- What is Real Estate Private Equity?

- Real Estate Private Equity (REPE): Career Guide

- List of Top REPE Firms

- REPE Fund: Corporate Structure

- Real Estate Private Equity Investment Strategies

- REPE Investing Risk Profile

- REPE Investment Property Type

- REPE Firm: Transaction Size

- Geographic Focus

- Debt or Equity Investments

- Real Estate Private Equity (REPE): Jobs Roles

- Real Estate Acquisitions

- Day in the Life of An Acquisitions Real Estate Professional

- Asset Management

- Acquisitions vs. Asset Management in Real Estate Private Equity

- Career Path in Real Estate Private Equity (REPE)

- Real Estate Private Equity (REPE): Hierarchy of Roles

- The Principal / Managing Director: Role, Promotion Path, and Salary

- Real Estate Private Equity (REPE) Acquisitions Associate Salary

- Top REPE Recruiters (2023 Update)

- Real Estate Private Equity Interview (REPE): What to Expect?

- Real Estate Modeling Test

- Real Estate Case Study

- Top 10 Real Estate Private Equity Interview Questions (REPE)

- Other Roles in Real Estate Private Equity

What is Real Estate Private Equity?

Real Estate Private Equity (REPE) refers to firms that raise capital to acquire, develop, operate, improve, and sell buildings in order to generate returns for their investors. If you’re familiar with traditional private equity, real estate private equity is the same, but with buildings.

Real Estate Private Equity (REPE): Career Guide

As the “private” in “private equity” suggests, these firms raise capital from private investors and deploy that capital to make investments in real estate. There is little standardization to how real estate private equity firms are structured, but they all generally engage in five key activities:

- Capital raising

- Screening investment opportunities

- Acquiring or developing properties

- Managing properties

- Selling properties

Capital is the lifeblood of any investment firm – without capital to invest, there is no firm. The capital raised by real estate private equity firms comes from Limited Partners (LPs).

LPs generally consist of public pension funds, private pension funds, endowments, insurance companies, fund of funds, and high-net-worth individuals.

List of Top REPE Firms

There are many types of firms focused on real estate investment. Here we’re focusing specifically on REPE as opposed to REITs, or a variety of other types of real estate companies, and below is a list of the top real estate private equity firms (Source: perenews.com):

