- What is Yield to Maturity?

- How to Calculate Yield to Maturity (YTM)?

- Yield to Maturity Formula (YTM)

- Accurately Estimating YTM with AI

- What Is the Difference Between APY and YTM?

- Yield to Maturity vs. Coupon Rate vs. Current Yield

- What is a Good Yield to Maturity (YTM)?

- Yield to Maturity Calculator (YTM)

- Mastering Yield to Maturity

What is Yield to Maturity?

The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity.

From the perspective of a bond investor, the YTM is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate.

- The yield to maturity is the expected annual rate of return earned on a bond, assuming the debt security is held until maturity.

- The yield to maturity is calculated by the following formula: [Annual Coupon + (FV – PV) ÷ Number of Compounding Periods] ÷ [(FV + PV) ÷ 2].

- The YTM metric offers bondholders with the option to estimate the return on a bond instrument, as well as measure the impact on the portfolio return.

- The yield on bonds is inversely related to the market interest rate, meaning that the higher the YTM, the less sensitive the bond prices are to interest rate fluctuations.

How to Calculate Yield to Maturity (YTM)?

Yield to maturity is one of the most frequently used returns metrics for evaluating potential bond and fixed-income investments by investors.

The YTM is the estimated annual rate of return that a bond is expected to earn until reaching maturity, with three notable assumptions:

- Assumption 1 → The return assumes the bond investor held onto the debt instrument until the maturity date.

- Assumption 2 → All the required interest payments and principal repayment were made on schedule.

- Assumption 3 → The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM).

The yield to maturity on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price.

The YTM metric facilitates comparisons among different bonds and their expected returns, which helps investors make more informed decisions on how to manage their bond portfolios.

Even for bonds consisting of different maturities and coupon rates, the YTM enables comparisons to be made since the YTM is expressed as an annualized rate regardless of the bond’s years to maturity.

Yield to Maturity Formula (YTM)

The formula for calculating the yield to maturity (YTM) is as follows.

The components of the yield to maturity equation consist of the following inputs:

- Coupon Payment (C) → Determined by the coupon rate of the bond, or “interest rate”, the annual coupon payment is the periodic payment distributed by the bond issuer to the bondholders. In general, the higher the coupon rate attached to the bond, the higher the yield, all else being equal.

- Face Value (FV) → The face value of a bond (i.e. the par value) is the amount to be repaid to a bondholder on the date of maturity.

- Present Value (PV) → The present value (PV) of the bond refers to the current market price and how much investors are willing to pay for the bond in the open market as of the present date, which may be higher (or lower) than the bond’s FV based on the market conditions and supply/demand.

- Maturity Date → The pre-specified date on which the issuer is contractually obligated to repay the principal – from this date, the number of years to maturity can be derived.

- Number of Compounding Periods (n) → The number of compounding periods refers to the number of payments made in one year multiplied by the number of years to maturity (e.g. five years until maturity and semi-annual coupon payments would mean n = 10 periods).

Accurately Estimating YTM with AI

YTM represents the expected annual return on a bond held to maturity, incorporating both coupon payments and principal repayment. As fixed-income portfolios grow more complex, artificial intelligence is playing a pivotal role in modeling bond performance, forecasting interest rate shifts, and optimizing portfolio decisions. Wall Street Prep created the AI for Business & Finance Certificate Program in partnership with Columbia Business School Executive Education to equip professionals with the tools to integrate AI into bond valuation and fixed-income analysis. Discover how AI-driven interest rate forecasting and automated bond analytics are reshaping how investors evaluate YTM and credit risk.

What Is the Difference Between APY and YTM?

Annual Percentage Yield (APY) is used to express the actual return on deposit accounts like savings accounts or certificates of deposit (CDs), including the effect of compounding interest. YTM represents the estimated return on a bond if held until maturity, considering both interest payments and any changes in the bond’s price.

Yield to Maturity vs. Coupon Rate vs. Current Yield

The yield to maturity, as mentioned earlier, is the annualized return on a debt instrument based on the total payments received from the date of initial purchase until the maturation date.

In comparison, the current yield on a bond is the annual coupon income divided by the current price of the bond security.

An important distinction between a bond’s YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed.

The relationship between the yield to maturity and coupon rate (and current yield) are as follows.

- Yield to Maturity (YTM) < Coupon Rate and Current Yield → The bond is being sold at a “premium” to its par value.

- Yield to Maturity (YTM) > Coupon Rate and Current Yield → The bond is being sold at a “discount” to its par value.

- Yield to Maturity (YTM) = Coupon Rate and Current Yield → The bond is said to be “trading at par”.

What is a Good Yield to Maturity (YTM)?

By understanding the YTM formula, investors can better predict how changing market conditions could impact their portfolio holdings based on their portfolio strategy and existing investments.

Considering yields rise when prices drop (and vice versa), investors can project yield-to-maturity (YTM) on portfolio investments to guide better decision-making.

The YTM can also enable debt investors to assess their degree of exposure to interest rate risk, which is defined as the potential downside caused by sudden changes in interest rates.

The relationship between the current YTM and interest rate risk is inversely proportional, which means the higher the YTM, the less sensitive the bond prices are to interest rate changes.

