What is SOFR?

The Secured Overnight Financing Rate (SOFR) is the benchmark rate derived from transactions observed in the Treasury “repo” market and is anticipated to replace LIBOR by mid-2023.

Secured Overnight Financing Rate: How Does SOFR Work?

SOFR stands for the “Secured Overnight Financing Rate” and represents the borrowing costs of cash collateralized by Treasury securities based on transactions in the “repo” market.

The repo market is where short-term borrowing and lending transactions occur, in which agreements are collateralized by highly liquid securities, namely government bonds (i.e. U.S. Treasury securities).

The key participants in the repo market consist of the following:

- Banks and Financial Institutions (i.e. Primary Dealers)

- Corporations

- Governments (e.g. NY Fed, Central Bank, Municipalities)

Each morning, the New York Fed calculates and publishes data on SOFR by taking the volume-weighted median of transaction data from three repo markets:

- Tri-party repo Market: Comprised of three participants: securities dealers, cash investors, and clearing banks, that function as intermediaries between dealers and investors (e.g. money market mutual funds, securities lenders, etc.) in the repo transaction.

- General Collateral Finance (GCF) repo Market: Collateralized repurchase agreements in which the assets pledged as collateral are not specified until the end of the trading day.

- Bilateral repo Market: Transactions in which asset managers and institutional investors borrow securities from broker-dealers and securities lenders either on a bilateral or cleared basis in the absence of a clearing bank – and instead, are cleared by the Delivery vs. Payment (DVP) Service of the Fixed Income Clearing Corporation (FICC).

Learn More→ LIBOR vs. SOFR (Princeton)

SOFR vs. LIBOR: What is the Difference?

LIBOR stands for “London Interbank Offered Rate,” and represents the globally accepted, standard benchmark for setting lending rates.

LIBOR is the rate at which banks lend to each other and has historically been the benchmark for pricing financial instruments such as loans, bonds, mortgages, and derivatives in the financial markets.

Unlike SOFR, which is fully transaction-based on the overnight repo market with more than $1 trillion in volume per day, LIBOR rates are instead set from data compiled from a panel of major banks regarding the rate at which they could borrow funds each morning.

By contrast, SOFR is a fully transaction-based rate, making it less susceptible to market manipulation and more appealing to regulators. Furthermore, SOFR is an overnight rate, whereas LIBOR is more forward-looking with terms that range from overnight to twelve months.

SOFR Rate Chart: 2021 to 2022 One-Year Time Range

SOFR One-Year Chart (Source: NY Fed)

LIBOR to SOFR Transition: Why is LIBOR Being Replaced?

The transition from LIBOR to SOFT was prompted after a highly-publicized scandal was revealed in which traders at major financial institutions had colluded to manipulate LIBOR.

The traders implicated in the scandal deliberately submitted interest rates lower or higher than reality to force LIBOR in a direction where their derivatives and trading divisions would directly profit.

Following the incident, U.K. regulators announced their desire for LIBOR to be phased out by the end of 2021 – but given the magnitude of the transition, the shift is expected to be done more gradually to reduce market volatility.

In mid-2017, the Alternative Reference Rate Committee (ARRC) formally recommended the SOFR as the replacement for LIBOR.

Since then, SOFR has been gradually making progress toward becoming the standard benchmark for financial contracts, particularly near the end of 2021.

The USD LIBOR is expected to cease entering new financial contracts by June 30, 2023, which is the stated deadline set by U.S. banking regulators to discontinue the use of LIBOR.