| Rank | Firm | Five-year fundraising total ($m) | Headquarters |

|---|---|---|---|

| 1 | Blackstone | 48,702 | New York |

| 2 | Brookfield Asset Management | 29,924 | Toronto |

| 3 | Starwood Capital Group | 21,777 | Miami |

| 4 | ESR | 16,603 | Hong Kong |

| 5 | GLP | 15,510 | Singapore |

| 6 | The Carlyle Group | 14,857 | Washington DC |

| 7 | BentallGreenOak | 14,760 | New York |

| 8 | AEW | 13,496 | Boston |

| 9 | Cerberus Capital Management | 13,076 | New York |

| 10 | Ares Management | 12,971 | Los Angeles |

| 11 | Gaw Capital Partners | 12,417 | Hong Kong |

| 12 | Rockpoint Group | 11,289 | Boston |

| 13 | Bridge Investment Group | 11,240 | Salt Lake City |

| 14 | Tishman Speyer | 11,229 | New York |

| 15 | Pretium Partners | 11,050 | New York |

| 16 | KKR | 10,933 | New York |

| 17 | Angelo Gordon | 10,042 | New York |

| 18 | EQT Exeter | 9,724 | Stockholm |

| 19 | Apollo Global Management | 9,713 | New York |

| 20 | Bain Capital | 9,673 | Boston |

| 21 | CBRE Investment Management | 9,424 | New York |

| 22 | Oak Street, A Division of Blue Owl | 8,823 | Chicago |

| 23 | LaSalle Investment Management | 8,565 | Chicago |

| 24 | TPG | 8,200 | San Francisco |

| 25 | PAG | 7,973 | Hong Kong |

| 26 | Harrison Street Real Estate Capital | 7,888 | Chicago |

| 27 | Sino-Ocean Capital | 7,472 | Beijing |

| 28 | Hines | 7,354 | Houston |

| 29 | Rockwood Capital | 6,990 | New York |

| 30 | AXA IM Alts | 6,920 | Paris |

| 31 | Greystar Real Estate Partners | 6,776 | Charleston |

| 32 | Crow Holdings Capital | 6,498 | Dallas |

| 33 | Aermont Capital | 6,370 | Luxembourg |

| 34 | Pacific Investment Management Co. (PIMCO) | 5,860 | Newport Beach |

| 35 | Morgan Stanley Real Estate Investing | 5,832 | New York |

| 36 | Goldman Sachs Asset Management Real Estate | 5,711 | New York |

| 37 | Partners Group | 5,635 | Baar-Zug |

| 38 | Lone Star Funds | 5,551 | Dallas |

| 39 | Harbor Group International | 5,453 | Norfolk |

| 40 | CIM Group | 5,446 | Los Angeles |

| 41 | Invesco Real Estate | 5,379 | New York |

| 42 | Henderson Park Capital Partners | 5,359 | London |

| 43 | IPI Partners | 5,300 | Chicago |

| 44 | Rialto Capital Management | 5,052 | Miami |

| 45 | Fortress Investment Group | 5,013 | New York |

| 46 | Almanac Realty Investors | 4,948 | New York |

| 47 | StepStone Group | 4,880 | New York |

| 48 | Oaktree Capital Management | 4,771 | Los Angeles |

| 49 | PGIM Real Estate | 4,759 | Madison |

| 50 | Heitman | 4,756 | Chicago |

| 51 | BlackRock | 4,619 | New York |

| 52 | Kayne Anderson Capital Advisors | 4,490 | Los Angeles |

| 53 | Tricon Residential | 4,462 | Toronto |

| 54 | DivcoWest | 4,443 | San Francisco |

| 55 | Artemis Real Estate Partners | 4,172 | Chevy Chase |

| 56 | Keppel Capital | 4,000 | Singapore |

| 57 | DRA Advisors | 3,906 | New York |

| 58 | Westbrook Partners | 3,897 | New York |

| 59 | Nuveen Real Estate | 3,714 | London |

| 60 | Schroders Capital | 3,454 | London |

| 61 | Centerbridge Partners | 3,307 | New York |

| 62 | Sculptor Capital Management | 3,215 | New York |

| 63 | HIG Realty Partners | 3,167 | Miami |

| 64 | Tristan Capital Partners | 3,154 | London |

| 65 | PCCP | 3,116 | Los Angeles |

| 66 | NREP | 3,072 | Copenhagen |

| 67 | Azora | 2,980 | Madrid |

| 68 | Lionstone Investments | 2,965 | Houston |

| 69 | FPA Multifamily | 2,955 | San Francisco |

| 70 | GTIS Partners | 2,812 | New York |

| 71 | Asana Partners | 2,800 | Charlotte |

| 72 | Warburg Pincus | 2,800 | New York |

| 73 | DLE Group | 2,761 | Berlin |

| 74 | Harbert Management Corporation | 2,689 | Birmingham |

| 75 | Square Mile Capital | 2,650 | New York |

| 76 | Patrizia | 2,611 | Augsburg |

| 77 | Waterton | 2,597 | Chicago |

| 78 | M7 Real Estate | 2,510 | London |

| 79 | Prologis | 2,475 | San Francisco |

| 80 | Ardian | 2,429 | Paris |

| 81 | Walton Street Capital | 2,429 | Chicago |

| 82 | Wheelock Street Capital | 2,329 | Greenwich |

| 83 | GLP Capital Partners | 2,300 | Santa Monica |

| 84 | Kennedy Wilson | 2,166 | Beverly Hills |

| 85 | Baring Private Equity Asia | 2,129 | Hong Kong |

| 86 | DNE | 2,126 | Shanghai |

| 87 | Kildare Partners | 2,101 | Hamilton |

| 88 | Related Companies | 2,099 | New York |

| 89 | TA Realty | 2,057 | Boston |

| 90 | COIMA | 2,038 | Milan |

| 91 | IGIS Asset Management | 2,013 | Seoul |

| 92 | Canyon Partners | 2,000 | Dallas |

| 93 | Cabot Properties | 1,950 | Boston |

| 94 | Berkshire Residential Investments | 1,917 | Boston |

| 95 | Enterprise Community Partners | 1,899 | Columbia |

| 96 | Capman | 1,890 | Helsinki |

| 97 | Signal Capital Partners | 1,875 | London |

| 98 | Beacon Capital Partners | 1,868 | Boston |

| 99 | FCP | 1,864 | Chevy Chase |

| 100 | RoundShield Partners | 1,860 | St Helier |

The Wharton Online and Wall Street Prep Real Estate Investing & Analysis Certificate Program

Level up your real estate investing career. Enrollment is open for the Oct 6 - Nov 30 Wharton Certificate Program cohort.

Enroll TodayREPE Fund: Corporate Structure

Like traditional private equity firms, real estate private equity firms raise money from Limited Partners (“LPs”) – these are private investors (usually pension funds, university endowments, insurance companies, etc.).

As an important fine point, REPEs raise capital for specific “funds” (think individual investment vehicles all run by the same firm). These funds have their own “mandates,” meaning they have specific types of real estate investments they look for.

Another important thing to understand is that REPE funds are “closed-end funds,” meaning that investors expect to get their money back (ideally along with a hefty return on investment) within a specified time frame – usually within 5-7 years.

This is a contrast to open-end funds raised by Real Estate Investment Management firms such as JP Morgan Asset Management and TA Realty that have no end date and therefore offer more flexibility to the manager.

Real Estate Private Equity Investment Strategies

REPE firms usually specialize to varying degrees around specific characteristics related to their investments:

In cases where the firms themselves are not organized this way, their specific investment funds usually will be.

