- What are Financing Fees?

- Debt Issuance Costs

- Financing Fees Calculator – Excel Template

- Financing Fees Calculation Example

- Financing Fees: Accounting Journal Entry (Debit and Credit)

- Revolver Commitment Fees are Still Treated as a Capital Asset

- Purpose of the Accounting Rule Change

- Financing Fees in M&A and LBO Models

- Financing Fee Treatment in Financial Modeling

What are Financing Fees?

When a company borrows money, either through a term loan or a bond, it usually incurs third-party financing fees (called debt issuance costs). These are fees paid by the borrower to the bankers, lawyers and anyone else involved in arranging the financing.

Prior to April 2015, financing fees were treated as a long-term asset and amortized over the term of the loan, using either the straight-line or interest method (“deferred financing fees”).

In April 2015, FASB issued ASU_2015-03, an update that changes how debt issuance costs are accounted for. Effective December 15, 2015, an asset will no longer be created, and the financing fee will be deducted from the debt liability directly as a contra-liability:

To simplify presentation of debt issuance costs, the amendments in this Update require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts.

– Source: FAS ASU 2015-03

Debt Issuance Costs

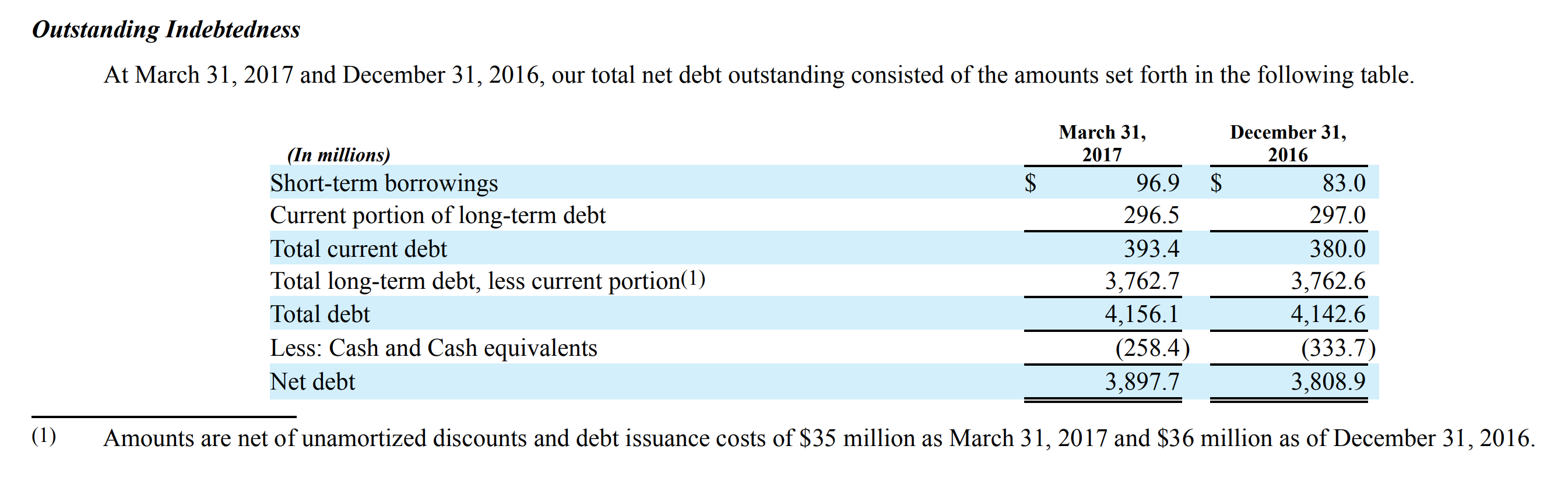

Companies will thus report debt figures on their balance sheet, net of debt issuance costs, as you see below for Sealed Air Corp:

This does not change the classification or presentation of the related amortization expense, which over the term of borrowing will continue to be classified within interest expense on the income statement:

Amortization of debt issuance costs shall be reported as interest expense

Source: FAS ASU 2015-03

The update impacts both private and public companies and applies to term loans, bonds and any borrowing that has a defined payment schedule. Below is an example of debt issuance costs treatment pre- and post-ASU 2015-03.

Financing Fees Calculator – Excel Template

Financing Fees Calculation Example

A company borrows $100 million in a 5-year term loan and incurs $5 million in financing fees. Below is the accounting at the borrowing date:

Financing Fees: Accounting Journal Entry (Debit and Credit)

Below are the journal entries laid out explicitly over the next 5 years:

Revolver Commitment Fees are Still Treated as a Capital Asset

The changes prescribed under ASU 2015-03 for debt issuance costs associated with term loans and bonds do not apply to commitment fees paid to revolving credit lenders and are still treated as a capital asset. That’s because FASB views the commitment fee as representing the benefit of being able to tap the revolver in the future, as opposed to a third-party related fee with no discernible long-term benefit. That means that commitment fees continue to be capitalized and amortized as they have been in the past.

Purpose of the Accounting Rule Change

The purpose of the change is part of a broader effort by FASB to simplify its accounting rules. The new rules now align with FASB’s own rules for debt discounts (OID) and premiums (OIP) as well as with IFRS treatment of debt issuance costs. Prior to the update, debt issuance costs were treated as an asset while debt discounts and premiums directly offset the associated liability:

The Board received feedback that having different balance sheet presentation requirements for debt issuance costs and debt discount and premium creates unnecessary complexity.

