financial components of a project finance deal. | A developer has many roles and responsibilities and works with a team to bring an idea from concept to completed construction. They are responsible for coordinating all parties involved in the development of the project including, finance, legal, and technical elements. Depending on the size, scope, and complexity of the transaction, they can both advise as well as lend to a project. Often, projects require multiple parties and the developer will outsource both the financial advisory and lending to other financial firms.

If a developer chooses not to do buy-side financial advisory in-house, a financial advisory firm will financially structure the developer’s deal and the final deal will be negotiated with the sell-side financial advisor. There are times when an investment bank will offer buy-side financial advisory services as an additional service to lending. |

| Sell-side advisory firms: The Big 4 (EY, KPMG, Deloitte, PwC), boutique firms including Project Finance ltd., and SXM Strategies. | Buy-side developers: Meridiam, Skanska, Star Americas, Plenary

Buy-side advisory firms: some investment banks (society general, Macquarie, key bank, MUJF) and boutique firms |

| Sell-side | Buy-side |

|---|---|

| Assists in issuing municipal financial products on behalf of a government entity to finance infrastructure. The financial product raises money for the government upfront and is repaid with interest over time through a dedicated government revenue stream such as taxes. | Raises capital from private capital market sources in the form of debt or equity. Debt is typically raised by investment banks through their debt capital market divisions. Equity is raised from private equity funds who source capital from various institutional or accredited investors.

Some large developers have their own in-house debt and equity funds to provide capital for projects they are developing. |

| Sell-side lenders: Municipal finance groups in investment banks such as Citibank, JP Morgan, Morgan Stanley | Buy-side lenders: Investment banks such as Citibank, JP Morgan, Morgan Stanley. Private equity funds such as John Laing, Plenary, and Skanska |

All financial jobs in project finance require knowledge in how to build a project financial model. Even jobs in the technical and legal groups of project finance requires basic knowledge of project finance modeling.