What are Capitalized Software Costs?

Capitalized Software Costs are costs such as programmer compensation, software testing and other direct and indirect overhead costs that are capitalized on a company’s balance sheet instead of being expensed as incurred. With the growth in the number and size of software companies, we think it’s important to shed some light on capitalized software costs.

Capitalize Software Costs: Accounting Criteria

In order to be able to capitalize software development costs, the software being developed has to be eligible based on certain criteria prescribed under GAAP. Broadly speaking, there are two stages of software development in which a company can capitalize software development costs:

- The application development (i.e. coding) stage for software intended for a company’s internal use.

- The stage when “technological feasibility” is achieved for software that will be sold or marketed to the public.

The accounting and forecasting best practices for capitalized software costs is virtually identical to that of intangible assets: The costs are capitalized and then amortized through the income statement.

Software Developed for Internal Use

Examples of software for internal use include internal accounting and customer management systems. These types of applications and systems cannot be products sold to the public.

| Stage | Treatment |

|---|---|

| Project stage (pre-coding stage) | Expensed |

| Application development stage (coding stage) | Capitalized, except for general and administrative costs related to the development |

| Implementation stage (software is live and being used) | Expensed |

Software Companies Sell or Market to the Public

This includes software to be sold, leased or marketed to external users.

| Stage | Treatment |

|---|---|

| Pre-technological feasibility | Expensed |

| Software is technologically feasible but not available for sale | Generally capitalized, with some exceptions |

| Available for sale | Expensed |

Software Development Costs: Capitalization Qualifications

When qualifying for capitalization, software development costs that qualify include:

- Software developer compensation

- Allocation to indirect overhead

- Software testing and other direct costs

Benefits of Capitalizing Software

Capitalized software is capitalized and then amortized instead of being expensed. This will result in lower reported expenses and therefore higher net income.

Note that the decision to capitalize for GAAP purpose does not necessitate doing the same for tax purposes. As a result, companies looking to show higher net income for book purposes would prefer to capitalize software costs.

Capitalize vs. Expense Software Costs

Quite a bit, especially in the decision regarding software that is sold to the public. That’s because deciding what’s in the “technologically feasible” phase but not yet “available for sale” phase is fairly subjective.

Companies that are conservative generally classify software as available for sale once it reaches technological feasibility. In this case, there’s not much to capitalize because costs must be expensed once they are available for sale. Less conservative companies may allocate most costs to the stage where the software is technologically feasible but not yet available for sale.

Similarly, the decision to classify internally used software as in the development stage vs. the implementation or project stage can also be subjective.

Capitalized Software Development Costs Example

AthenaHealth capitalizes a significant amount of development costs for internally used software. In their 2017 10K, they explain that it is for internal use software called AthenaNet:

We capitalize certain costs related to the development of athenaNet services and other internal-use software. Costs incurred during the application development phase are capitalized only when we believe it is probable the development will result in new or additional functionality. The types of costs capitalized during the application development phase include employee compensation, as well as consulting fees for third-party developers working on these projects. Costs related to the preliminary project stage and post-implementation activities are expensed as incurred. Internal-use software is amortized on a straight-line basis over the estimated useful life of the asset, which ranges from two to five years. When internal-use software that was previously capitalized is abandoned, the cost less the accumulated amortization, if any, is recorded as amortization expense. Fully amortized capitalized internal-use software costs are removed from their respective accounts.

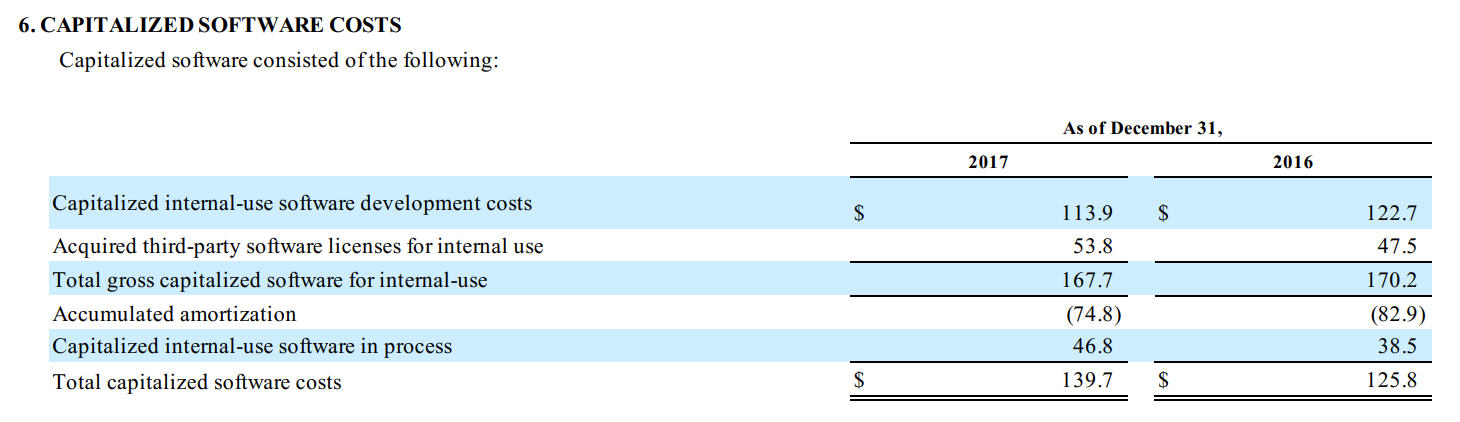

Here you can see the impact of capitalized software costs on the balance sheet:

In their footnotes, you can see that these costs are amortized, exactly like other intangible assets:

Meanwhile, Google capitalizes virtually no software development costs:

We expense software development costs, including costs to develop software products or the software component of products to be sold, leased, or marketed to external users, before technological feasibility is reached. Technological feasibility is typically reached shortly before the release of such products and as a result, development costs that meet the criteria for capitalization were not material for the periods presented.

Software development costs also include costs to develop software to be used solely to meet internal needs and cloud based applications used to deliver our services. We capitalize development costs related to these software applications once the preliminary project stage is complete and it is probable that the project will be completed and the software will be used to perform the function intended. Costs capitalized for developing such software applications were not material for the periods presented.

— Alphabet Inc. 10k, fiscal year ended 12/31/17

Because of the subjectivity about determining the software development phases of internal use and commercial software, it is important to understand differences in these accounting decisions when comparing software companies. Two identical software companies might have very different looking financials based solely on this accounting decision.

For quite a few companies, I’ve noticed that the amount of software development costs on their cash flow statement doesn’t match the difference between gross capitalized software EoP – gross capitalized software beginning of period. The difference is sometimes substantial (sometimes higher and sometimes lower). Is there a reason I… Read more »

Hi, Cary, You’ll notice the same thing if you try to reconcile changes to historical PP&E balances to the capex and depreciation shown on the CFS. These must be differences between the accrual and cash amounts, and they simply cannot be reconciled without more information, which presumably was available to… Read more »