– Source: FAS ASU 2015-03

Conceptually, since debt issuance fees provide no future economic benefit, treating them as an asset prior to the update conflicted with the basic definition of an asset:

Additionally, the requirement to recognize debt issuance costs as deferred charges conflicts with the guidance in FASB Concepts Statement No. 6, Elements of Financial Statements, which states that debt issuance costs are similar to debt discounts and in effect reduce the proceeds of borrowing, thereby increasing the effective interest rate. Concepts Statement 6 further states that debt issuance costs cannot be an asset because they provide no future economic benefit.

– Source: FAS ASU 2015-03

The change also aligns US GAAP with IFRS in this regard:

Recognizing debt issuance costs as a deferred charge (that is, an asset) also is different from the guidance in International Financial Reporting Standards (IFRS), which requires that transaction costs be deducted from the carrying value of the financial liability and not recorded as separate assets. – Source: FAS ASU 2015-03

Financing Fees in M&A and LBO Models

Those that are involved in modeling M&A and LBO transactions will recall that prior to the update, financing fees were capitalized and amortized while transaction fees were expensed as incurred.

Going forward, transaction professionals should take note that there are now three ways that fees will need to be modeled:

- Financing fees (term loans and bonds): Directly lower the carrying value of the debt

- Financing fees (for revolvers): Capitalized and amortized

- Transaction fees: Expensed as incurred

So much for simplifying things. For what it’s worth, FASB did consider expensing the financing fees, aligning the treatment of financing fees with transaction fees, but decided against it:

The Board considered requiring that debt issuance costs be recognized as an expense in the period of borrowing, which is one of the options to account for those costs in Concepts Statement 6. …The Board rejected the alternative to expense debt issuance costs in the period of the borrowing. The Board concluded that this decision is consistent with the accounting treatment for issuance costs associated with equity instruments as noted in the preceding paragraph.

– Source: FAS ASU 2015-03

Financing Fee Treatment in Financial Modeling

Effective December 15, 2015, FASB changed the accounting of debt issuance costs so that instead of capitalizing fees as an asset (deferred financing fee), the fees now directly reduce the carrying value of the loan at borrowing. Over the term of the loan, the fees continue to get amortized and classified within interest expense just like before. The new rules don’t apply to commitment fees on revolvers. As a practical consequence, the new rules mean that financial models need to change how fees flow through the model. This particularly impacts M&A models and LBO models, for which financing represents a significant component of the purchase price. While ignoring the change has no cash impact, it does have an impact on certain balance sheet ratios, including return on assets.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

Hi,

Would the Amort of DFF or OID be added back to EBITDA and is it included in EBIT? I believe it is not because it is not an operating expense / not core to business.

Thanks – John

Assume an investor bought a note (face value of $1,000) at $950 AND paid $200 fees for legal opinions. Further assume the $200 is not expenses immediately, then what is the book value/carrying value of the debt investment on the investor’s balance sheet? Is it $970? What are the journal… Read more »

As of 2020, if the debt is refinanced or repaid before maturity, what’s the treatment of the previous financing fee that have been amortized over the period? How does it flow on the three statements?

Hello,

I am confused as to what the different accounting entries would be in the case that the term loan was amortized annually (say 20% each year). Could you please shed some color on that?

Thanks!

I assume that there won’t be any change on the IS meaning that those 1 million per year will still have a negative impact on a per-year basis? Is that right?

Dear all, I’m really wondering how the amortization is adjusted once the principal gets repaid annually – is the treatment similar to OIDs, where one has to adjust “loss on unamortized OID”? It would make sense in my opionion, otherwise the financing fees would be just based on a theoretical… Read more »

Just curious, when calculating Firm Value (i.e. Equity Value + net debt + Prefered sec + NCI), do you used the actual principal that is due ( I.e. principal not principal less issuance costs)?? Also, should weights for calculating cost of debt be based around the actual principal, not principal… Read more »

For commitment fee on revolver, what should the useful life of amortization be? For example, if, from Year 1 to Year 5, the company pays $100k commitment fee, then what should be the amount of amortization for each year? Is Year 1 amortization = $100k / 5, Year 2 amortization… Read more »

If you prepay a lump-sum of a term loan, but do not pay it all off, by taking out new debt at a lower interest rate in order to use those funds to pay off the term loan that was at a higher interest rate, what do you do with… Read more »

If a prepayment fee is incurred in order to refinance debt at a lower rate, can the prepayment fee be treated as a financing fee and deferred over the life of the new debt? Thought being that the prepayment fee was only incurred to obtain new lower rates. ASU 2016-15… Read more »

How should treat payment of bank loan commitment fees on cash flow statement? I am not so sure whether operating or financing activities. Can someone assist me?

Thanks

When a loan is prepaid, with a fund raise. What is the offset for the debt discount?

Debit Loan Payable 10M

Credit Debt Discount 1.2M

Credit Cash 10.3M . (loan valude 10M, prepaid penalty 200k, 100k legal cost)

thanks

Using the post-2015 accounting treatment of financing fees, would the incremental annual amortization of the contra liability account that is recognized in interest expense need to be added back to net income to compute cash flow from operations? thank you

If the debt is refinanced or repaid before maturity, what’s the treatment of the financing fee? How does it flow on the three statements?