What is Conversion Rate?

The Conversion Rate refers to the number of conversions (e.g. orders placed, subscribers, trial sign-ups), expressed as a percentage of the total number of visitors to a webpage.

How to Calculate Conversion Rate

The conversion rate measures the number of users that performed a specific desired action.

The “end goal” is determined by the company, with common examples being a customer placing an order, a user subscribing, or a sign-up for a free trial.

Once determined, the figure is divided by the total number of users that visited the website (and had the potential opportunity to convert).

Upon competition of the desired action, visitors are effectively converted into either:

- Leads ➝ Potential Customers (i.e. Pipeline)

- Customers ➝ Paying Customer (i.e. Converted)

The term “desired action” can take many forms, and it varies by the company (and website), but some common examples include the following:

- Customers Order

- Subscriptions to Newsletters

- Event Registration

- Free Trial Sign-Up

In particular, the metric is most frequently referenced by e-commerce companies and application-based businesses.

Nevertheless, tracking conversions is essential for all companies across different industries, such as a retail store measuring the percentage of customers that entered their store and then purchased an item.

Once potential customers convert into paying customers, opportunities for upselling and cross-selling emerge to further derive more revenue from the existing customer base.

Conversion Rate Formula

The conversion rate is calculated by dividing the number of conversions by the total number of visitors.

For example, if an eCommerce business received 1,000 site visitors in one month and received 50 customer orders, then the conversion would be 5.0% for the month.

- Conversion Rate (%) = 50 Orders ÷ 1,000 Site Visitors = 5.0%

How to Optimize Conversion Rate (CRO)

Conversion rate optimization (CRO) describes the best practices implemented by websites to optimize their conversion rates and enhance the efficiency at which sales are generated.

Broadly put, above-market conversion rates imply that the current marketing strategy is bringing in the right customers to the site (i.e. attracting the right targets to sell to), and the sales pitch or “message” resonates well with the viewers.

Defining what constitutes a “good” conversion rate is entirely dependent on the industry, audience demographics, as well as the total site traffic among various other factors.

For instance, an online business selling a niche product would aim for a much higher conversion than a business that sells a broad line of products with a broad reach, i.e. companies with a larger total addressable market (TAM) lead to more site traffic (and less “targeted” viewers).

However, if a business brings in greater site traffic, the reliance on a higher conversion rate declines, so they typically will target lower conversion rates.

As a company’s website scales and site traffic (e.g. the volume of viewers) increases, it is inevitable for the conversion rate to decline over time, similar to how the growth rate of companies decreases in the later stages of their life cycle.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Oct 6 - Nov 30 cohort.

Enroll TodayHow to Improve Conversion Rate

Since the conversion rate measures the percentage of visitors that completed the desired action, increasing the conversion rate leads to an increase in sales efficiency – all else being equal.

In general, there are some guidelines to increase conversion rates, but there is no rigid methodology that works across all websites and industries.

Hence, companies frequently change their marketing strategies and conduct A/B testing in an effort to improve their conversion rates.

The customers within each market are unique, so each conversion optimization strategy must be tailored to meet their specific needs.

The core component of all successful customer conversion strategies is an in-depth understanding of the target end market and customer preferences.

More specifically, the company must identify the problems faced by their potential customers so that the right solution can be offered (i.e. “pain points”).

Even after establishing a plan with strong progress (e.g. increased conversions), the Company must adjust to the continuously changing competitive landscape (and end-market customer dynamics) – which is why on-page and external surveys are often utilized to obtain user feedback.

In some cases, the reverse can also be done, in which a solution is marketed to customers who did not realize they had originally wanted the product or service.

Once customer data is collected, proper adjustments must be made to determine which customer types appear to be the most receptive, i.e. have the highest net promoter score (NPS) and lowest churn rate.

Conversion Rate Calculator – Excel Template

We’ll now move to a modeling exercise, which you can access by filling out the form below.

eCommerce Conversion Rate Calculation Example

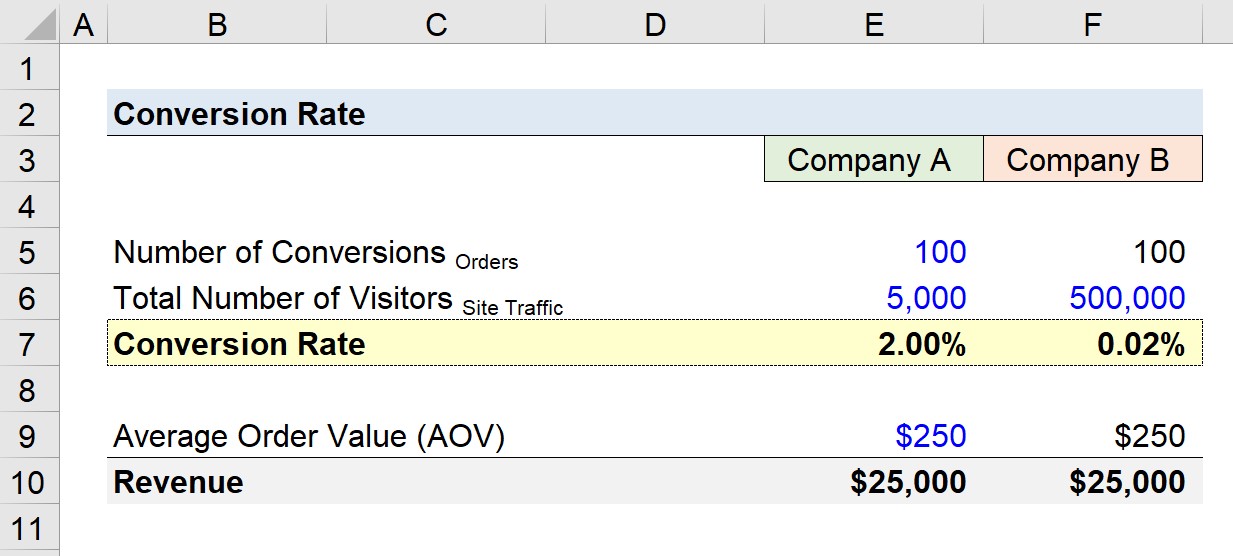

Suppose we have two closely competing e-commerce companies that each had 100 orders placed on their websites over the past month.

The online products sold by the two competitors – “Company A” and “Company B” – are priced at the identical price of $250.00 per order.

- Number of Conversions = 100 Orders

- Average Order Value (AOV) = $250.00

However, the difference lies in their total number of website visitors for the month, i.e. the site traffic.

- Site Traffic, Company A = 5,000 Viewers

- Site Traffic, Company B = 500,000 Viewers

There is a significant discrepancy in site traffic between the two companies, so the conversion rates are far apart, as one would reasonably expect.

- Conversion Rate, Company A = 100 ÷ 5,000 = 2.00%

- Conversion Rate, Company B = 100 ÷ 500,000 = 0.02%

Despite Company A’s higher conversion efficiency, the total revenue brought in for the month by each company is identical.

At the end of the day, both companies received 100 customer orders with an average order value (AOV) of $250.00 per sale, so the monthly revenue amounts to $25,000 for each company.

- Monthly Revenue = 100 × $250.00 = $25,000