REPE Investing Risk Profile

Many REPE firms organize themselves according to risk profile as their driving investment strategy. They will carve out a portion of the risk/return spectrum and focus on transactions – regardless of property type and geography – that fit the specified risk profile and return targets.

The most high-profile types of real estate private equity fund strategies are called “Opportunistic” or “Value-Add” and refer to higher risk/return types of investments than the more conservative “Core” or “Core-Plus” strategies. In the image below, you can see the return profile targeted across these different strategies.

This is an effective way for REPE firms to organize themselves because it sets clear expectations for a firm’s investors and allows the manager to diversify risk across geography and property types.

When you hear terms like “opportunity fund” or “targeting core investments,” they are usually referring to risk profiles and return targets.

REPE Investment Property Type

REPE firms do not often constrain themselves when it comes to property type. In a scenario where they did, a firm would focus exclusively on one property type, hotels, for example, and diversify their investments in other ways within the property type sector.

| Property Type | Description |

|---|---|

| Multifamily |

|

| Office |

|

| Retail |

|

| Industrial |

|

| Hospitality |

|

REPE Firm: Transaction Size

Many REPE firms organize themselves by transaction size, which is largely informed by the amount of assets under management (AUM) but can also be part of a firm’s strategy.

Transaction size relative to AUM has implications on diversification and overhead (how many employees are necessary to close the target number of transactions).

If a firm has a large amount of AUM, it is likely to focus on larger transactions to keep the number of deals necessary to fully deploy its capital to a reasonable size. A firm with a smaller amount of AUM is likely to focus on smaller transactions in order to achieve the desired amount of asset diversity.

If a firm had $500 million of AUM and focused on transactions requiring $25 million of equity, the firm would need to purchase 20 properties to fully deploy its capital. On the other hand, if the same firm with $500 million of AUM focused on transactions requiring only $10 million of equity, the firm would need to purchase 50 properties to fully deploy its capital.

Geographic Focus

Many REPE firms choose to organize themselves by geographic location. There are a number of benefits from a strategic perspective, such as developing a higher level of expertise in an area and gaining a deeper network. From an operational perspective, it requires fewer offices across the country (or world) and reduces the amount of time employees must spend traveling to visit properties.

However, a constrained geographic focus reduces the level of diversification and the number of potential transactions. Many smaller firms are organized in this way and while larger firms tend to cover more geographies, they do so out of various offices that are geographically focused.

Debt or Equity Investments

Traditionally, REPE firms are thought to be equity investors. But REPE can also pursue debt investment strategies where they make investments in different parts of the capital structure. Many REPE firms invest in both equity and debt.

Real Estate Private Equity (REPE): Jobs Roles

As with non-real estate private equity, REPE deals require a team to execute. Below is the breakdown of the roles and job types in real estate private equity.

| Real Estate Private Equity Job Type | Description |

|---|---|

| Real Estate Acquisitions | Responsible for sourcing and executing deals. The acquisitions role is considered the most prestigious role in real estate private equity. Senior acquisitions professionals focus on sourcing, while junior acquisitions professionals provide the financial modeling and deal execution horsepower. |

| Asset Management | Responsible for implementing the business plan once a property is acquired and ultimately selling the property. |

| Capital raising and investor relations | Responsible for raising the money to be invested in the first place and managing communications with current investors. |

| Accounting, Portfolio management, and Legal | Provides necessary support in different areas. |

Real Estate Acquisitions

Real Estate Acquisitions involve the sourcing (senior deal professionals) and execution (junior deal professionals) of real estate transactions. The day-to-day responsibilities of an acquisitions professional include:

- Sourcing deals

- Conducting market research

- Building financial models

- Analyzing deals

- Writing investment memorandums

Compared to asset management, acquisitions is generally viewed as the more “prestigious” role.

Day in the Life of An Acquisitions Real Estate Professional

At the junior levels, most time is spent modeling potential acquisitions and writing investment memorandums.

Writing an investment memorandum requires summarizing a financial model, conducting market research, and crafting an investment thesis.

Onsite property tours are also a major part of real estate investing, and at many firms, junior acquisitions professionals can expect to spend a good amount of time traveling to various properties. During the execution phase of a deal, acquisitions professionals will shift their attention to due diligence and supporting the legal team.

The amount of involvement junior professionals have in due diligence and legal varies by firm. There is no typical day in the life as the distribution of time across these activities ebbs and flows with how active the firm is in deploying capital.

Asset Management

At the junior levels, most time as an asset manager is spent executing business plans for the assets you are responsible for – this can vary by property and risk type.

For example, if you are the asset manager for an industrial warehouse, your responsibilities may include speaking with property management to understand how the property is functioning, working to sign new leases to maintain occupancy, touring the asset various times throughout the year and speaking with brokers to understand the market and what the property might sell for today.

If, however, you are the asset manager for a multifamily development opportunity, your responsibilities might include working with your joint venture partner to ensure the property is being constructed on time, hiring a property management team to get the property leased up, and doing research to decide where rents should be set.