SOFR Transition Progresses Despite Volatile Markets

“Debtwire Par estimates that, by the end of April 2022, approximately 96 percent of recently issued loans had adopted SOFR”

Source: White & Case

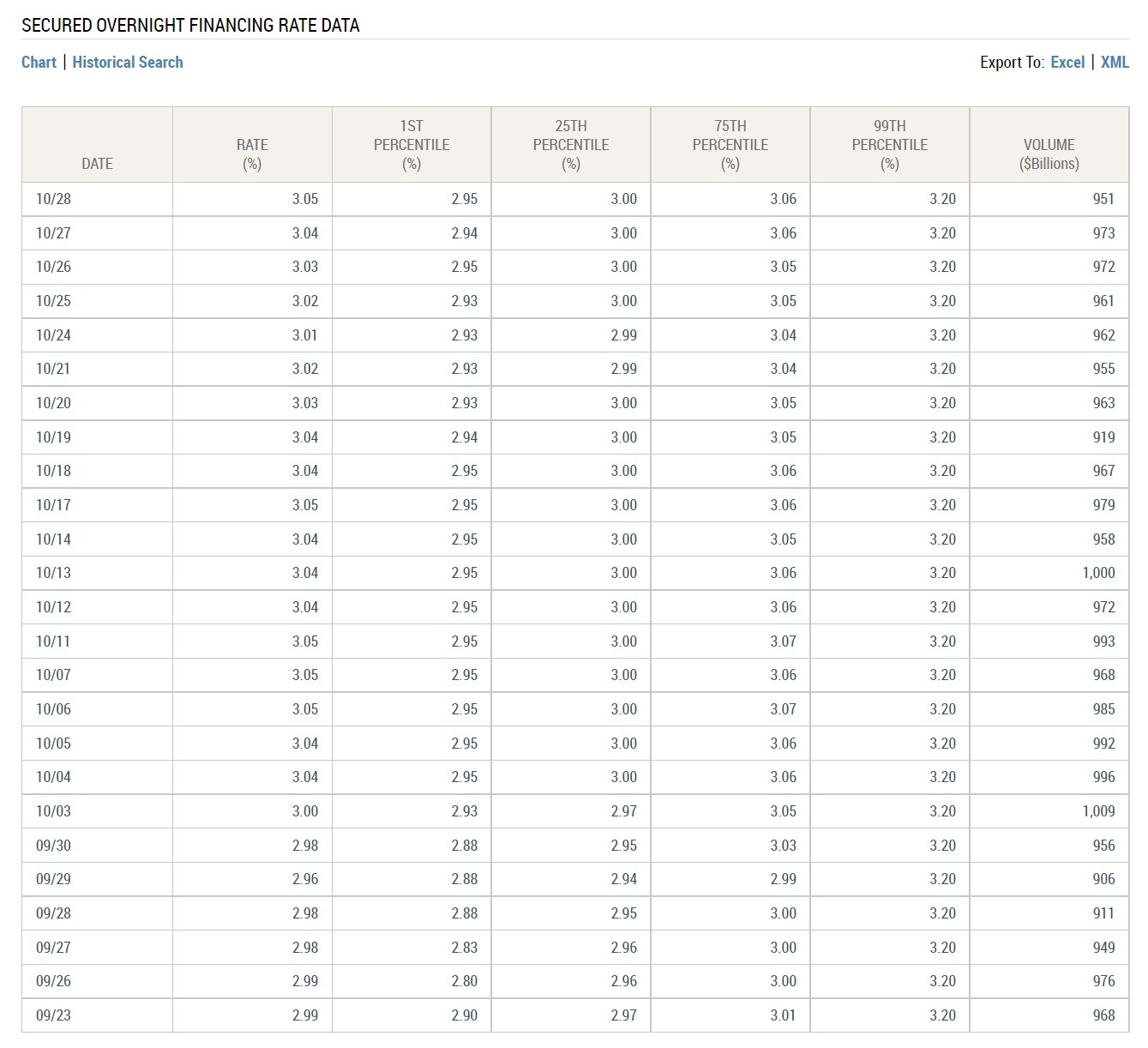

2023 SOFR Data Chart: What is SOFR Rate Today?

Around this particular point, you might be wondering, “What’s the SOFR rate currently at?”

Well, the New York Fed, or more formally, the “Federal Reserve Bank of New York”, publishes the SOFR rates data publicly for readers to reference.

SOFR Rate Reference Data (Source: New York Fed)

Get the Equities Markets Certification (EMC©)

This self-paced certification program prepares trainees with the skills they need to succeed as an Equities Markets Trader on either the Buy Side or Sell Side.

Enroll Today