Microsoft Excel is integral to financial analysis across investment banking, private equity, corporate finance, and related fields. Understanding the Excel definition in the context of financial services and becoming proficient in this spreadsheet application enables financial professionals to organize complex datasets, build sophisticated valuation models, and create compelling visualizations that drive decision-making. Ultimately, proficiency in Excel provides a critical competitive advantage in analyzing financial data efficiently and accurately, contributing to career advancement.

This article provides an overview of Excel’s essential functions and their practical applications in finance, including corporate finance, advanced financial analysis, and modeling techniques.

- Excel is essential for financial analysis, enabling professionals to organize data, build financial models, and create visualizations that drive decision-making.

- Key Excel functions for finance include mathematical, logical, and financial functions like SUM, IF, PMT, and NPV, which are crucial for complex calculations like DCF analysis and investment evaluation.

- Excel’s data analysis tools, such as pivot tables, scenario manager, and charts, help financial professionals analyze large datasets, perform sensitivity analysis, and communicate insights effectively.

- Excel is widely used in corporate finance for financial modeling, valuation (DCF, comparable company analysis), and data reporting, making it indispensable for informed decision-making in M&A and capital markets.

- Mastery of Excel’s financial functions and modeling techniques provides a competitive advantage in finance careers, enhancing efficiency and the ability to deliver actionable insights.

What Is Excel?

Excel is the industry-standard spreadsheet software for financial analysis. Its grid-based structure, organized into rows and columns, allows financial professionals to manage and manipulate complex financial data. It also allows for sophisticated financial calculations, creating dynamic financial models, and generating impactful visualizations.

Excel’s capabilities directly address the core analytical needs of financial professionals. Its ability to efficiently process large datasets, execute complex calculations, and present findings via customized reports and dashboards is crucial for evaluating investment opportunities, forecasting financial performance, and communicating key financial insights. In particular, crucial financial tasks like discounted cash flow (DCF) analysis, financial statement modeling, and comparable company analysis are all done within the spreadsheet and are fundamental to informed financial decision-making. This makes Excel, and the ability to use Excel shortcuts, an indispensable tool for investment bankers, financial analysts, and corporate finance professionals.

Essential Excel Terms and Functions for Finance

Financial professionals must have a strong foundation in core Excel terms and functions. Key components include data formatting, advanced financial functions, data analysis tools, and error-handling techniques. Each component is crucial for efficiently and effectively processing financial data, building robust financial models, and generating actionable insights, ultimately enhancing analytical capabilities and providing a competitive edge in a finance career.

Here’s an overview of those core components:

Data Entry and Formatting

Accurate data entry and consistent formatting are critical for financial models that must present information clearly and professionally:

- Number formats: Excel provides specialized number formats for financial data, including Currency, Accounting (with aligned currency symbols), Percentage, and Custom. These formats are crucial in financial modeling to clearly distinguish between inputs, calculations, and outputs to reduce errors and enhance model readability.

- Data types: Financial data in Excel can be entered as numbers (for monetary values), text (for labels), dates (for time-series analysis), Boolean values (TRUE/FALSE for logical tests), or formulas (for calculations). Understanding these data types ensures accurate calculations.

- Conditional formatting: Conditional formatting allows cells to change appearance based on their values. The purpose of this function is to highlight exceptions, trends, or threshold breaches in financial data. For instance, financial professionals may use color scales to denote high-risk leverage ratios or highlight cells exceeding certain thresholds.

- Cell styles: Cell styles are pre-defined formatting combinations that maintain a consistent appearance across financial models. Financial models typically utilize specific styles for assumptions, calculations, outputs, and headers to improve model clarity and navigation.

- Data validation: Data validation controls the type or range of data entered into cells, a crucial feature in financial models for preventing input errors. This function is frequently used to create dropdown lists for scenario selection, ensuring accuracy and consistency in financial forecasts and analyses.