In asset management, you would also play a part in sourcing new investment opportunities by helping with due diligence. If a new asset is about to be acquired, asset management may be engaged to review the historical financials and competitive set to see what can be expected in the future, hire a property management team and sign contracts with vendors.

Another big part of asset management is selling properties. Asset management is responsible for working with portfolio management to determine the most opportune time to sell the asset, engaging a brokerage team, creating a disposition memorandum outlining the thesis to sell the property and successfully executing the sale.

In summary, the asset management includes the following responsibilities

- Executing property business plans

- Performing quarterly asset valuations

- Monitoring performance relative to budget

- Working with the acquisitions team to perform due diligence on new acquisitions

- Working with portfolio management to execute the business plan of the asset as it relates to the fund

- Selling properties

Acquisitions vs. Asset Management in Real Estate Private Equity

Some firms combine the Acquisitions and Asset Management roles (called “cradle-to-grave”). This is more often the case at smaller firms and has its pros and cons. At firms with a cradle-to-grave structure, junior professionals get exposure to both parts of the business while maintaining the “prestige” of being an acquisitions professional.

Acquisitions is generally viewed as the more “prestigious” role, but Asset Management is where the nuts and bolts of owning real estate are learned.

It is not uncommon for Asset Management to feature more entry-level positions that can be leveraged into an acquisitions role down the road.

Career Path in Real Estate Private Equity (REPE)

The career path within Real Estate Private Equity is similar to that of traditional PE. Just like traditional PE, there is a fairly standard hierarchy, and progression up the ladder is linear:

Where things get more complicated is the point of entry.

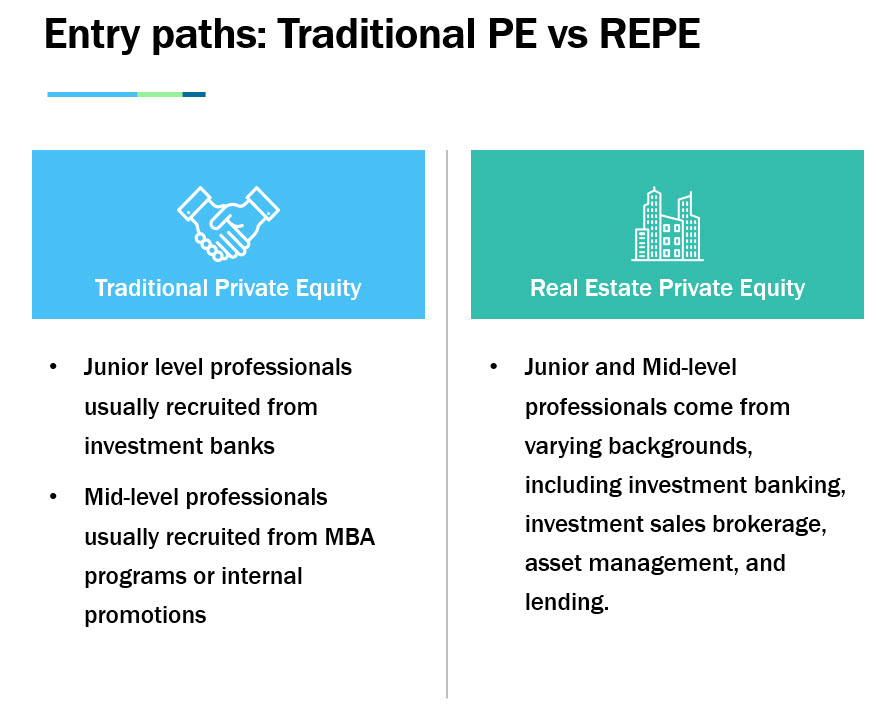

- In traditional PE, junior-level professionals are recruited from investment banks and mid-level professionals are recruited from MBA programs or internal promotions.

- In Real Estate PE, junior and mid-level professionals come from varying backgrounds, including investment banking, investment sales brokerage, asset management, and lending.

Large Real Estate Firms: Blackstone, Carlyle, Oaktree, etc.

The largest REPE firms – think Blackstone, Oaktree, Brookfield and Carlyle – have a standardized and predictable path of progression, enabling them to hire entire classes at a time. They also have the resources to formally train junior hires.

If your goal is to work in acquisitions at a large name-brand REPE firm, then your best bet is to secure a job in investment banking first. Asset management is less competitive, and recruiting often happens directly out of undergrad.

- Acquisitions Recruiting: From investment banks (just like traditional PE).

- Asset management Recruiting: Directly out of college for asset management and lending roles.

Breaking into the Rest: “Traditional” Real Estate Private Equity Firms

Below the top 20 REPE firms, the recruiting process varies widely. Firms usually do not recruit out of college, only hire 1-2 professionals at a time on an “as-needed” basis prefer to recruit through employee networks and only use headhunters sparingly.