The most noteworthy drawback to the yield-to-maturity measure is that YTM does NOT account for a bond’s reinvestment risk. The bond’s coupon payments are assumed to be reinvested at the same rate as the YTM, which may not be an option in the future given uncertainties regarding the markets.

In effect, if coupons were to be reinvested at lower rates than the YTM, the calculated YTM is going to turn out to have been inaccurate, as the return on the bond would have been overstated.

The standard YTM formula is also meant to be an approximation as opposed to a precise figure – for instance, the YTM is prone to error due to the potential for unexpected events such as if the bondholder decides not to reinvest all coupon payments or if the bond is called early (i.e. repaid prior to maturity).

However, the benefits related to comparability tend to outweigh the drawbacks, which explains the widespread usage of YTM across the debt markets and fixed-income investors.

Yet, the YTM’s assumptions that all coupon payments are made as scheduled, and that interest is reinvested at the same rate are nonetheless risky, simplified assumptions.

Yield to Maturity Calculator (YTM)

In this section, we’ll walk you through modeling exercises to help you better understand how to calculate Yield to Maturity using the formula. By applying the YTM formula to real-life bond scenarios, you will gain hands-on experience in estimating bond returns. The downloadable Excel template provided will allow you to practice these calculations, giving you a tool to explore different bond scenarios and deepen your understanding of how YTM works in a practical, interactive way.

You can access the modeling exercises by filling out the form below.

1. Bond Pricing Assumptions

Suppose we’re tasked with calculating the YTM on a corporate bond issuance using the following set of assumptions.

- Face Value of Bond (FV) = $1,000

- Annual Coupon Rate (%) = 6.0%

- Number of Years to Maturity = 10 Years

- Price of Bond (PV) = $1,050

We’ll also assume that the bond issues semi-annual coupon payments.

2. Coupon Rate and Interest Payment Calculation Example

Given those inputs, the next step is to calculate the semi-annual coupon rate, which we can calculate by dividing the annual coupon rate by two.

- Semi-Annual Coupon Rate (%) = 6.0% ÷ 2 = 3.0%

Then, we must calculate the number of compounding periods by multiplying the number of years to maturity by the number of payments made per year.

- Number of Compounding Periods (n) = 10 × 2 = 20

As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the semi-annual coupon of the bond, i.e. the semi-annual interest payment.

- Semi-Annual Coupon (C) = 3.0% × $1,000 = $30

3. Yield to Maturity Calculation Example (YTM)

With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

- Semi-Annual Yield to Maturity (YTM) = [$30 + ($1,000 – $1,050) ÷ 20] ÷ [($1,000 + $1,050) ÷ 2]

- Semi-Annual YTM = 2.7%

In the final part of our bond rate of return analysis exercise in Excel, the only remaining step is to convert our semi-annual YTM to an annual percentage rate, i.e. the annualized yield to maturity (YTM).

- Annual Yield to Maturity (YTM) = 2.7% × 2 = 5.4%

In conclusion, the implied yield to maturity (YTM) in our hypothetical bond issuance, expressed on an annual basis, comes out to 5.4%.

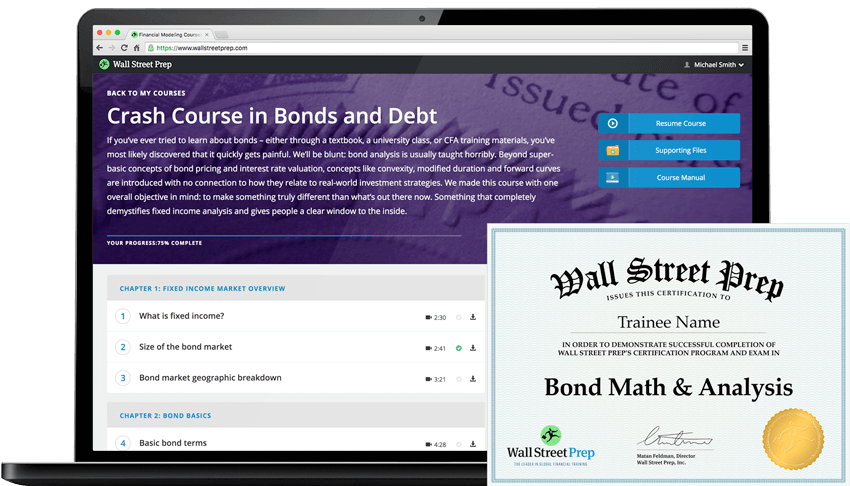

Crash Course in Bonds and Debt: 8+ Hours of Step-By-Step Video

A step-by-step course designed for those pursuing a career in fixed income research, investments, sales and trading or investment banking (debt capital markets).

Enroll TodayMastering Yield to Maturity

Yield to Maturity is a vital concept in bond investing and valuation, providing a comprehensive measure of a bond’s potential return if held until maturity. Understanding how to calculate YTM, whether manually or using tools like the YTM calculator and downloadable Excel template, is essential for making informed investment decisions.

Unlike other yield metrics, YTM accounts for both the bond’s price and its future cash flows, offering a more accurate assessment of its total return. With the practical tools provided, investors can deepen their understanding and confidently analyze bond investments.