- What are Cyclical Stocks?

- What is the Definition of Cyclical Stocks?

- What are the Characteristics of Cyclical Stocks?

- What are Examples of Cyclical vs. Non-Cyclical Sectors?

- What is an Example of Cyclical Stock?

- What is Cyclical Unemployment?

- Cyclicality vs. Seasonality: What is the Difference?

- How to Mitigate the Risk of Investing in Cyclical Stocks

What are Cyclical Stocks?

Cyclical Stocks are publicly traded securities characterized by share prices that fluctuate along with the prevailing macroeconomic conditions and business cycles.

What is the Definition of Cyclical Stocks?

The share prices of cyclical stocks and the financial performance of the underlying company are affected by shifts in the broader economy and consumer spending patterns.

A useful question to ask when attempting to determine the cyclicality of a company is: “Would consumers require (or demand) this product or service even during a recession?”

If the economy were to undergo a sudden downturn, discretionary purchases on items such as homes and automobiles would soon observe steep declines in consumer demand.

Hence, companies with valuations that arise during periods of economic expansion and then decline sharply in recessionary periods are cyclical, i.e. the economy directly impacts the trajectory of their share prices.

More specifically, consumer confidence is tied to the current economic situation, as buyers tend to cut back on their spending if there are concerns about a recession (and vice versa if the near-term outlook on the economy is positive).

- Expansion Phase ➝ Increased Economic Output + Greater Consumer Spending

- Recession Phase ➝ Lower Economic Output + Reduced Consumer Spending

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Oct 6 - Nov 30 cohort.

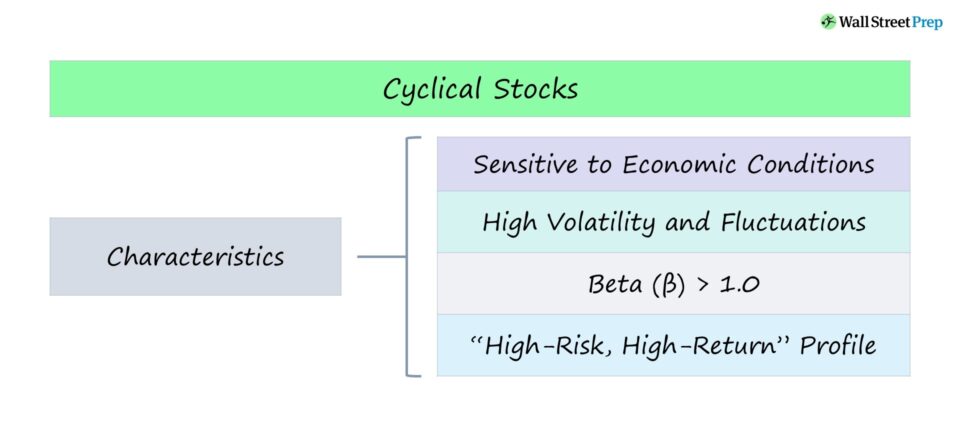

Enroll TodayWhat are the Characteristics of Cyclical Stocks?

Cyclicality describes irregular patterns occurring at unpredictable intervals, i.e. a cycle where the consequences are known, but the timing and the catalyst are practically impossible to predict accurately nor consistently.

Beta (β) measures the sensitivity of a particular security to systematic risk, i.e. the risk inherent to the entire market, or “market risk.”

Since beta compares the volatility of a security relative to the broader securities market (i.e. S&P 500), a high beta coincides with more cyclical securities.

- High Beta (>1.0) ➝ More Cyclicality

- Low Beta (<1.0) ➝ Less Cyclicality

For example, industries with exposure to construction exhibit higher betas (and cyclicality) as consumers are more likely to purchase new homes in periods of strong economic growth.

But “essential” consumer products including everyday necessities such as personal hygiene products (e.g. soap, shampoo, toothpaste) and toiletries do not exhibit as much cyclicality.

Regardless of the economic conditions or the consumer’s current level of disposable income, the majority of consumers require (and purchase) these products for everyday use.

Considering how most people cannot function without these products, which are sold at low prices, the sellers of these goods have lower betas and are non-cyclical.

Cyclical companies often carry a lower percentage of leverage in their capital structure because debt financing is expensive, and the terms offered by lenders are typically unfavorable to the borrower given their lack of track record of cash flows and unpredictable performance.

Most lenders, especially those that are risk-averse and prioritize capital preservation, are not comfortable providing loans to a high-risk company, i.e. a company with cyclical cash flows and fluctuating consumer demand makes the company less attractive to work with from a risk standpoint.

Before all else, debt lenders prioritize stability and predictability in revenue and profit margins, which is contradictory to cyclicality.

What are Examples of Cyclical vs. Non-Cyclical Sectors?

Cyclical companies operate in industries that are more affected by changes in the economic cycle.

If economic growth wanes and consumer purchasing power declines, fewer consumers purchase the products and services offered by non-essential, discretionary industries — causing their share price performance to be cyclical.

On the other hand, non-cyclical stocks (or “defensive stocks”) remain stable even if economic conditions worsen and consumer confidence declines.

| Cyclical Stocks | Non-Cyclical Stocks |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What is an Example of Cyclical Stock?