Because the recruiting process is much less standardized, many REPE firms look to:

- The investment sales brokerage firms they work with (Cushman & Wakefield, CBRE, Eastdil, etc…)

- Real estate lenders with good junior training programs

- Larger REPE firms that may have a pool of junior asset management professionals looking to make the jump to acquisitions

Real Estate Private Equity (REPE): Hierarchy of Roles

The role hierarchy in REPE is similar to traditional private equity, with principals on top and associates on the bottom.

The Principal / Managing Director: Role, Promotion Path, and Salary

Day to Day Responsibilities

Principals are the most senior members of the investment team, usually reporting up to a Group Head or Chief Investment Officer. Their responsibilities are wide-ranging and include sourcing new transactions, participating in investor meetings, monitoring the asset management acquired properties they sourced, and managing the more junior investment professionals responsible for the due diligence on new investments.

Principals spend much of their time networking – whether that means attending industry conferences or traveling to major cities to get facetime with top brokers and potential partners.

Typical Promotion Path

Principals have a long track record of acquisitions experience. Many are homegrown and rose through the ranks from being junior associates and others lateral from competing REPE firms for a promotion from a Senior Vice President position.

Salary

The compensation range for a REPE Managing Director / Principal ranges between $500k – $750k. However, compensation at this level can vary drastically due to a meaningful amount of carried interest, the value of which is dictated by investment performance.

Senior Vice President / Director

Day to Day Responsibilities

Senior Vice President responsibilities are similar to that of Principals but relatively speaking, they spend more of their time executing and managing investments than they do sourcing transactions and interfacing with investors.

They will spend time reviewing investment memos and models and opining on key decisions related to acquired properties. A key delineating factor between Senior Vice Presidents and more junior professionals is their ability to negotiate and navigate the legal aspects involved in real estate investing. In addition, a good amount of time is spent developing a network to source transactions.

Typical Promotion Path

Senior Vice Presidents have a track record of acquisition experience. Most are promoted from internal Vice President positions, though they may have spent their time prior to being a Vice President at another REPE firm.

SVP / Director Compensation Range

The compensation range for a REPE SVP/Director ranges between $400k – $600k. As with the MD/Principal role, compensation at this level can vary drastically due to a meaningful amount of comp coming in the form of carry.

Vice President

Day to Day Responsibilities

Vice Presidents are typically the “quarterback” of the deal team who is held responsible for executing new acquisitions. Most of a Vice President’s time is spent managing junior professionals, overseeing the writing of investment memos, refining financial models, and negotiating and reviewing legal documents.

As Vice Presidents progress, they will begin to focus more of their time on developing their network with hopes of beginning to source new transactions.

Typical Promotion Path

The path to becoming a Vice President varies – the most straightforward is internal promotion from an Associate or Senior Associate position.

The Vice President level is also a common place for professionals to lateral from different REPE firms.

Lastly, some firms will hire MBA graduates at this level. Post-MBA Vice President positions are hard to come by and often go to graduates who have prior real estate experience.

VP Compensation Range:

The compensation range for a REPE VP ranges between $375k – $475k

Associate / Senior Associate

Day to Day Responsibilities

At most REPE firms, Associates are the more junior professionals, which means they are responsible for the majority of the analytical work.

Associates spend the majority of their time building real estate financial models and writing investment memos for potential acquisitions.

Pulling together the necessary data for these deliverables often requires touring the property and its competitive set (or oftentimes calling properties and secret shopping), digging up market data on REIS (general market data) and/or RCA (historical sales comparables), and reviewing documents provided during due diligence.

The financial model and investment memo are what is presented to investment committees to make the case for an investment. Depending on how the firm is organized, an Associate may also be involved in working with in-house lawyers on purchase and sale agreements (PSAs), loan documents, and joint venture agreements – in most cases, the Vice President on the transaction will lead the legal work.

Another responsibility that varies with firm organization is time spent on asset management. At some firms, an Associate on the acquisitions team would spend no time on asset management. At other firms, an Associate may spend a considerable amount of time on calls with property managers and tracking the monthly financial performance of different investments.

In short, Associates are the analytical horsepower and can expect to build financial models, write investment memos, collect market data, and manage due diligence.

Typical Promotion Path

As we’ve already mentioned, the typical entry point for an acquisitions associate at a large REPE is from a bulge bracket investment bank.

Some of the top REPE firms recruit Associates from real estate groups and M&A groups at investment banks.

The recruitment cycle is similar to that of traditional Private Equity, where the process is guarded by headhunters and all of the top firms recruit during a short window in the winter of each year.

For traditional real estate private equity firms, the most common entry point is through real estate asset management at a larger firm or investment sales at a top brokerage firm.

At larger firms, you should expect to be an Associate for 2-3 years, at which point the highest performers might be offered a promotion to Senior Associate or Vice President (again, firm dependent). Oftentimes, you’d be expected to go get an MBA before promotion.

So from start to finish, the path could look like this: 2 years Investment Banking Analyst, followed by 2-3 years Real Estate Private Equity Associate, then 2 years MBA and finally a return to a REPE firm as a Vice President.

