What is Collateral?

Collateral is an item of value that borrowers can pledge to lenders to obtain a loan or a line of credit.

Oftentimes, lenders require borrowers to offer collateral as part of the lending agreement, in which the loan’s approval is entirely dependent on the collateral – i.e. the lenders are attempting to protect their downside protection and de-risk.

How Collateral Works in Loan Agreements

By pledging collateral as part of a financing arrangement, a borrower can obtain financing at lending terms that it otherwise would likely not have been able to receive.

For a borrower’s request for a loan to be approved, a lender could demand collateral as part of the deal in an effort to protect their downside risk.

More specifically, marketable assets with high liquidity are preferred as collateral by lenders, e.g. inventory and accounts receivable (A/R).

The easier it is to convert an asset into cash, the more liquid it is, and the more potential buyers for an asset there are, the more marketable the asset is.

If the lender has a claim on the borrower’s collateral (i.e. a “lien”), then the loan is called a secured loan, as the financing is collateral-backed.

If the borrower defaults on the financial obligation – i.e. the borrower is unable to service interest expense payments or meet mandatory principal amortization payments on time – then the lender has the right to seize the pledged collateral.

Common Examples of Collateral in Debt Financing

| Type of Loan | Collateral |

| Corporate Loan |

|

| Residential Mortgages |

|

| Automobiles (Auto Loan) |

|

| Securities-Based Lending |

|

| Margin Loans |

|

Collateral Incentives – Illustrative Example

Let’s say that a customer at a restaurant has forgotten his wallet and realized his mistake when it came time to pay for the consumed meal.

Convincing the restaurant owner/staff to allow him to drive back home to retrieve his wallet would likely be met with distrust (i.e. “dine and dash”) unless he left a valuable belonging such as a watch behind.

The fact that the customer left a belonging with value – a watch with both personal value and market value – serves as evidence that he most likely intends to come back.

In the case that the customer never returns, then the restaurant is in possession of the watch, which the restaurant would now technically own.

Collateral in Loan Agreements

Collateral serves as evidence that a borrower intends to repay their debt obligations as outlined in the loan agreement, which minimizes the risk to the lender.

Unless the provider of the debt is a distressed fund seeking majority control in anticipation of default, most lenders request collateral for the following reasons:

- Ensure the Borrower is Incentivized to Avoid Default

- Limit the Maximum Potential Loss of Capital

A company that has defaulted and fallen into financial distress can enter a time-consuming restructuring process, which both the borrower and lender would want to avoid, if possible.

Collateral Pros/Cons for Borrower and Lender

By requiring collateral for the loan agreement to close, the lender – typically a risk-averse, senior lender like a bank – can further protect their downside risk (i.e. the total amount of capital that could be lost in a worst-case scenario).

However, pledging the rights to property and assets of value does not just help the loan approval process.

In fact, the borrower will often benefit from lower interest rates and more favorable lending terms for collateral-backed, secured loans, which is why secured senior debt is well-known for carrying low-interest rates (i.e. being a “cheaper” source of debt capital compared to bonds and mezzanine financing).

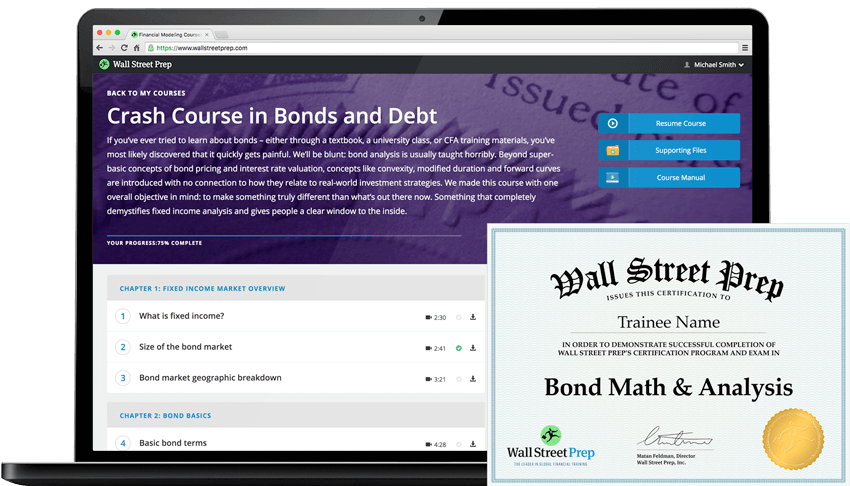

Crash Course in Bonds and Debt: 8+ Hours of Step-By-Step Video

A step-by-step course designed for those pursuing a career in fixed income research, investments, sales and trading or investment banking (debt capital markets).

Enroll Today