Core Financial Functions

Excel’s built-in financial functions enable analysts to perform sophisticated calculations efficiently:

- Basic mathematical functions (SUM, AVERAGE, COUNT, MIN, MAX): These functions aggregate financial data, calculating totals, averages, and identifying extreme values in datasets.

- Logical functions (IF): IF statements evaluate conditions and return values based on whether they are true or false, crucial for scenario analysis and handling exceptions in financial models. (e.g., IF(Leverage_Ratio>5,”High Risk”,”Low Risk”)).

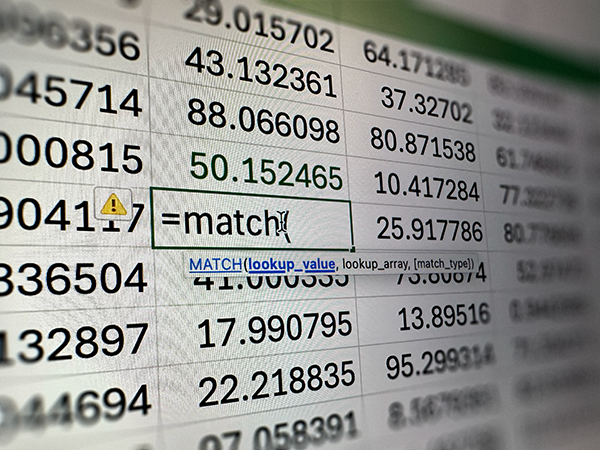

- Lookup functions (VLOOKUP, HLOOKUP, INDEX, MATCH): Lookup functions enable financial analysts to retrieve data from tables based on specified criteria, such as a company’s ticker symbol (to find comparable company data) or loan maturity (to determine interest rates).

- Time value of money functions (PMT, PV, FV, NPV, IRR): These functions are fundamental to financial analysis, enabling calculations for loan payments (PMT), present and future value of investments (PV, FV), and investment profitability (NPV, IRR). These calculations, used to evaluate capital projects and determine investment returns, are essential for discounted cash flow analysis, capital budgeting, and investment evaluation.

- Financial statement functions: (SUMIF, SUMIFS, AVERAGEIFS, COUNTIFS): These functions aggregate and analyze financial data based on specified criteria, essential for creating consolidated financial statements, performing variance analysis, and evaluating performance by segment.

Data Analysis Tools

In addition to functional calculations, Excel provides a suite of powerful data analysis tools that enable financial professionals to extract meaningful insights from complex datasets:

- Sorting and filtering: These tools enable financial analysts to organize and analyze data efficiently by arranging it in a meaningful order or displaying only records that meet specific criteria. This functionality is essential for tasks like identifying industry leaders by market capitalization, analyzing transactions within specific time periods, and detecting trends and outliers.

- Pivot tables: Pivot tables summarize raw financial data into structured formats, enabling financial analysts to efficiently analyze complex datasets. These tools are used to analyze data by various dimensions, such as revenue by product line, expenses by department, or performance by geographic region, creating dynamic reports that facilitate data exploration and informed decision-making.

- Data tables: These tools perform sensitivity analysis in financial models by illustrating how changes in input variables affect output results. For instance, a one-way data table can show how different discount rates impact a company’s NPV, while a two-way data table can simultaneously analyze the effects of varying both revenue growth and cost of goods sold on profitability.

- Charts and graphs: Excel enables the creation of visual representations of financial data, such as line charts for time-series analysis, bar charts for comparisons, pie charts for composition analysis, and scatter plots for correlation analysis. These visualizations are essential for effectively communicating financial trends and relationships in reports and presentations.

- Scenario manager: Excel’s scenario manager allows financial analysts to create and save various input scenarios within financial models, facilitating robust sensitivity analysis and decision-making by modeling different potential outcomes (e.g., best-case, worst-case, expected-case financial projections).