At traditional (smaller) REPE firms, the path is similar, but instead of 2 years getting an MBA, the firm might promote you to a Senior Associate position prior to Vice President.

Real Estate Private Equity (REPE) Acquisitions Associate Salary

Compensation structure is generally structured similarly to traditional private equity – heavily weighted towards bonus, though compensation within real estate private equity tends to be more highly variable than traditional PE.

At the junior level, base and bonus are all cash, while at mid-to-senior levels, compensation typically includes a carried interest component.

A first-year acquisitions Associate with investment banking experience should expect a base salary in the range of $90,000 – $120,000, depending on location and firm size, and a year-end bonus that is approximately $100% of base pay, bringing the all-in compensation for most first-year acquisitions Associate will range between $160k – $230k.

At many firms, base salary doesn’t often increase meaningfully year-to-year, but bonuses can grow from 100% to as much as 200% in a few short years.

As you go further up their real estate private equity hierarchy, compensation grows similar to traditional PE:

At many firms, base salary doesn’t often increase meaningfully year-to-year, but bonuses can grow from 100% to as much as 200% in a few short years.

Top REPE Recruiters (2023 Update)

Headhunters serve an important role (depending on who you ask) in the recruitment process. They spend their time locating, interviewing, and assessing the talent on the market. For Real Estate Private Equity firms, headhunters serve as a convenient place to look for the top talent in the industry. It is good practice to meet with all of the top headhunting firms so that you stay in the loop of potential REPE job opportunities. Below is a list of a few prominent headhunting firms active in the REPE space:

- CPI

- Amity Search

- Glocap Search

- RETS Associates

- Ferguson Partners

- Rhodes Associates

- Crown Advisors

- Terra Search

Real Estate Private Equity Interview (REPE): What to Expect?

So, you’ve landed a Real Estate Private Equity interview. If you’re interviewing at one of the larger REPE firms, the process will be similar to traditional private equity. Typically, there are 3 rounds of interviews, although they tend to be less structured than investment banking or traditional private equity.

Regardless of your entry point (undergrad, investment banking, asset management, brokerage, MBA), the interview structure is likely to be more or less the same. But, your entry point will likely inform where your interviewers are likely to push harder and where they might give you some grace. From my experience, the interview experience could differ in the following ways:

- Recent Undergraduates: The expectations on the technical side will be lower, but this does not mean you shouldn’t expect technical questions. Interviewers won’t expect a recent undergraduate to be nearly as technically sound as a former investment banker. Expect emphasis to be placed on how hard you’re willing to work, how hungry you are, and your interest in the real estate industry.

- Former Investment Bankers: The expectations on the technical side will be very high. Interviewers will expect very high performance on modeling tests. Most investment bankers will have spent their time analyzing REITs, which is very different from analyzing individual properties, which is much of the work at most Real Estate Private Equity firms, so interviewers will be more forgiving in this area.

- Asset Management & Brokerage: The expectations on real estate knowledge (the industry in general, opinions on property types, market trends, etc.) will be higher for this group than others, given a background working with individual real estate assets. Interviewers will also have high expectations on the technical side, though not as high as former investment bankers.

- MBAs: In my experience, interviewers are the most skeptical of MBAs. MBAs will be expected to perform highly on both the technical side and real estate knowledge aspect. For MBAs with prior real estate experience, this shouldn’t be a problem, but for MBAs changing industries, this will be a challenge, though not insurmountable.

Round 1: The informational interview

The informational interview is often with a Vice President or junior Principal who has been tasked with pulling together a pool of candidates. This initial interview is all about understanding your experience in real estate, your desire for working at the particular firm, and your long-term goals. You should be prepared to walk through your resume and ask good questions about the role and the firm.

Round 2: The technical interview

The technical interview is usually with an Associate who has been around for a while. A junior professional typically conducts this early technical screen because they are closer to the nuts and bolts of modeling and market analysis than the senior professionals. At this point, you should be prepared to answer technical and industry questions about how to value real estate, the main property types and how they differ from one another, and what type of real estate investments you think are in favor, among a number of other potential questions.

Round 3: Superday interviews

While the first two interviews are often done remotely, the final Superday interview is always conducted in person.

Of course, due to COVID-19, superdays in 2021 will likely all be virtual.

During a Superday, you are likely to interview all senior and mid-level professionals. They will continue to assess your technical capabilities as well as how you’ll fit into the team – at this point, everything is fair game (see the most common interview questions below).

The Superday is likely to conclude with a modeling test and potentially a case study.

