What is Levered Free Cash Flow?

Levered Free Cash Flow (LFCF) is the residual cash belonging to only equity holders after deducting operating costs, reinvestments (e.g. working capital and capital expenditures), and financial obligations.

How to Calculate Levered Free Cash Flow

Levered free cash flow, or “free cash flow to equity”, represents a company’s remaining cash flows generated from its core operations once all spending obligations related to operating costs, reinvestments, and debt-related payments are fulfilled.

- Operating Costs → Cost of Goods Sold (COGS) and Operating Expenses (SG&A, R&D)

- Reinvestments → Net Working Capital (NWC) and Capital Expenditure (Capex)

- Financial Obligations (Debt-Related) → Mandatory Debt Amortization and Interest Expense

Once the items listed above are deducted, the leftover cash flow belongs to the shareholders of the company, i.e. those in possession of shares that represent partial ownership stakes in the company’s equity.

While the remaining proceeds technically belong to the shareholders, the allocation of the cash is at management’s discretion.

- Dividend Issuance → Cash Payments to Preferred and Common Equity Shareholders

- Reinvestment → Reinvest the Funds into Operations (Working Capital, Capex)

- Stock Buyback → Repurchase Previously Issued Shares to Reduce the Number of Shares in Circulation

Thus, equity shareholders such as private equity firms pay close attention to the levered free cash flow metric, since LFCF can be a proxy for the state of a company’s financial health.

- Higher LFCF → More Discretionary Cash, Greater Debt Capacity, and Low Credit Risk

- Low LFCF → Less Discretionary Cash and Less Debt Capacity, and High Credit Risk

Levered FCF vs. Unlevered FCF: What is the Difference?

- Levered Free Cash Flow (LFCF) → LFCF is a “levered” measure of cash flow because of the inclusion of expenses that stem from financing obligations, namely interest expense and mandatory debt repayment. For instance, interest payments are received only by debt holders, which are higher in priority than all equity holders in the capital structure. Since LFCF pertains only to equity shareholders, the discount rate it pairs with is the cost of equity (ke), which would be used to calculate the equity value in a levered DCF model. The levered DCF is seldom used in practice, aside from for financial institutions, as the core of their business model is oriented around lending (and earning interest income).

- Unlevered Free Cash Flow (UFCF) → On the other hand, UFCF is an “unlevered” measure of cash flow since the spending obligations deducted are applicable to all capital providers, i.e. both debt lenders and equity holders. Instead of starting from net income – which is post-interest and includes the tax savings from the interest tax shield – the calculation of UFCF starts from a capital-structure neutral metric, NOPAT, and does not account for any repayment of debt obligations. Because UFCF represents all stakeholders, rather than only one capital provider group, the corresponding discount rate is the weighted average cost of capital (WACC), which calculates the enterprise value (TEV) in an unlevered DCF model.

Levered Free Cash Flow Formula

The levered free cash flow formula is as follows.

Where:

- Net Income → Net income, often referred to as the “bottom line”, is a company’s accounting profit inclusive of all operating costs, including interest expense.

- D&A → D&A stands for “Depreciation and Amortization”, which are non-cash expenses that allocate an expenditure across the useful life of the fixed asset (PP&E) or intangible asset. No actual cash outflow occurred, as D&A is an accrual accounting convention intended to match the timing of an expense recognition with the period in which the benefit is received, as opposed to recognizing the entire expenditure at one time in the period of occurrence.

- Change in Net Working Capital (NWC) → The change in NWC tracks the net change in a company’s operating assets (e.g. accounts receivable, inventory) and operating liabilities (e.g. accounts payable, accrued expense) over a specified period.

- Net Borrowing → The net borrowing is calculated by subtracting the amount of debt repayment from the amount of debt borrowed (i.e. Debt Borrowing – Debt Repayment). The debt borrowed is included here because the proceeds from the borrowing can be used to distribute shareholder dividends or repurchase shares, which are corporate actions directly relevant to equity holders.