Excel’s Applications in Corporate Finance

Excel is the dominant tool for a wide range of corporate finance functions, leveraging its flexibility and computational power to support critical financial processes. Its capabilities extend from basic data analysis to the creation of complex financial models, all of which are essential for informed business decision-making. This makes it necessary to become proficient in Excel for finance.

These are the key applications of Excel in corporate finance:

Financial Modeling

Financial professionals use Excel to create structured representations of a company’s financials and operations, serving as decision-making tools to evaluate potential outcomes under different scenarios. Building these models involves organizing historical data and defining key assumptions, with Excel’s layout facilitating transparency and efficient updates. For instance, a three-statement model links financial statements through formulas to ensure consistency and allow users to assess the impact of changing assumptions.

Excel also enables scenario analysis, allowing analysts to test the sensitivity of financial models to changing conditions. Tools like data tables and the scenario manager help evaluate how changes in key variables, such as sales growth or profit margins, affect financial metrics, aiding management in strategic decision-making.

JPMorgan Chase frequently employs Excel for company valuation during M&A transactions, utilizing tools like Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transaction analysis. A prime example is their 2017 merger with Cazenove, where analysts built integrated Excel models consolidating both companies’ financials. These models enabled detailed projections of post-merger cash flows, the evaluation of synergies, and a thorough assessment of the deal’s impact on shareholder value and the balance sheet.

Data Analysis and Reporting

Excel enables financial professionals to transform raw financial data into actionable insights using its robust analysis and reporting tools. Specifically, analysts utilize Excel to identify patterns, trends, and outliers as statistical functions, such as regression analysis, facilitate forecasting, enabling a deeper understanding of performance drivers and opportunities for improvement.

Excel also facilitates the creation of professional financial reports through its formatting, conditional formatting, and charting tools. These reports, essential for clear financial communication, include monthly management reports, board presentations, and investor materials. Additionally, its linking capabilities ensure consistency and efficient updates across worksheets, streamlining the reporting process.

Valuation

Excel provides the computational framework for various valuation methodologies used to determine the value of assets and companies.

For instance, discounted Cash Flow (DCF) analysis, a key valuation method, relies heavily on Excel. Analysts build DCF models in Excel to project future cash flows, determine discount rates (often using calculations involving the Weighted Average Cost of Capital, or WACC), and calculate present values. Excel’s time value of money functions streamline this process, and scenario tools enable sensitivity analysis of key assumptions.

Comparable company analysis, another common valuation technique, utilizes Excel’s data organization and calculation capabilities. Analysts will create and use Excel spreadsheets to compile financial metrics for comparable companies, calculate valuation multiples, and apply these to the target company. Excel’s statistical, sorting, and filtering functions also aid in identifying relevant comparable companies and determining appropriate multiple ranges. The resulting valuation ranges inform investment decisions and M&A negotiations.

In capital markets, Goldman Sachs leverages Excel’s powerful functionalities for critical tasks like bond pricing and portfolio optimization. For instance, their analysts utilize functions such as YIELD and PRICE to calculate the yield to maturity (YTM) on new bond issuances and to strategically structure portfolios based on the risk-return profile. Excel enables them to model various interest rate scenarios and assess how bond prices react to these changes, a crucial capability for managing fixed-income portfolios and evaluating investment strategies.

The Indispensable Role of Excel in Finance

Excel is an indispensable finance tool, serving as the foundation for financial analysis, modeling, and decision-making across the industry. Mastering Excel’s financial functions, data analysis tools, and modeling techniques provides a significant competitive advantage in the workplace. The ability to efficiently organize data, perform complex calculations, and present insights visually translates directly to more informed financial decisions and persuasive financial communications.

Strengthen your understanding of Excel’s role in finance by learning key Excel functions for financial modeling and analysis. Elevate your financial expertise through our comprehensive Excel and finance courses, which will help you apply these concepts in real-world financial scenarios and accelerate your professional development.