Real Estate Modeling Test

The modeling test is often the biggest challenge for many candidates. Poor performance on the modeling test is often enough to derail an otherwise stellar candidate. But with enough preparation, anyone can ace these tests. The most common modeling test is 2-3 hours long, and you can expect to:

- Perform common Excel functions

- Demonstrate knowledge of modeling best practices

- Construct a real estate pro forma based on the provided assumptions

- Build an amortization table

- Build a joint venture waterfall

- Create a returns summary analysis and sensitivity

Real Estate Case Study

Some firms expect candidates to complete a case study in addition to the modeling test. Often, case studies are provided after a modeling test as a take-home exercise focused less on technical capability and more on market analysis and communicating an investment thesis. In other cases, the case study will be provided in combination with the modeling test and be conducted at the end of the Superday. A successful case study discusses the following:

- Property overview

- Market analysis and positioning

- Investment highlights

- Investment risks and mitigating factors

- Financial highlights

- Investment recommendation

Top 10 Real Estate Private Equity Interview Questions (REPE)

Because Real Estate Private Equity is viewed as a niche segment of the private equity world, firms are focused on hiring people who have a real interest in the world of real estate.

Because of this, the first and biggest red flag is always “they don’t actually seem interested in real estate” – make sure you know your “why”.

Senior Associates and Vice Presidents are often tasked with asking technical questions, while Senior Vice Presidents and Principals usually try to understand a candidate’s background to identify what their strengths and weaknesses are.

In my experience, my technical capabilities have largely been tested on the modeling test and in-person interviews have tended to lean more towards how you think about real estate, ability to be organized and manage deadlines (closing a deal is project management 101), and my desire to do the job.

To the original point about red flags, you’d be surprised how many people don’t get the job because they simply “didn’t seem like they wanted this job”.

Unlike investment banking interviews, REPE interviews (and private equity interviews more broadly for that matter), tend to focus less on technical finance interview questions and rely on the modeling test and case study to confirm you’ve got the technicals down.

So if you are comfortable with the following 10 questions (and prepared for a modeling test and case study), you’re well on your way to acing your interview.

Why real estate?

The key to answering this question is to make your response personal and not cookie-cutter. With that said, responses almost always touch on real estate being “tangible”. Other ideas to consider are how large the real estate industry is and the expected growth in popularity among investors. From a personal perspective, think about your first time engaging with real estate or the role it plays in your life today.

What are the three ways of valuing real estate assets?

Cap rates, comparables, and replacement cost. Property value = property NOI / market cap rate. Comparable transactions can inform per-unit or per-square-foot valuations as well as current market cap rates. The replacement cost method dictates that you would never purchase a property for more than you could build it new. Each method has its weaknesses, and the three should be used together.

Learn More → Cap Rate Primer

Compare the cap rates and risk profiles for each of the main property types.

From highest cap rate (most risky) to lowest cap rate (least risky) – hotel, retail, office, industrial, multifamily. Hotels generally trade at the highest cap rates because cash flow is driven by nightly stays (extremely short-term leases) and more operationally intensive activities like restaurants and conferences. The creditworthiness of retail tenants is increasingly in question due to trends in e-commerce. The office sector is closely correlated to the broader economy but has longer-term leases. The industrial sector benefits from e-commerce trends, longer-term leases, and simple operations. Multifamily is thought of as the safest asset class because no matter how the economy is performing, people will need a place to live.

Walk through a basic cash flow proforma for a real estate asset.

A: The top line is revenue which will be primarily rental income but might also include other revenue lines and will almost always include deductions for vacancy and leasing incentives like rent abatements and concessions. After revenues, you subtract all operating expenses to get to NOI. After NOI, you subtract any capital expenditures and account for the purchase and sale of a property. This will get you to unlevered cash flow. To get from unlevered to levered cash flow, you subtract financing costs.

Describe the main real estate investment strategies.

There are 4 common real estate investment strategies: core, core-plus, value-add, and opportunistic.

- Core is the least risky and therefore targets the lowest returns. Core investments are typically newer properties in great locations with high occupancy and very creditworthy tenants.

- Core-plus is slightly riskier than core. Core-plus investments are similar to core but may feature minor leasing upside or require small amounts of capital improvements.

- Value-add is what most people think of when they hear “real estate investing”. Value-add investments are riskier deals and risk can come from various places – substantial lease-up, an older property needing meaningful capital improvements, a tertiary location, or poor credit tenants.

- Opportunistic is the riskiest and therefore targets the highest returns. Opportunistic investments include new development or re-development.

If I paid $100M for a building and it has 75% leverage, how much does it need to sell to double my equity?

$125M. With 75% leverage, you would invest $25M of equity and borrow $75M of debt. If you doubled your equity, you’d get $50M ($25M x 2) of cash flow to equity and still need to pay down $75M of debt. $50M of equity + $75M of debt = $125M sale price.

If you had two identical buildings that were in the same condition and right next to each other, what factors would you look at to determine which property is more valuable?

Since the physical attributes, building quality and location are the same, I would focus on the cash flows. First, I would want to understand the amount of cash flow. You can determine this by looking into what average rents are in the buildings and how occupied the buildings are. Despite the same location and quality, the management and leasing of each building could be different leading to differences in rents and occupancy. Second, I would want to understand the riskiness of the cash flows. To assess this, I would look at the rent roll to understand the creditworthiness of tenants and the terms of leases. The formula for value is NOI / cap rate. NOI will be informed by the amount of cash flow. The cap rate will be informed by the riskiness of the cash flows. The property with high cash flow and less risk will be valued higher.