MGM Resorts (NYSE: MGM) is a global operator of resorts, hotels, and casinos — and would fall under the “consumer discretionary” category.

As one might reasonably expect, MGM’s operations were significantly hampered by the breakout of the global COVID pandemic in early 2020.

In March 2020, MGM was forced to close all of its casinos as part of the global lockdowns and furlough approximately 62,000 of its U.S. workforce.

Even after restrictions eased, 18,000 employees were still laid off, more than 25% of its total U.S. workforce.

MGM is one of the largest casino operators in Las Vegas but has fallen short in filling its hotel rooms, casino capacity has remained restricted, and restaurants / bars were still under capacity constraints.

Considering how tourist-oriented most of their resorts are, MGM saw losses mount with disappointing revenue figures even after re-opening — and the slowdown in business and consumer demand amid COVID eventually forced certain locations to remain closed and for employees to be laid off.

Just like adjacent sectors such as airlines and hospitality (i.e. sectors related to tourism and travel), the fear of an upcoming recession caused a dim outlook on MGM, despite the widespread optimism surrounding the vaccine and a return to normalcy.

The cyclicality of MGM’s market capitalization from 2004 to 2022 can be seen below, especially around the 2008 housing crisis and COVID.

MGM Resorts Market Capitalization Trends (Source: CapIQ)

What is Cyclical Unemployment?

Cyclical unemployment refers to the variations in the unemployment rate that correspond with the cyclical trends of the business cycle.

The fluctuations stem namely from changes in aggregate demand for goods and services within an economy.

- Economic Expansion ➝ During economic expansions, companies encounter higher demand, causing increased production and a greater need for labor, thereby reducing cyclical unemployment.

- Economic Recession ➝ Conversely, during economic recessions, demand decreases, production volume declines, and businesses cut their workforce (i.e. mass lay-offs), resulting in higher cyclical unemployment.

One notable characteristic of cyclical unemployment is the pattern is periodic, i.e. temporary, as the underlying driver is closely linked to the economic cycle.

If the economy enters a recession, the drop-off in aggregate demand leads to job losses (and thus, a higher unemployment rate).

However, an economic recovery will cause demand to rise and employment levels to improve — barring unusual circumstances.

Cyclical unemployment is considered an inevitable part of the overall business cycle and can be significantly influenced by government intervention and central bank policies aimed at stabilizing the economy (e.g. inflation).

Historical precedents illustrate the impact of cyclical unemployment:

- The Great Recession (2007-2009) ➝ The economy saw a significant rise in unemployment rates due to a severe economic downturn, particularly affecting industries related to housing and finance (i.e. sub-prime mortgage crisis).

- COVID-19 Pandemic ➝ Likewise, the COVID-19 pandemic in early 2020 caused a sharp uptick in cyclical unemployment from the government mandated lockdowns and reduced consumer spending. In effect, the global pandemic caused widespread business closures and lay-offs.

Cyclical unemployment can be offset, at least in theory, via a combination of fiscal and monetary policies.

For example, the government can allocate more funds toward infrastructure projects and provide financial assistance to stimulate demand (PPP loans).

Central banks (Fed) can also cut interest rates to encourage borrowing and investment among consumers and companies.

The aforementioned measures are intended to increase aggregate demand and reduce the unemployment rate, fostering economic stability and positive growth.

Cyclicality vs. Seasonality: What is the Difference?

Cyclical trends are less predictable with regards to timing than seasonality — thus, investing at the wrong time on a cyclical stock could result in substantially worse implications on returns.

An example of a cyclical industry is semiconductors, as industry growth is driven by global GDP and spending trends on IT by enterprises, which are known for fluctuating heavily.

Consistently predicting the directional changes in GDP (and timing recessions) without a large margin for error is nearly impossible too.

Besides being tied to enterprises’ spending trends, semi-conductors also depend on discretionary consumer purchases (e.g. smartphones, laptops, devices), which decrease during downturns.

Not to mention, recent products have increasingly shorter lifespans and become obsolete rather quickly due to the current pace of innovation, even after minor incremental improvements.

Hence, inventory build-ups and write-downs / write-offs of inventory are frequent occurrences in the semi-conductors industry.

By contrast, seasonality is more predictable because there are clear patterns, unlike cyclicality.

For example, the retail industry (e.g. clothing) is well-known for being seasonal, as consumer demand regularly spikes around the holidays.

But the difference here is that the consumer spending trends can be predicted, as confirmed by how retail companies hire more staff as the year wraps up and public companies emphasize the sales performance across the holidays.

How to Mitigate the Risk of Investing in Cyclical Stocks

The share prices of cyclical stocks tend to rise when the economy expands and then decline when the economic growth contracts.

The concern with investing in cyclical stocks is that high returns are dependent on timing the market correctly, which is easier said than done.

If a cyclical stock is purchased at the “bottom” and later sold at the “top,” there is greater potential for high returns. But in reality, timing the market correctly is a difficult task that requires much market/industry knowledge (and a lot of luck).

Consequently, when investing in cyclical stocks, a long time horizon is necessary to withstand the volatility due to the unpredictable performance of such stocks.