Levered Free Cash Flow Calculator

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

Levered Free Cash Flow Calculation Example

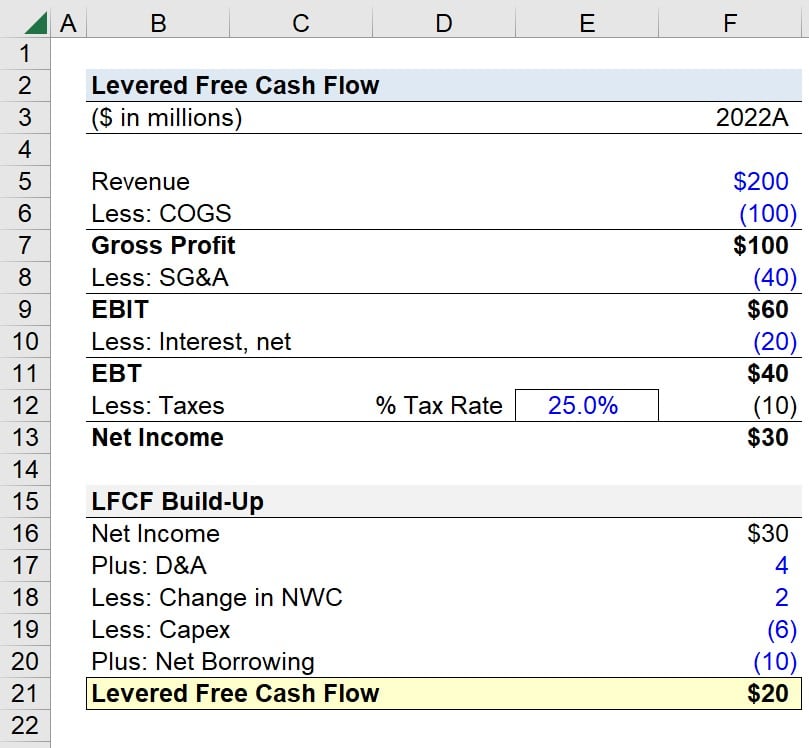

Suppose you’re tasked with calculating the levered free cash flow of a company in 2022 given the following set of assumptions.

| Income Statement | 2022A |

|---|---|

| Revenue | $200 million |

| Less: COGS | (100 million) |

| Gross Profit | $100 million |

| Less: SG&A | (40 million) |

| EBIT | $60 million |

| Less: Interest, net | (20 million) |

| EBT | $40 million |

| Less: Taxes | (10 million) |

| Net Income | $30 million |

Furthermore, the following values were obtained from the company’s cash flow statement (CFS).

- D&A = $4 million

- Change in NWC = $2 million

- Capex = ($6 million)

- Net Borrowing = ($10 million)

Starting from net income, the first adjustment is D&A, which is treated as an add-back since it is a non-cash expense.

From there, we adjust for the change in NWC, which is a cash inflow given the positive value, i.e. the company’s net working capital balance decreased from the year prior (creating a “source of cash”).

As a general rule, a year-over-year (YoY) increase in a company’s net working capital (NWC) is a “cash outflow”, whereas a decrease in net working capital is a “cash inflow”.

The next step is to deduct the capital expenditure (Capex) in the period, as well as the mandatory debt amortization for the given period. Since the net borrowing is a negative value, that means the company repaid more debt than it raised.

Once we input our assumptions into the levered free cash flow formula, we arrive at $20 million for our company’s LFCF in 2022.

- Levered Free Cash Flow (LFCF) = $30 million + $4 million + $2 million – $6 million – $10 million = $20 million

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

Hi, If you’re looking at yearly/quarterly cash flows, wouldn’t it make sense to focus on debt borrowing or debt paydown that are for the short-term or current portion of the long-term? Thank you in advance!

Hi, Antar,

Yes, but Levered FCF in any given period is calculated using the debt borrowings and paydown for that period, so whether short run or long run, you capture that particular period.

BB