If you purchase a property for $1M at a 7.5% cap rate, have 0% NOI growth throughout the hold period, and exit at the same cap rate after 3 years, what is your IRR?

We know that NOI / cap rate = value. If a property’s NOI and cap rate do not change, then the value also remains the same. Because there is 0% NOI growth and after 3 years, we are selling the property for the same 7.5% cap rate we purchased it for, we will sell the property for $1M, resulting in no terminal value profit. Since there is no terminal value profit, the only profit comes from interim NOI, which is simply $1M x 7.5% and remains constant each year. Because IRR is our annual return, in this case, our IRR equals our cap rate or 7.5%.

If you purchase a property for $1M at a 5.0% cap rate with 60% leverage and a 5.0% fixed cost of debt, what is the cash-on-cash yield?

Cash-on-cash yield = levered cash flow / equity invested and levered cash flow = NOI – cost of debt. 60% leverage implies $600k of debt and $400k of equity invested. A $1M purchase price at a 5.0% cap rate implies $50k of annual NOI. $600k of debt at a 5.0% fixed cost implies $30k annual cost of debt. $50k annual NOI – $30k annual cost of debt = $20k of levered cash flow. $20k levered cash flow / $400k equity invested = 5.0% cash-on-cash yield.

Do you have any questions for me?

This question usually ends an interview. As was highlighted in other parts of this article, the structure and strategy of real estate private equity firms can vary widely. This is your opportunity to gain a better understanding of the firm.

You should ask questions about how roles and responsibilities are structured:

- “Is there a strict delineation between the acquisitions and asset management team?”

- “How much exposure do junior acquisitions professionals get to the legal process of executing a deal?”

- “How much traveling do junior team members do?”

You should ask questions about the firm’s strategy:

- “Does the firm focus on a single risk profile (core, core-plus, value-add, opportunistic) or multiple strategies?”

- “Does the firm only do equity investing or both debt and equity?”

- “Does the firm do any development or only acquisitions?”

If you have the opportunity to speak with the most junior team members, you should try and get a sense for how they are enjoying their experience with the firm.

Other Roles in Real Estate Private Equity

While acquisitions and asset management are the highest profile roles within real estate private equity, several other roles exist, namely:

- Capital raising

- Investor relations

- Accounting

- Portfolio Management

Capital Raising and Investor Relations

Capital Raising(“CR”) & Investor Relations (“IR”), as the titles suggest, involve the all-important responsibilities of raising capital for the firm and managing the communications between the firm and the investors.

Some firms break out the Investor Relations (“IR”) and Capital Raising (“CR”) functions into separate teams while other firms combine them into one role. On the IR side, team members are responsible for managing the existing relationship between the firm and investors, via writing quarterly and annual reports, orchestrating annual investor conferences and quarterly update calls, writing acquisition and disposition notices. Meanwhile, the CR function is responsible for raising capital for the firm’s various funds and investments strategies, and often involves conducting research on and meeting with prospective investors to target.

At the junior levels in the CR/IR function, most of an analyst or associate’s time is spent preparing senior members of the team for meetings with investors, crafting concise messaging regarding investment performance through quarterly reports and update presentations for existing investors and creating pitchbooks for prospective investors.

For investor meetings, a junior person is responsible for creating, preparing and updating the meeting materials and briefing the senior members on their teams for speaking notes. Each day also entails tracking the team’s progress of new capital raised as a fund nears closing or working on marketing materials to prepare for a new fund’s launch.

Accounting and Portfolio Management

The Accounting and Portfolio Management role in REPE involves supporting the CR/IR, acquisitions, and asset management teams. Portfolio Management is often responsible for guiding the acquisitions team to target properties that fit the fund mandate and ensuring the creation of a diversified portfolio.

Specific responsibilities include providing fund performance data for investor reporting and requests (routine and ad-hoc), reviewing quarterly financial statements and investor reports, fund liquidity management (capital calls/distributions and credit facility), maintaining fund-level models, overseeing fund administrators and database management (asset-level reporting),

The day-to-day largely depends on if the firm is fundraising and/or deploying capital. For example, when a firm is fundraising, more time is spent supporting the investor relations team and providing firm performance data to share with potential clients.

Supporting the acquisitions and asset management team follows a more stable monthly and quarterly cadence. Monthly responsibilities include reviewing property management reports and maintaining a database management system to report asset-level performance to the firm.

Quarterly responsibilities relate more to financial reporting and investor updates. Generally, firms update their investors quarterly with updated fair market values. The portfolio management team manages the fair market value process.

Many firms outsource their fund accounting process to a fund administrator. The fund administrator prepares investor contributions and distributions at the direction of the portfolio management team, management fee calculations, and quarterly financial statements, all of which are reviewed by the accounting and portfolio management team.

I am preparing for the 2nd round interview for REPE, and this contents is extremely helpful!

If cap rates double over a period of 5 years, is there an approximate IRR?